Fortune News | Nov 06,2021

Dec 7 , 2019

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

The growth of the profit of the insurer was slow due to increased underwriting surplus, interest income and dividend income.

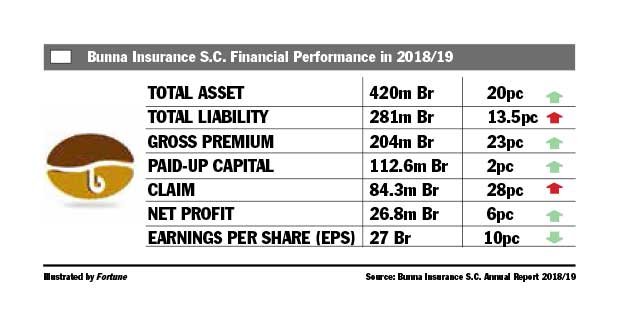

The growth of the profit of the insurer was slow due to increased underwriting surplus, interest income and dividend income. Bunna Insurance S.C., the youngest insurer, netted 26.8 million Br in profit in the last fiscal year, registering a modest increase of six percent.

Earnings per share (EPS) also rose by 27pc, nearly in line with the preceding year's growth rate of 30pc.

Bunna's paid-up capital increase contributed to the slight decline of EPS, according to Dagnachew Mehari, CEO of Bunna.

Buna’s paid-up capital increased by two percent to reach 112.6 million Br.

Zewdu Minas, a chairperson of the board, proclaims that the insurance firm performed well, despite the challenging situations in the country and the economy.

"The widespread political unrest, serious decrement of premiums in the insurance market, and high level increment of claims payouts were among the challenges," said Zewdu.

The growth of the profit of the insurer was slow due to increased underwriting surplus, interest income and dividend income.

During the reporting period, the underwriting surplus soared by 28pc to 34.5 million Br, driven up by increased gross premium and a rising retention rate that also led to a 28pc increase in claims paid that stretched to 84.3 million Br.

“This reveals that there should be mechanisms for controlling risks,” Abdulmenan Mohammed, a financial statement analyst with about two decades of experience, commented.

Gross written premium increased by 23pc, exceeding 204 million Br, out of which 45.6 million Br was ceded to reinsurers. The retention rate of the company increased by three percentage points to 78pc.

"There is still some room for further increase in retention rate," the expert said.

Revenues of the company have also shown improvements. Interest income increased by 33pc to 16.2 million Br, while dividend income rose up by 24pc to more than eight million Birr.

However, earnings from commission merely declined by two percent to 15.3 million Br. It is despite the marked increase of 37pc in the commission paid to agents that reached 12.7 million Br.

“The increase in commissions paid indicates that Bunna must have faced tough competition,” Abdulmenan remarked. “The firm needs to keep an eye on commission expenses.”

Endalkachew Tesfaye, executive officer of marketing, planning & business development at Bunna, argues that the 16pc increase in paid commissions should not be interpreted as mere expenses.

"It is normally considered part of the increase in premium," Endalkachew said.

As general administrative expenses including salaries and benefits increased by 52pc, or close to 31 million Br, the direct operating expenses also increased by 16pc to 21 million Br.

“The pace of increase in expenses at Bunna is concerning, and the management should carefully watch this area," according to Abdulmenan.

The expenses soared since the firm procured a five-storey building in the backyard of the African Union for 126 million Br, according to the CEO, who says that it will be helpful in the future for addressing the increasing rental payments for office use.

Dagnachew also says that the firm has contributed money to the internally-displaced people and for the under-construction riverside development project.

Claims of the firm have increased due to two major incidents that made Bunna pay out five and three million Birr claims for the bond it covered for contractors and political risk policy, respectively. It is coupled with a motor insurance claim increase, due to the increasing number of traffic accidents.

However, Dagnachew argues that all the expenses were offset adequately, as they are not finally reflected in the underwriting surplus, which increased by 28pc.

There was a massive increase in the insurance company’s total assets that went up by 20pc to 420.8 million. This included the 167.2 million Br and 71.2 million Br, respectively, for savings investments and shares. These investments increased the total assets of Bunna by 56.7pc, up from 48.3pc in the previous fiscal year.

“This is a good investment strategy,” the expert said, commending the management of the company.

The liquidity level of Bunna rose in value, while it slightly decreased in relative terms. The eight percent increase in cash and bank balances went up to 39.4 million Br, whereas the ratio of cash and bank balances to total assets declined to nine percent from 10.3pc previously. The rate of cash and bank balances to liabilities also decreased to 13pc from 14.2pc.

Abdulmenan noted that the liquidity level of the insurance company was quite reasonable.

The five-year-old insurer started making profits two years ago. It registered gross premium income of 204 million Br and total assets of 420.8 million Br in the last fiscal year.

Bunna’s capital and non-distributable reserves accounted for 28.2pc of its total assets.

“As Bunna is well-capitalised, it should use its strong capital base to increase its shareholders’ returns,” Abdulmenan recommended.

Teklu Arga, a shareholder of the company and a lecturer at Jimma University, is delighted with the performance of the company over the past five years.

"All the expenses of the company will help it enhance its competitiveness and reputation in the long run," he told Fortune.

PUBLISHED ON

Dec 07,2019 [ VOL

20 , NO

1023]

Fortune News | Nov 06,2021

Exclusive Interviews | Jan 05,2020

Radar | Mar 04,2023

Fortune News | Mar 14,2020

Fortune News | Aug 02,2025

News Analysis | Apr 20,2024

Radar | Jul 27,2025

Fortune News | Sep 06,2020

Radar | Nov 12,2022

Fortune News | May 20,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...