Radar | Sep 04,2021

The management of the state-owned Commercial Bank of Ethiopia (CBE) continues to wane in its botched efforts to sell off textile plants foreclosed from Turkish investors after defaulting on billions of Birr in loans.

The Saygin Dima and Selendawa textile plants owe the CBE over one billion Birr combined.

The CBE put Saygin Dima Textile Factory on the auction bloc last month for the second time in recent years with a floor price of 787.5 million Br. No interested buyers showed up at the bid opening date on December 15, 2021. The Bank had attempted to auction the company off five years ago, yielding similar results.

Saygin Dima became operational in the late 2000s after a joint venture agreement between the federal government and Turkish investors. The CBE disbursed 574 million Br in loans to the textile factory, but the government withdrew from the joint venture six years later, claiming "unsatisfactory performance" by the company. Saygin Dima was operating at less than half of its production capacity, though its management planned to produce, daily, 30tn of yarn, 40,000m of fibre and 50,000m of finished thread.

The Turkish investors had agreed to buy out the government’s share in Saygin Dima, valued at 625 million Br, advancing a 10pc payment upfront. The buyout never fully materialised.

Located in the Sebeta-Dima area, 24km southwest of Addis Abeba, CBE’s Acquired Assets Administration Office first auctioned the plant, with a four-storey building, in 2016. Two years ago, the Bank tried to sell the textile plant on the 17ht plot through negotiations to a Turkey-based Feda Textile. But officials of Sebeta Town Administration demanded that the buyer pay the arrears in lease payment, leading Feda to pull out from the deal.

"It was not part of the deal,” Abiy Gebrekristos, manager of Acquired Assets Administration Office at the CBE, told Fortune.

The fate of Selendawa Textile Factory remains more obscure. After no less than nine attempts to sell the company frustrated, the CBE tried a negotiated sale last week. Located in the town of Dire Dawa, the CBE put Selendawa Textile Factory up for auction four times with a floor price of half a billion Birr. No buyers showed interest.

Established through a joint venture arrangement between Turkish investors and the federal government in 2013, Selendawa is a processing plant for yarn on 18ht of land. However, the company has been operating on 10pc of its daily production capacity of 50tn of yarn, 12,000m of fibre, and four tonnes of netted fabric.

For people such as Leben Girma, who worked as a human resource manager at Eltex Textile & Garment Factory for eight years, the lack of due diligence carried out to let these investments made is the main reason for the failure of the assets in attracting buyers.

“The investors brought in aged machines that have poor quality with low productivity,” he said.

Saygin Dima and Selendawa have now ceased operations. Combined, the two textile factories had close to 1,500 employees.

It was a time of high hopes when various Turkish companies, including industry giants like Ayka Addis, Oyap Ethio Industry & Trading, Saygin Dima, and MNS Textile, began to invest in Ethiopia. Close to 244 Turkish companies entered Ethiopia over the 15 years, many of them setting foot in the country after 2011.

These companies have borrowed billions of Birr from the state-owned Development Bank of Ethiopia (DBE) and the CBE. Of the total 39.1 billion Br the DBE advanced in loans to public and private businesses in 2017/18, 20pc was disbursed to Turkish companies. Many of these companies failed to settle their debts, forcing the two state-owned banks to take over the plants from the owners and foreclosing on the assets in a bid to recover the credit.

In 2018, DBE established Ethio Capital Investment S.C. to manage and restart the operation of foreclosed companies. This includes Ayka Addis Textile Factory, which the DBE has unsuccessfully tried to auction off on three separate occasions. The policy bank, however, continues to cover payroll for over 4,300 Ayka employees.

Other textile factories, such as Angels Textile and Elsi Addis, are also among those foreclosed by the two state-owned banks for failing to service their debts.

Abdulmenan Mohammed, a financial statement analyst with two decades of experience, observed that the failure to sell off the factories would likely not significantly affect the CBE.

“The impact will be not significant," said Abdulmenan. "The Bank has already maintained provisions for these impaired loans.”

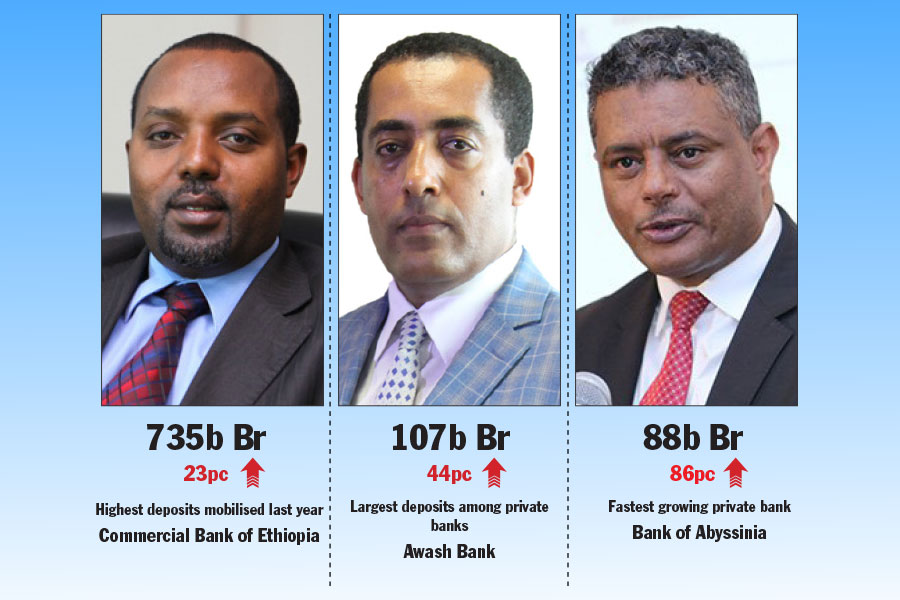

The 80-year-old Bank is the most capitalized in the industry, with its deposits reaching 735 billion Br by the end of the last fiscal year.

Abiy, the CBE manager, attributed the spell of uncertainty in the country to a lack of buyers` interest. The CBE has other options on the table in dealing with these assets, he disclosed.

“The Bank may lend 70pc of the funds required to investors who are willing to pay the 30pc,” he told Fortune.

Experts say that such options can only lead to a debt trap. Abdulmenan suggests the better possibility for the CBE is to review the floor price.

Leben agrees.

"It's set too high, which drives investors away,” he said.

PUBLISHED ON

Dec 19,2021 [ VOL

22 , NO

1129]

Radar | Sep 04,2021

Fortune News | Jan 30,2021

Fortune News | May 21,2022

Radar | Apr 02,2022

Fortune News | Dec 11,2021

Fortune News | Sep 18,2021

Radar | Sep 22,2024

Fortune News | Jul 18,2021

Fortune News | Oct 16,2021

Radar | Dec 04,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...