Radar | Oct 20,2024

The National Bank of Ethiopia (NBE) has revised its premium pricing strategy for gold miners and suppliers in a bid to revive the struggling gold market. Effective August 29, 2024, the new directive introduced fixed price premiums based on the quantity of gold delivered, marking a departure from previous policies.

The policy change follows Ethiopia's transition to a market-based exchange rate system for the Birr, a move designed to address long-standing market distortions, curb illicit trading, and stimulate gold production. Governor Mamo Mihretu has directed all branches of the central bank to adjust their declaration rates according to the new system, a measure seen as crucial to aligning with the federal government's broader fiscal policies.

Martha Haileselassie, an advisor to the central bank's vice governor, expressed optimism that the new directive would address Ethiopia's persistent forex shortages, promote economic growth, and create a more competitive and transparent exchange market. She says supporting financial institutions is essential to addressing the country's long-standing macroeconomic imbalance.

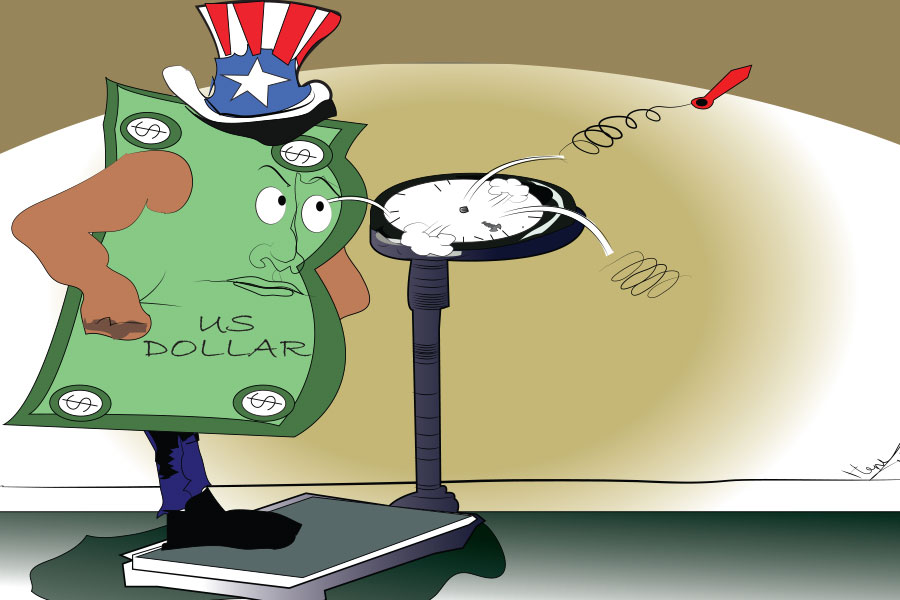

The central bank's daily exchange rates now reflect the weighted average rates of all commercial banks, replacing the previous fixed exchange rate used for duty computations. This has introduced a new level of volatility and unpredictability into the import process. On August 30, 2024, the NBE posted an indicative mid-rate of 111.21 Br to the dollar, a more than 100pc increase from rates observed a month ago.

The shift is expected to have wide-ranging implications for the broader economy, particularly in sectors heavily reliant on imports. Regulators hope these reforms will create a more conducive environment for gold suppliers, ultimately enhancing production.

Gold premiums under the new directive are calculated using current market selling rates, with 95pc of payments made upfront to suppliers. The adjustment is intended to provide immediate liquidity to those in the gold supply chain, ensuring that the flow of gold into the market remains steady. Exporters, meanwhile, are now allowed to retain 50pc of their foreign currency earnings for up to three months, a notable extension from the one-month retention previously allowed for other exporters. The remaining half is held as a price guarantee, with payments to suppliers expected to be made within 30 days of delivery to buying centres.

The directive also grants special privileges to suppliers and aggregators who source gold from artisanal miners. Suppliers delivering between 250gm and 25Kg of gold would have their transportation costs covered, while those delivering more than 25Kg receive additional financial incentives. However, these benefits are not extended to large-scale miners, reflecting the central bank's focus on supporting smaller players in the market who may be more vulnerable to fluctuations in gold prices.

Fikadu Digafe, vice governor of the central bank, believes in the need to formalise the gold market and control unregulated and illicit trade, which has long undermined the sector's potential.

"Gold is a crucial commodity," Fekadu told Fortune, stating the importance of preferential treatment to encourage suppliers and industrial miners to boost gold production.

The central bank has made three consecutive revisions to the premiums offered above the international gold price for domestic suppliers. The latest revision introduced a tiered pricing system, offering premiums of 60pc for supplies ranging from 50 grams to three kilograms and 72pc for quantities exceeding 30Kg. This represents a substantial increase from the previous flat premium of 35pc, signalling the central bank's intent to make gold mining more lucrative for small and medium-sized suppliers.

However, federal authorities remain concerned with the unabated problem of the contraband gold trade. During a parliamentary committee session last year, Minister of Mines Habtamu Tegegn raised the severity of the issue, noting that regional states such as Sidama and Oromia achieved only 1.87pc and 24.13pc of their production targets, respectively. In Gambella Regional State, where 65 miners are concentrated around the Dima area, and another 20 operate on the outskirts, over 2,000 artisanal miners are employed. Nonetheless, the region has struggled to meet its gold production targets, with only 500Kg of gold produced last year, far below expectations.

Ambisa Yadeta, head of the Gambela Regional State Trade & Industry Bureau, acknowledged the severity of the problem, attributing much of the shortfall to the flight of economic activity to the underground market. He expressed hope that the new directive would bring relief to the region's miners and help curb persistent illicit trade.

The directive has also addressed ongoing issues within the trade and delivery chain. Producers often deliver gold to Addis Abeba, bypassing traditional channels and opening doors for illicit activities. This has complicated efforts to regulate the market and ensure that all gold transactions are conducted legally and transparently.

During a trade summit last week at the Ministry of Trade & Regional Integration (MoTRI) headquarters, Deputy Prime Minister Temesgen Tiruneh addressed concerns about the sector's stunted growth. According to Temesgen, domestic companies' participation in gold mining has been limited to a select few, and illicit mining activities have severely impacted gold production.

"We need to do better with gold," he said.

The Extractive Industries Transparency Initiative (EITI), a global standard for monitoring oil, gas, and mineral resources across 57 countries, estimated Ethiopia's gold reserves at 200tns. The potential for gold exploration is high in regional states like Benishangul Gumuz, where over 10 producers and 250 suppliers operate, primarily in areas such as Kurmuk, Membi, and Sherkole. However, these areas have also faced constraints related to cash shortages and the illicit market, which have impeded production.

Admasu Morka, head of the Benishangul Gumuz Mining Development Bureau, noted that reforms have been necessary to address these issues. Last fiscal year, only 294Kg of gold was exported from the regional state, a meagre amount considering its potential. He also cited ongoing concerns such as fuel shortages and logistical issues, often exacerbated by security concerns, which have not been adequately addressed.

The story of OMA Mining Plc, a joint venture between Ethiopian and Sudanese investors, illustrates gold miners' difficulties in the country. The company operated for 12 years in the Guji zone of Oromia Regional State before ceasing operations for lack of viability. Dereje Demsse, the former operational manager, attributed the company's decision to cease operations largely to inadequate exploration, leading to exaggerated profit expectations.

"The company was dissatisfied with its results," he said.

Dereje blames financial constraints for several companies skipping the crucial exploration stage, moving directly to extraction in a bid to recover their initial investments quickly.

"This often leads to lower-than-expected yields," he told Fortune.

Dereje remains upbeat about the gold industry's potential. He believes that with comprehensive studies and proper exploration, gold mining could yield better returns than other minerals. However, he argued that the premiums offered by the central bank do little to cover the high costs of thorough exploration.

Ethiopia earned over 274 million dollars from gold exports in the third quarter of last fiscal year, an 83pc increase from the same period the previous year. Minister Habtamu attributed this success to efforts in combating contraband trade and illegal transactions. His Ministry reported that 2.4tns of gold were obtained from gold mining companies, with an additional 0.6tns from artisanal miners. However, the Minister acknowledged that contraband trade and security issues continue to pose considerable risks to the mining sector.

Elias Kassahun, a mining expert and lecturer at Addis Abeba Science & Technology University, echoed these concerns, stating that the mining export sector has been weakened by long-standing issues that have undermined production. While he acknowledged that the recent price adjustments will likely boost exports in the short term, he cautioned that market distortions are likely to persist without robust monitoring and consistent regulatory oversight.

"The remedy will only serve in the short term, without consistent and strict follow-up," he told Fortune.

According to Elias, the scattered gold deposits complicate industrial-scale extractions, with inadequate exploration studies and security concerns leading to the neglect of some mining sites. Nonetheless, he remains hopeful that increased gold production in the Tigray Regional State will enhance market exploration potential and attract new entrants. While he considers the central bank's recent reforms a positive step, Elias urged the importance of regulatory predictability in attracting investment to the sector.

"The effectiveness of the reforms will largely depend on consistency in enforcing the regulation," he said.

PUBLISHED ON

Sep 01,2024 [ VOL

25 , NO

1270]

Radar | Oct 20,2024

Fortune News | Sep 19,2020

Sponsored Contents | Oct 24,2023

In-Picture | Oct 06,2024

Radar | Nov 21,2020

Agenda | Aug 11,2024

Editorial | Feb 16,2019

Life Matters | Apr 22,2023

Radar | Oct 22,2022

Verbatim | May 31,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...