Radar | Jul 31,2021

Fortune: Your company alludes to the African market’s unique set-up from other parts of the world. Why is that? Is it a combination of being unbanked and a lack of monthly subscription models? Or is it something else?

Frank: Digital payments are growing all over the world. Both on point of sales [PoS], as people are trying to reduce the cash payments, and e-commerce, as people shop online and want to buy something like watch Netflix or buy a Zoom subscription.

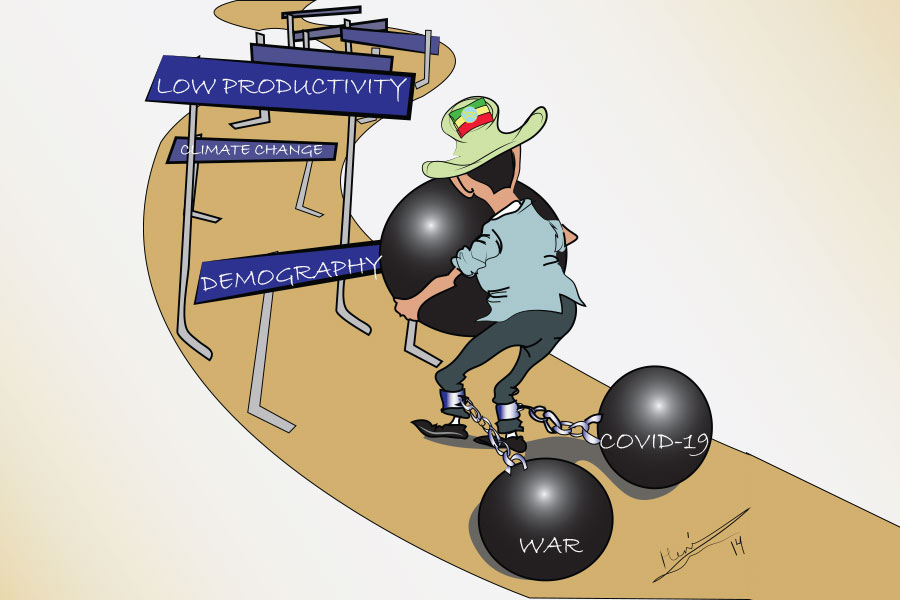

The growth is especially high in fast-growing and emerging markets. It is predicted that the growth in Africa over the next years is more than 60pc in the number of payments and demand. On the one side, what makes the continent special is the potential and need because much of the payment methods were done domestically. Now the consumer wants to do more of it cross-country, within Africa but also beyond.

The other thing is that Africa is the main market when it comes to mobile payment. Every region has its own payment preferences driven by habits and technical availabilities. In African countries, large populations with limited access to bank accounts and credit cards but wide availability of mobile networks mean that it is a special market. Take Ethiopia. Look at the number of mobile subscribers increasing over the past few years. It gives huge opportunities to make it accessible for huge parts of the population.

Of course, you cannot say Africa is one. There are big differences between countries. Some of them, like Kenya with Safaricom and M-Pesa, have been frontrunners. Others have been somewhat stuck. A year ago, the World Economic Forum rated Ethiopia close to last amongst the African countries in mobile money, financial inclusion and transactions. They called it a sleeping giant. Although every country is at a different stage of development, Ethiopia is considered one of the most attractive and interesting markets out there.

When you talk about cross-border transfers, are you talking more about trade or remittances? Which is the more attractive?

The opportunity is on many sides. There will be an increasing need for cross-border remittances. And there are a lot of players trying to enable this.

Where there is more potential and need is on cross-border trade and payments. People say, “I also want to use Netflix,” or “I want to use Spotify and download music.” We are on a Zoom call now. People want to pay a subscription for that. What about buying something from Amazon or other international retailers because domestic ones do not have a product?

This is where we can apply our expertise best because we have access and knowledge with merchants. Our focus is mainly on the e-commerce part where a lot of things have to be done.

How is payment infrastructure different in Africa from that of the world? Do many other countries make use of mobile payments?

Every country and region has its own preference. In the US, most people pay using cards as they are available. In Europe, some countries such as the UK lean on cards but others like Austria and Germany, not so much. If you look at Asia, you mostly have wallets like Alipay and Tencent. Why is that? Because the initiative was coming from the merchant. You had a huge merchant like Alibaba that made a payment method to make it easy to pay on their website. Suddenly, it was so big others started using it.

In Ethiopia, two-thirds of people do not have a bank account. The penetration of credit cards is something like 0.3pc because it is used mainly by non-nationals and Diaspora. The logical thing here is to use mobile payment because there is greater phone penetration.

What is your overview of the Ethiopian electronic payment scene? It is obviously underdeveloped, even compared to neighbours such as Kenya, but at the same time, there have been payment methods available for over half a decade without making much difference.

In Sub-Saharan Africa, within the next half a decade there will be 130 million more mobile payment subscribers. Accounting for half of that are just five countries including Ethiopia. From the international perspective, there are a bundle of reasons why mobile payment is preferred. But you can break them down into two main points.

The first one is infrastructure and the regulatory environment. A few years back, Ethiopia gave the impression of being protective, cautious to foreign investments. A lot of things have recently changed though. The number of people with access to the internet, mobile phone subscribers and affordability of telecom services have improved and created better circumstances. There is also a new player in the market with Safaricom-Vodacom, the second-ever telecom provider. A second license was put on hold, which is a pity. The circumstances from a regulatory point of view have improved tremendously.

The second one is who is in the driver’s seat. Take what people are looking for when it comes to a payment method. Is it easy to sign up, use and access? Is there a network where I can use it regularly?

There are several payment options in Ethiopia. They partly had bad timing because of the penetration of internet and mobile access. But these initiatives were mostly private sector. Look at M-Birr. It is a great service but given the market potential of Ethiopia, their reach is small. At the same time, take Telebirr, by the state-owned Ethio telecom. A week after their launch, they had a million subscribers. It is now over 11 million. They want to reach 20 million by the end of this year, which is reasonable.

In Africa, payments initiated by telecom companies, as they have a client base and accessibility, are more feasible than by a private initiative even if it is a good service. The difference with Kenya is that it earlier had the technical and regulatory circumstances that allowed these types of services to grow. It was also driven by Safaricom, which positively exploded. With the new telecom license and Telebirr, Ethiopia will see greater adoption.

As important as a more open regulatory environment has been, there is a worry that local operators in the digital space, especially on mobile payment and telecom services, would be crowded out by the likes of Safaricom. Is this a helpful attitude?

Just by announcing a second license will be awarded, innovation was encouraged. Maybe it was a coincidence, but Telebirr was released a few weeks before the second telecom license was awarded. The mobile app may have never been launched had Ethio telecom not been anticipating competition.

It is fair for a country to be cautious of protecting its economy and local players. I am not saying sell everything to foreign companies or countries. But you have to make a decision as a government. You cannot be half pregnant.

We had the same debate in Austria a while ago. Would liberalising certain industries kill state-owned players? In most cases, it was actually positive for state enterprises. For example, when the telecom sector was liberalised, the state-owned operator was forced to be more innovative and lowered fees. In the end, maybe it had less revenue on a single transaction but it had several-fold as many transactions and, at the end of the day, it made more revenue. And this was used to increase quality, services and lower prices for consumers. The state-owned telecom operator is still the market leader, much bigger than it was before despite competition and at the same time consumers benefited. More jobs were also created in the economy and the government collected more taxes.

In Ethiopia, a lot has been done over the past couple of years that is very impressive. But it is being done with a foot on the brake. There are still limits on the amount of transactions you can make, on how operators could build network infrastructure and there are capital controls for cross border trade. It is important to find the balance between keeping the economy safe and allowing innovation and creating the enabling ecosystem.

The Safaricom license was not just 850 million dollars for the license but the promise of an eight billion-dollar investment. And the state-owned telecom already has a head start. They should not be afraid. If they are doing their job well, they will succeed. Competition will increase their value as well as more people will use it.

I talked to a friend in Kenya the other day. She told me, and this might be a single opinion, that Safaricom and M-Pesa were game-changers in Kenya for financial inclusion. Say there is somebody in the city that wants to send money to their parents in rural areas. In the past, that was expensive and slow. Today, it is much simpler. People have much more money in their hands that they can use in the economy.

For the longest time, the concern with opening up markets to advanced systems and methods such as payments has been lack of expertise in regulation. If you take the current Digital Strategy, for instance, it is being shepherded by the World Bank. How much of a concern should data protection, surveillance and security be?

I worry a lot about data protection. As an individual, I do care about the protection of my money. I require from my government as much safety as possible.

That said, there is so much expertise already out there. You are not the first country that has to try this. There are so many countries that prove the right balance is possible. You can allow players to offer services and still have the oversight. It is not either being protected or having innovation. Both are possible. I am not expecting to go from zero percent to 100pc immediately. But as long as the path is steady, it is the right approach. It is not about revolutions but evolutions.

PUBLISHED ON

Jan 22,2022 [ VOL

22 , NO

1134]

Radar | Jul 31,2021

Editorial | Jun 19,2021

Films Review | Nov 23,2019

Radar | Sep 10,2021

Fortune News | Sep 08,2024

Editorial | Sep 26,2021

Films Review | Nov 16,2019

Films Review | Oct 16,2021

Radar | Oct 09,2021

Fortune News | Jul 11,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...