Fortune News | Dec 19,2021

Dec 19 , 2021

By HAWI DADHI

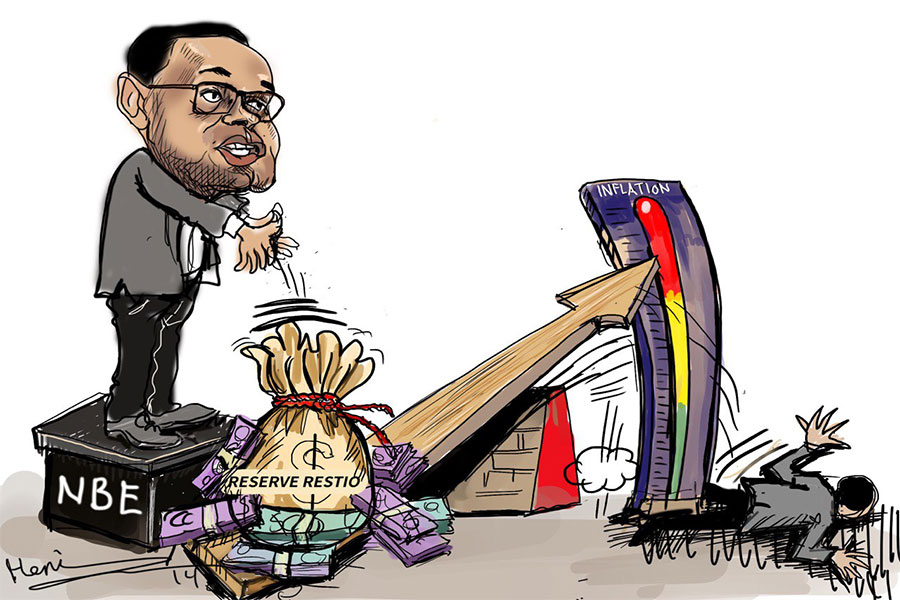

The central bank tightens its grip on microfinance institutions (MFIs), planning to increase the minimum paid-up capital threshold to as high as six-fold.

This will be the second time the minimum paid-up requirement for MFIs has been raised in recent years after the National Bank of Ethiopia (NBE) bumped it up from two million Birr to 10 million Br in 2015. The MFIs were given seven years to meet the requirement. Only one of the 42 MFIs operating in the country had failed to do so by June 2021.

Regulators at the central bank have completed a study to decide on the threshold increase. Many under-establishment MFIs have capital ranging from 50 million to 60 million Br and the threshold requirement will not be any less than this, according to Asfaw Abera, director of microfinance supervision at the NBE. However, regulators are waiting for five MFIs transitioning into commercial banks to finalise the process before applying the change.

“The NBE has decided to put the increase of capital requirement on hold until the transition is over,” Asfaw told Fortune.

The Oromia, Addis, Amhara, Somali and Omo microfinance institutions, all backed by regional state administrations, hope to join the banking industry. The Oromia Credit & Saving Institution, now Siinqee Bank, has mobilised seven billion Birr in paid-up capital, putting it on a footing with industry giants such as Awash International Bank. Amhara Credit & Saving Institution plans to enter the industry with over 3.8 billion Br in equity.

Unlike commercial banks, MFIs use group lending to reach low-income borrowers, mainly serving segments of the population that would otherwise have remained unbanked. However, they are limited to advancing loans of less than one percent of their total capital to an individual borrower, while the ceiling for group borrowers sits at four percent.

MFIs in Ethiopia have provided loans to about five million clients, much more than the 250,000 commercial banks lend to. They mobilised 52.5 billion Br in deposits by the end of the fourth quarter of last year while disbursing 69.3 billion Br. Their total capital hit 27.8 billion Br in 2020, a 27.8pc jump from the previous year.

Kinfemichel Yibkaw, an expert who has worked in the microfinance industry for over a decade, sees the pressure on MFIs to increase their paid-up capital could mean customers can take out larger loans.

The revised requirement may not become a barrier to publicly owned microfinance institutions at the cusp of transitioning to full-fledged banks. However, it might be a challenging task for others like Eshet Microfinance. Established in 2000, Eshet tried to raise its paid-up capital to 10 million Br, including recapitalising shareholders’ returns. It succeeded in meeting the requirement last month, disclosed Furgassa Hirpa, general manager of Eshet.

Complying with the soon-to-be-introduced capital threshold could prove more daunting.

"The company hasn't floated shares since its establishment," said Furgassa. “If the management decides in favour of floating shares, it wouldn't be hard to comply with the revised paid-up capital requirements.”

The changes are not very worrisome for other microfinance institutions with a solid capital base, such as Nisir Microfinance. Nisir, incorporated seven years ago with a paid-up capital of 7.7 million Br, now has close to 200 million Br in equity. It floated shares to the public and recapitalised dividends.

Dawit Wakgari, CEO of Nisir, believes the increased threshold is suitable for loan disbursement and deposit expansion.

“It can be an entry barrier for new entrants,” said Dawit.

Kinfemichel sees it differently. If more microfinance institutions decide to float shares to comply with the paid-up capital requirement, he argued that it would attract more investors into the sector.

There are 30 microfinance institutions in the process of joining the industry, six of whom are close to getting permits.

Most are attempting to join with as high as 100 million Br in paid-up capital, disclosed Asfaw. Compared to Kenya, this is quite a feat where the minimum capital requirement to establish a microfinance institution is 530,000 dollars (25.8 million Br).

PUBLISHED ON

Dec 19,2021 [ VOL

22 , NO

1129]

Fortune News | Dec 19,2021

Delicate Number | Oct 09,2021

Fortune News | Mar 06,2021

Fortune News | Feb 16,2019

Radar | Jun 24,2023

Obituary | Jul 11,2021

Fortune News | Mar 25,2023

Editorial | Jun 18,2022

Radar | Apr 13,2019

Radar | Aug 04,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...