Commentaries | May 24,2025

May 3 , 2025

By Vera Songwe , Moritz Kraemer

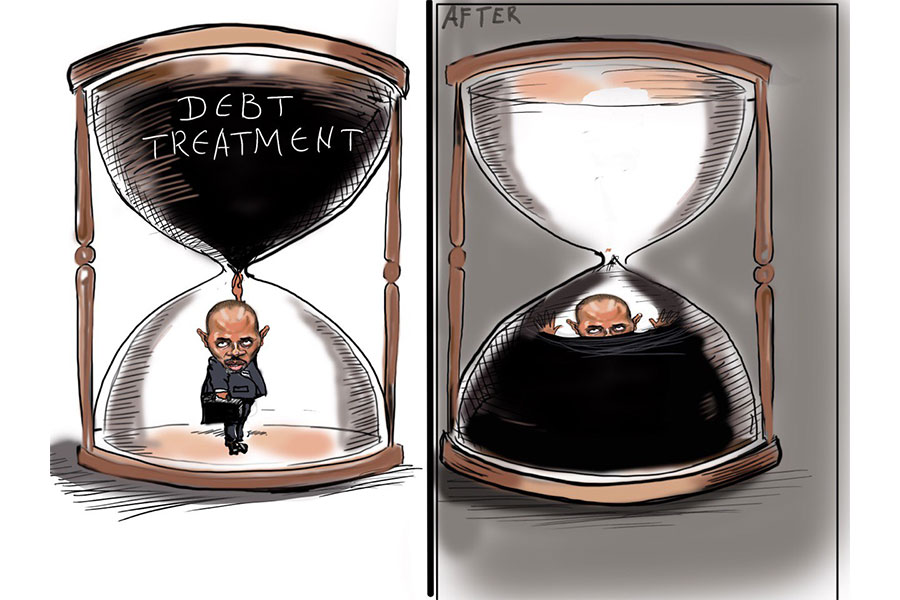

Global economic turbulence is not simply a matter of trade complexities, as demonstrated during the recent G20 finance ministers' gathering at the annual IMF and World Bank meetings. With nearly half of the world's lowest-income countries teetering on the edge of debt distress, the IMF has warned of the looming threat. As the financial stress persists, these vulnerable economies are exposed to even greater risks amid weaker growth forecasts and diminished aid from vital donors such as the United States, write Vera Songwe, a former under-secretary-general at the United Nations, and Moritz Kraemer, chief economist at LBBW Bank and co-chair (with Songwe) of the Expert Review on Debt, Nature & Climate. This commentary is provided by Project Syndicate (PS).

Today's global economic turmoil is not only about trade. As G20 finance ministers gathered in Washington two weeks ago during the annual spring meetings of the International Monetary Fund (IMF) and World Bank, IMF Managing Director, Kristalina Georgieva, has warned that growing economic uncertainty and financial market stress pose serious threats to developing countries.

The danger is particularly acute for highly indebted economies, which are now facing weaker growth prospects and reduced financial support from the United States (US) and other donor countries. In February, the IMF estimated that nearly half of the lowest-income countries were at risk of debt distress, at which point they may no longer be able to meet their debt obligations. That number is expected to rise as conditions continue to deteriorate.

Compounding the crisis, the world's poorest countries, especially small island developing states, are highly vulnerable to climate change and biodiversity loss. Extreme weather events like hurricanes, droughts, and floods can wipe out critical infrastructure and cripple agricultural production in an instant, while slower-onset changes like rising temperatures and shifting rainfall patterns require continuous and costly adaptation measures.

The debt and climate crises are closely intertwined. As more public funds are diverted toward disaster relief and recovery, fewer resources are available for climate adaptation, nature conservation, and long-term investment. This, in turn, increases vulnerability, weakens growth prospects, and drives up borrowing costs, shrinking fiscal space even further. The result is a self-reinforcing, vicious circle.

But it does not have to be this way.

Over the past year, we have co-chaired the Expert Review on Debt, Nature, and Climate, an initiative launched by the governments of Colombia, Kenya, France, and Germany. In our final report, "Healthy Debt on a Healthy Planet," we outline several steps that emerging and developing economies can take to break free from the debt-climate trap and move toward a virtuous cycle of low-carbon, climate-resilient, and nature-positive growth.

Climate and nature considerations should be integrated into macroeconomic and fiscal analyses. This is especially critical in the debt sustainability frameworks used by the IMF and World Bank to assess developing countries' fiscal health. Although both institutions have made some progress in recent years, much more needs to be done to ensure that these frameworks fully account for climate-related risks. Equally important, such assessments should recognise not only the risks posed by climate change but also the economic benefits of investing in resilience. Their value, especially their potential to fuel medium-term growth and reduce a country's financial risks, should be properly reflected in economic and financial models to encourage governments to act.

Many developing countries need assistance in reducing their debt burdens. Some are already in debt distress, while others suffer from liquidity problems. Our report proposes new mechanisms for restructuring and refinancing debt in return for investments in climate adaptation and conservation projects that promote sustainable growth. Borrower countries, major global creditors, the IMF, and multilateral development banks (MDBs) should all champion such solutions.

Proven approaches to addressing debt, nature, and climate risks should be scaled up. These include contingency clauses in debt contracts that suspend repayments during natural disasters and various forms of sustainability-linked finance. While debt-for-climate and debt-for-nature swaps are not yet scalable due to a lack of standardisation, they have already delivered vital funding for environmental initiatives, demonstrating their value and warranting greater support.

More broadly, MDBs should greatly boost lending to support low-carbon, climate-resilient, and nature-positive growth. While discussions on much-needed recapitalisation are ongoing, optimising MDB balance sheets remains the most effective way to stretch scarce public resources and accelerate sustainable development.

Lastly, our report calls for the development of new financing instruments to mobilise private capital for climate mitigation and adaptation. For example, we propose establishing a Finance Facility against Climate Change (F2C2), a special-purpose vehicle designed to issue green bonds backed by future donor commitments. The proceeds would be directed primarily toward climate-mitigation investments in developing countries. If successful, the F2C2 could unlock up to one trillion dollars in private financing.

We also propose a new kind of equity-like instrument to finance climate-resilient infrastructure. Investments in sea walls, flood defences, and similar systems can reduce the costs of disaster relief and recovery. As the primary beneficiaries, insurance companies can work together with MDBs to develop an instrument capable of translating these savings into returns for investors.

These are all practical, actionable proposals. When combined with technical assistance and policy support, they could improve the growth prospects of developing countries wrestling with debt and climate risks. Making debt management both fiscally and environmentally sustainable is not only feasible but also essential to safeguarding global growth, which is in the interest of all countries, not just the poorest.

PUBLISHED ON

May 03,2025 [ VOL

26 , NO

1305]

Commentaries | May 24,2025

Commentaries | Jun 28,2025

Life Matters | May 11,2019

Fortune News | Mar 02,2024

Fortune News | Sept 18,2021

Editorial | Jul 17,2022

Viewpoints | Jun 28,2025

Viewpoints | Aug 16,2025

Commentaries | Sep 06,2020

Photo Gallery | 174027 Views | May 06,2019

Photo Gallery | 164252 Views | Apr 26,2019

Photo Gallery | 154354 Views | Oct 06,2021

My Opinion | 136611 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

Oct 12 , 2025 . By NAHOM AYELE

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...