Radar | Apr 01,2024

In its latest fiscal year performance, Bunna Bank joined a hoard of competitors in posting a rise in net profits, positioning it as a noteworthy contender within the banking industry. However, its financial performance placed it in a peculiar middle-tier position — above Berhan Bank but trailing behind competitors such as Abay and Oromia banks.

Despite the uptick in profits, shareholders experienced a decline in Earnings Per Share (EPS), with a drop to 236.44 Br from the previous year but above Berhan Bank (156 Br) while it fell short of Oromia Bank (324 Br) and Abay Bank (360 Br). A critical indicator of profitability on a per-share basis, Bunna's 23.6pc in EPS was the second largest rate over the past decade, although lower than the average of 38.4pc across 15 private banks posted in 2021/22, revealing room for growth in maximising shareholders’ value.

The Bank's executives attributed the decrease to strategic capital infusions to reinforce its resource base amid rising operational costs. While the move is believed to help Bunna consolidate its capital structure, analysts caution operational efficiency and cost management strategies in a period marked by industry repositioning.

The Bank ended its operations with a 6.6pc climb in net profits to 949.21 million Br, almost double the profit Berhan Bank reported but lagging behind Abay's 1.55 billion Br and Oromia's 1.58 billion Br. Although it appears to be dwarfed by Awash Bank's 6.9 billion Br profit (the industry's largest for private banks), Bunna Bank's performance is noteworthy, defying its smaller scale and contributing to the industry's aggregated profit of 22.2 billion Br in the latest operational year.

Under the stewardship of Mulugeta Alemayehu, its president, Bunna Bank's strategic shift towards acquiring technology and expanding its footprint was notable.

With an accounting and business administration background from Addis Abeba University, Mulugeta began his career at the state-owned Commercial Bank of Ethiopia (CBE) and helmed the presidency at Bunna Bank in 2018. Under his watch, Bunna Bank has seen notable increases in its interest income, which surged by 53.4pc to 5.63 billion Br.

A diverse portfolio of loans, advances, treasury bonds, and other financial instruments drove this growth. The total loans, advances, and interest-free financing went up 35.6pc to 34.17 billion Br. Despite the upticks, Bunna's loan portfolio only exceeded Berhan's 27.35 billion Br, markedly less than Oromia's 41.56 billion Br and a tad bit lower than Abay's 36.47 billion Br.

While Bunna Bank’s provision for impairment of loans and other assets increased by 29.4pc to 160.2 million Br, the total deposit reached 34.35 billion Br, rising by 34pc.

The loan-to-deposit ratio of Bunna Bank increased to 99.5pc from 93.4pc. While generating interest income, analysts warned that a high loan-to-deposit ratio could pressure the Bank's liquidity position, recalling the borrowing of 511.11 million Br from the central bank.

Mulugeta concured.

"We're also planning to collect disbursed loans aggressively," he said.

Following the same trend, the Bank's income from fees and commissions rose by 14.3pc to 811.98 million Br, complemented by a 35.5pc increase in gains from foreign exchange dealings from last year's 82 million Br, a rare accomplishment in an industry besieged by forex crunches.

"The management should be appreciated," said Abdulmenan Mohammed (PhD), a London-based financial analyst.

These achievements, however, are set against a backdrop of broader industry-wide impediments, including the disparity between official and parallel market rates, which have impacted foreign exchange earnings.

Bunna’s Board Chairman, Alemayehu Sewagen, raised these problems during the shareholders' annual general assembly in December at the Millennium Hall on Africa Avenue (Bole Road). He pointed to the adverse effects on the Bank's performance, emphasising the need for strategic adjustments to overcome limitations.

A seasoned banker with two decades of experience, Mulugeta's management is characterised by an ambitious vision, steering away from conventional banking practices of deposit-centred towards a more diversified approach. This includes a significant expansion of the bank's branch network, with 122 new branches added, totalling 465. He disclosed his desire to balance expansion with cost control as a crucial move forward, integrating technology and staff efficiency.

While these expansions contributed to the Bank's increased footprint, they also increased operational costs. A significant portion of these expenses was allocated to personnel, with costs surging to over two billion Birr, surpassing that of several competitors but falling slightly below Oromia Bank’s 2.32 billion Br.

Abdulmenan voiced concerns over this trend, urging the Bank's management to closely check its expenditure framework to ensure sustainability and profitability in the long run.

Mulugeta acknowledged the significant growth in costs but remained upbeat about the Bank's future, alluding to a "holistic transformation" in his operational strategy. The transformation is evident in the Bank's financial indicators, with a notable increase in cash and bank balances, albeit accompanied by a slight decline in the ratio to total assets. According to Abdulmenan, the shift suggests a strategic reallocation of resources, with savings being channelled into investments to boost returns, requiring careful management to avoid liquidity issues.

"Management needs to be vigilant to avoid liquidity issues," Abdulmenan said.

According to Mulgeta, the savings were used for investments to boost returns, decreasing cash and bank balances.

Bunna's cash and bank balances increased by 35.6pc to 4.46 billion Br in the year while its ratio to total assets dropped by 0.4pc to 9.6pc, indicating a rise in absolute terms and a relative decline. These balances-to-assets ratios are less than Oromia's 16pc, Abay's 15pc, and a percentage point higher than Berhan's 8.6pc. In aggregate, they were less than half of Oromia's 10.99 billion Br and nearly half of Abay's 8.25 billion Br, while slightly higher than Berhan's 3.73 billion Br.

Bunna Bank’s strategic efforts also extend to its capital structure, with its paid-up capital growing by 29.3pc to 4.28 billion Br. However, this growth was accompanied by a reduced capital adequacy ratio from 18.9pc to 15.7pc.

Incorporated with 175 million Br paid-up capital 14 years ago, Bunna Bank was short of 1.72 billion Br to meet the central bank's minimum paid-up capital requirement. The Bank's capital amount accounts for approximately 3.67pc of the aggregate capital for 29 private banks, while its total equity and assets contributions stood at 3.28pc and 2.69pc, respectively, of the industry.

Although reflective of a smaller scale, these figures show Bunna Bank's substantial place in the banking ecosystem. Its executives’ measures, including aggressive loan collection strategies and investment in digital financial products, aim to fortify the Bank’s competitive position in total assets, equity, and profitability.

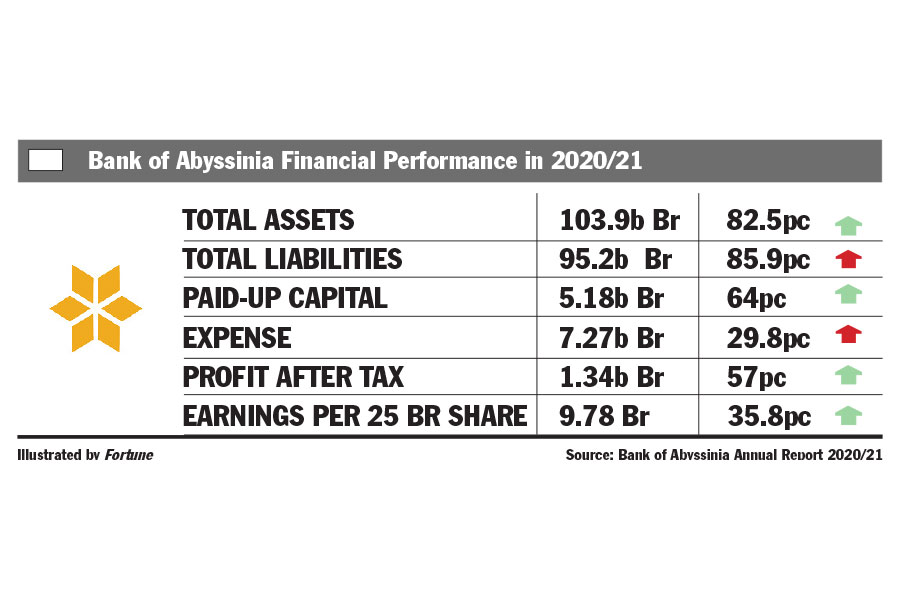

While modest compared to giants like Awash, Dashen and Abyssinia banks, shareholders recognise the Bank's achievements and potential.

Tesfaye Fente, one of the 8,000 founding shareholders, praised Bunna Bank for its accessibility, range of services, financial stability, and customer service. With shares worth nine million Birr with Bunna Bank and stakes in 12 other banks, Tesfaye observed several new entrants into the industry, followed by staff migration lured by the promise of better benefits.

"It's an industry-wide problem," he told Fortune.

However, Bunna Bank's workforce grew by 1,168 during the year, bringing the total number to 4,100.

Yohannes Limeneh has been a deputy manager at the Qera Branch of Bunna Bank for several years. He saw how business activities in the capital's cattle market nearby slowed down due to conflict-related issues, which impacted his branch's performance.

"Our branch is directly affected by the livestock market’s declined activities," he told Fortune.

Yohannes believes that a shift towards innovative digital financial products would best leverage the skill sets of the Bank's energetic employees.

Bunna Bank's balance sheet size is at the core of its financial position, encapsulating a total asset value of 46.4 billion Br, representing a growth of 36pc from the previous year. Compared with industry giants such as Awash Bank, which boasts a staggering total asset figure of 224 billion Br, Bunna Bank's market footprint appears smaller. The disparity extends to total equity, where Bunna Bank's 6.5 billion Br contrasted with Awash Bank's 27.9 billion Br, illustrating the challenges inherent in scaling operations within an industry dominated by more sizeable competitors.

Bunna Bank demonstrated a competent performance among its peers when measured in efficiently utilising its assets to generate profits, as shown by its returns on assets and equity. These are crucial barometers for assessing how effectively a bank leverages its equity and assets to generate profits.

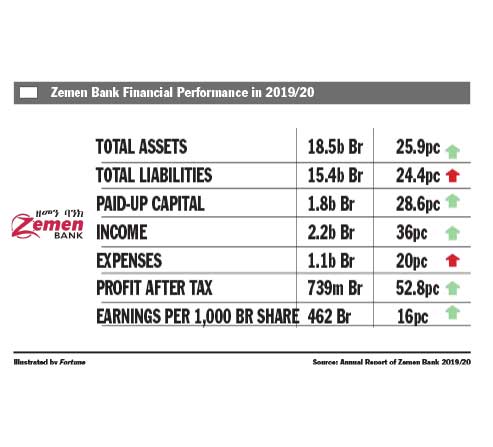

Bunna Bank's return on equity (RoE) was at 17.8pc, moderate compared to banks such as Awash Bank's 25.8pc (the highest in the industry) and Wegagen Bank's 9.6pc. Its return on asset (ROA) was 2.61pc, half the size of Zemen Bank's leading rate and Wegagen Bank's 1.3pc.

Bunna Bank used its assets to generate earnings relatively effectively, outperforming many of its peers.

PUBLISHED ON

Mar 09,2024 [ VOL

24 , NO

1245]

Radar | Apr 01,2024

Viewpoints | Oct 20,2024

Fortune News | Aug 14,2021

Editorial | Mar 01,2024

Radar | Oct 17,2020

Fortune News | Feb 09,2019

Fortune News | May 23,2021

Fortune News | Feb 20,2021

Fortune News | Jan 01,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...