The National Bank of Ethiopia (NBE) Governor Mamo Mihiretu has initiated a new directive allowing commercial banks to trade their liquidity through interbank money market operations, hoping to enhance financial stability in the sector. The directive put forth last week enables banks to access short-term liquidity by borrowing and lending directly from their excess reserves.

The directive outlines regulatory mechanisms for liquidity trade, requirements, trading timelines, platforms, and mechanisms for a safe, efficient, and collateralised interbank market. Until an electronic trading platform is fully implemented, a manual book-entry system will facilitate interbank market trading while physical certificates may temporarily substitute for dematerialised securities.

According to Fikadu Digafe, vice governor of the central bank, this is one of the central bank's roles to ensure fiscal and monetary stability while opening the door for inter-bank money market rate operation. He said they plan to meet short-term liquidity objectives by allowing finance movement based on demand and supply.

"Financial stability and vibrancy is the goal," he said.

Financial stability and vibrancy is the goal.

The central bank had availed a three-year strategic plan, marked by several directives and establishing open market operations to take a shot at inflation. Taking benchmarks from other countries such as Kenya, Uganda and Malaysia, Fikadu said the operation will be a trust-based liquidity swap between the banks, while the fixed-time deposit facilities are ongoing.

Market participants must quote overnight or seven-day tenors, with a minimum deal amount of 25 million Br while the law grants the banks to manage their exchange rate and interest risk.

“We’ve established a regulatory mechanism to monitor fairness,” he said.

Trading hours are restricted to the five working days of the week, and transactions must include the maturity date, interest rate, and price in local currency.

Recently, the central bank set an interest rate of 15pc as the anchor of its monetary policy, three percentage points lower than what it previously lent to commercial banks under liquidity strain. The law also introduces risk management measures, such as a reduction of underlying assets to mitigate market and credit risks. Transactions will be backed by collateral securities similar to those used in the central bank's refinancing operations.

The interbank lending market will be facilitated through the Central Securities Depository System (CSD), managed by the US-based technology firm Motran, which recently partnered with the central bank. The directive introduces a Real-Time Gross Settlement (RTGS) system to enable the transfer of funds with interest upon maturity.

Another trading platform is under the Ethiopian Security Exchange (ESX) for the upcoming operation in the capital markets. CEO Tilahun Kassahun noted that the exchange will facilitate trading once approvals are granted by the Capital Market Authority. He said that interbank operations are foundational for other financial instruments such as bonds, securities, and derivatives.

“Enabling banks to operate without the need to match loans to deposits will give them flexibility,” he said.

The Ethiopian Securities Exchange (ESX) began its capital-raising activities last year, attracting interest from the private sector, including commercial banks and insurance companies. It exceeded its initial capital requirement, raising a subscribed capital of 1.51 billion Br and a paid-up capital of 800 million Br.

Banks express a positive outlook. The Ethiopian Bankers Association praised the directive as a substantial step toward financial stability, addressing longstanding concerns.

According to Melaku Kebede, president of Hibret Bank, the liquidity boost is crucial for maintaining stability and growth. He noted that interbank operations will allow banks to play both lender and borrower roles, enhancing flexibility in managing liquidity.

“The industry has faced a huge liquidity burden for the past year,” he said.

He also considers that inter-banking can only work if there is a bank that will pick up the slack when another one falls.

"All of us can't be in trouble at the same time," he said.

The mismatch between deposits and loans has created liquidity risks for banks. According to a financial report published by the central bank last June, 56.3pc of total banking sector deposits are held by only 0.5pc of depositors. The report also highlighted a decline in the liquid assets to deposits ratio, indicating potential challenges for banks to meet short-term obligations.

A major portion of the banking system is exposed to liquidity risk. The report revealed that if the 10 largest depositors were to withdraw funds simultaneously, nearly two-thirds of commercial banks would be unable to meet their regulatory liquidity obligations which indicates a potential for systemic instability. It also revealed that a mere 0.5pc of borrowers with a credit exposure above 10 million Br held nearly three-quarters of the banking sector's loans.

Eshetu Fantaye, a veteran financial expert, believes the central bank is implementing a more cautious monetary policy by reducing its lending to commercial banks. This shift, he argues, is intended to encourage interbank lending and borrowing while curbing inflation. Eshetu observes the decision to limit interbank loan maturities to seven days as a prudent step to stabilise short-term liquidity.

However, he also observes potential risks. A fully-participated interbank market could increase systemic risk. Eshetu notes robust regulation and regular CAMEL ratings for banks, as important to mitigate these risks. Transparent disclosure of bank ratings, he suggests, can foster a more informed lending environment.

"The central bank should not hesitate to publicly recognise both strong and weak performers," Eshetu told Fortune. "This transparency is crucial for maintaining market discipline."

PUBLISHED ON

Jul 28,2024 [ VOL

25 , NO

1265]

Agenda | Aug 27,2022

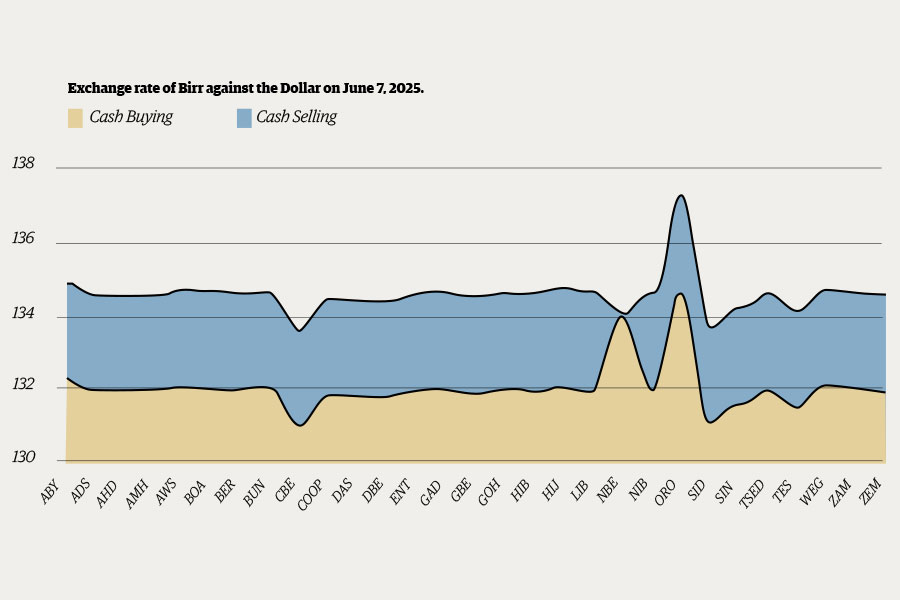

Money Market Watch | Jun 08,2025

Fortune News | Jul 07,2024

Fortune News | Jan 03,2025

Featured | Jul 13,2019

Commentaries | Sep 01,2024

Fortune News | Jul 19,2025

Featured | Jan 07,2024

Addis Fortune | Aug 09,2025

Radar | Apr 24,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...