Viewpoints | Jun 27,2020

Oct 5 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

Fikadu Digafe, V.G for Monetary Stability, Solomon Desta, V.G for Financial Institutions, Eyob G. Eyesus, V.G for Corporate Services, Tiruneh Mitafa, outgoing V.G for Financial Institutions and Yemane Yosief, outgoing V.G for Corporate Services.

Fikadu Digafe, V.G for Monetary Stability, Solomon Desta, V.G for Financial Institutions, Eyob G. Eyesus, V.G for Corporate Services, Tiruneh Mitafa, outgoing V.G for Financial Institutions and Yemane Yosief, outgoing V.G for Corporate Services. As part of the ongoing reform at the National Bank of Ethiopia (NBE), the board of the Bank appointed three new vice governors including a chief economist promoted from within the Bank.

Fikadu Digafe, Solomon Desta and Eyob G. Eyesus, who were working as directors at the central bank, were promoted to vice governors in charge of monetary stability, financial institutions and corporate services, respectively.

Fekadu, who was recently appointed as director of external economic analysis & international relations at the Bank, will be coordinating the research team as chief economist of the country. He has been involved in the different research work at the Bank, including for the quarterly publication of the central bank, Birritu.

The post was vacant for almost 10 months after the departure of Bekalu Zeleke, who joined Bank of Abyssinia having a brief stay at the Bank. Bekalu replaced the long-serving vice-governor Yohannes Ayalew (PhD), who was appointed to be executive director of the Ethiopian Development Research Institute in June 2018.

Solomon, who has been a director of bank supervision overseeing the regulation of financial institutions, replaced Tiruneh Mitafa. Tiruneh was appointed to the post four years ago after he retired from the Development Bank of Ethiopia (DBE), where he had served as vice president. Tiruneh replaced Getahun Nana, who moved to lead the state policy bank, DBE.

Eyob, who has been serving as director of the payment & settlements system directorate, was named vice governor for corporate services, replacing Yemane Yosief, who was appointed to the post in 2009 along with Yohannes and Getahun.

The central bank has a structure of a governor with three deputies who are responsible for monetary stability, corporate services, and financial sector supervision. Vice governor for monetary stability assumes the role of being the chief economist responsible for generating monetary policies to ensure macroeconomic stability.

Early last week during a meeting held at the Ministry of Finance, Yinager Dessie (PhD), governor of the central bank, disclosed that the Bank is undergoing a major reform. The meeting was called to discuss the recently designed Homegrown Economic Reform Agenda with leaders of the financial institutions and economists.

The reform plan was developed by a team of experts from the central bank and the Ministry of Finance, in collaboration with the Office of the Prime Minister and the National Planning & Development Commission. The central bank is the primary implementer of this reform plan, which has been referred to by one international organisation executive as "ambitious but doable".

"The implementation requires new thinking, skill and knowledge," said Yinager, "so we're working on building our capacity and bringing new experts on board."

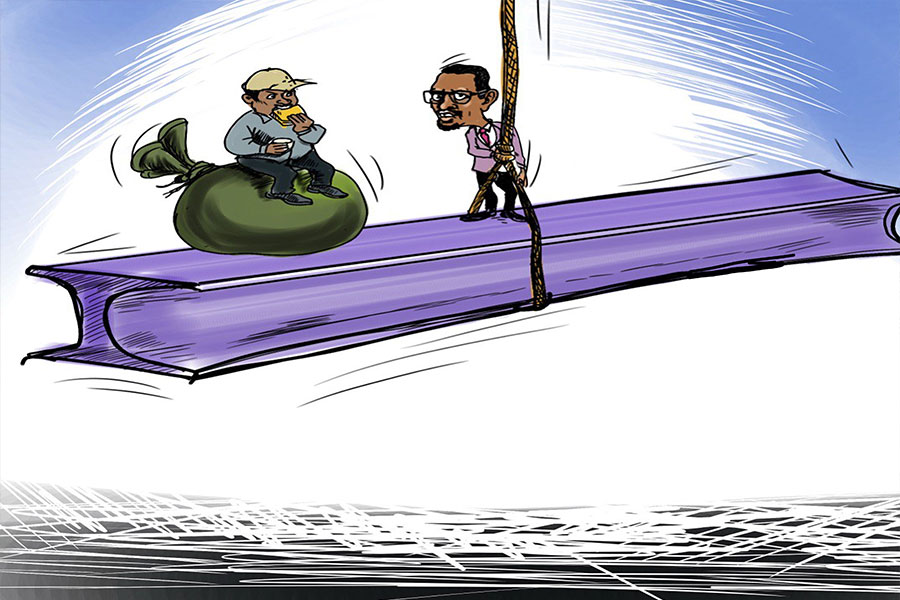

However, the new appointment of the vice governors has faced a strong backlash from economists.

"Considering the existing imbalances in the macroeconomy," said a senior advisor, who requested anonymity, "the appointees are not up to the task."

Alemayehu Geda (Prof.), a macroeconomist with two decades of experience, also says that the chief economist of a country should have a track record of publishing multiple comprehensive research papers about the country, continental or international economy, and this should be coupled with ample experience in the field.

"The appointment shows the extent to which the government is not serious toward the economy," he said.

Ethiopia needs a chief economist who will have a group of experienced economists that will regularly conduct assessments quarterly or biannually to come out with forecasts, comprehensive macroeconomic reports and economic models, according to Alemayehu.

The country should also take the experience of other countries that organised a Monetary Policy Committee, which comprises members from a government institution, the private sector and academia, according to Alemayehu.

The committee will be tasked with helping the government in advising on monetary policies that can solve the problems in the economy, according to Alemayehu.

The central bank, which rarely reshuffles top-level executives, got its current governor in June 2018 after Yinager succeeded Teklewold Atnafu, the longest-serving governor who remained in the post for almost two decades. Teklewold currently works as an advisor at the Office of the Prime Minister. He is also a member of the central board of directors, which is chaired by Girma Biru.

PUBLISHED ON

Oct 05,2019 [ VOL

20 , NO

1014]

Viewpoints | Jun 27,2020

Editorial | Mar 30,2024

Radar | Aug 10,2025

Radar | Oct 23,2023

Fortune News | Aug 02,2025

Radar | Sep 27,2025

Fortune News | Mar 30,2019

Radar | Jun 18,2022

Radar | Jun 08,2019

Fortune News | May 04,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...