Commentaries | May 24,2025

Oct 9 , 2024

The federal government announced a rise in retail fuel prices, adjusting a litre of benzene to 91 Br and diesel to 90 Br.

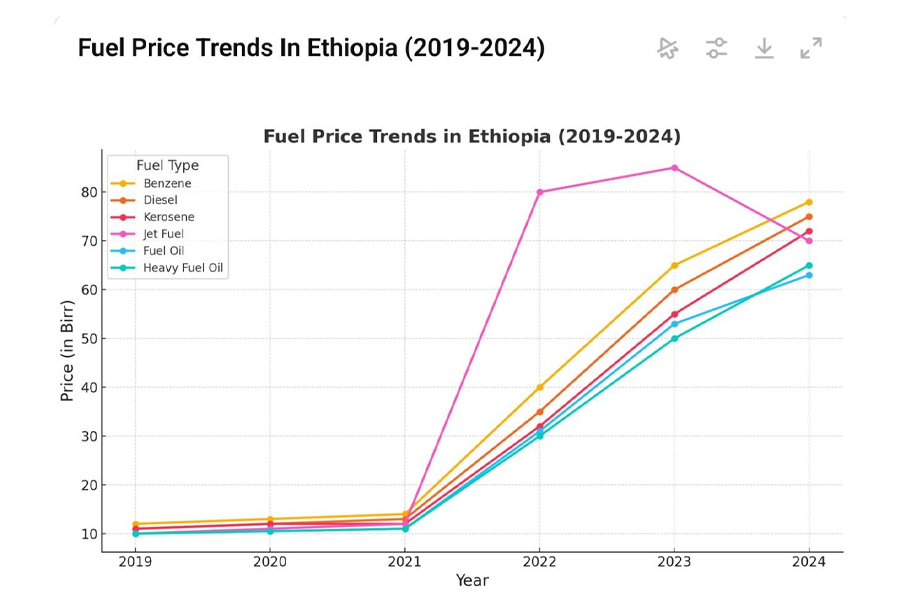

Retail fuel prices have surged dramatically over the past five years, driven by global market dynamics, domestic economic reforms, and currency depreciation. The gradual elimination of government fuel subsidies, a policy encouraged by international lenders, has shifted the financial burden onto consumers. Diesel prices have climbed sharply due to global supply disruptions and a weakening Birr, creating a volatile market environment that has elevated transportation and production costs.

However, the authorities have pledged today to continue to cover costs to cushion the impact on motorists. The Ministry of Trade & Regional Integration (MoTRI) has allocated about 300 billion Br for petroleum subsidies, covering 80pc of diesel and 75pc of benzine costs.

International fuel prices, stable at around 72 dollars a barrel until April, have recently climbed to 80 dollars. Domestically, Benzine is priced at 82.60 Br a litre and diesel at 83.74 Br, with market speculations that prices could exceed 100 Br.

"The price increases are due to global factors such as war and the recent floating of the Birr," said Ahmed Tusa, an advisor to the Minister of Trade.

According to Ahmed, public transport service providers would continue to receive additional support beyond the previous 19.50 Br subsidy for a litre. Over the past three years, the federal government has disbursed 197 billion Br in subsidies, along with 30 billion Br allocated for public transport. In the past two months alone, 35 billion Br in subsidies has been paid, with 150 billion Br required for credit payments.

The fuel sector faces problems such as waste and contraband, with an estimated 20pc to 25pc of imported fuels sold in the illicit market.

"Digitising the fuel supply chain and implementing GPS tracking for fuel trucks helped combat these issues," said Ahmed.

As a net importer of crude oil, Ethiopia is highly susceptible to international price changes. Rising fuel costs are compounded by the Birr's depreciation against major currencies. The depreciation has magnified price increases, making fuel more expensive in local currency. Consequently, retail price increases beginning in 2019 reflect not only international oil trends but also Birr’s floating and economic restructuring.

In the two years beginning in 2019, prices at gas stations showed gradual increases reflecting fluctuation in international oil prices. The notable divergence occurred post-2021, when the federal government accelerated subsidy withdrawal as part of broader economic reforms to bridge fiscal deficits and secure international financial assistance. The shift coincided with the global energy crisis, exacerbated by geopolitical tensions like the Russia-Ukraine conflict, further inflating fuel prices.

Diesel experienced the most pronounced increase. Its retail price reduced subsidy support and global market reactions to a constrained supply chain. As the primary fuel for transporting goods and people, rising diesel prices have had a domino effect, inflating costs across multiple sectors and stoking overall inflation.

Kerosene, widely used by rural households for cooking and lighting, also saw sharp price rises, disproportionately affecting low-income households. The authorities’ decision to reduce subsidies on kerosene, a product often seen as a social safety net, was part of a strategy to ease fiscal pressures.

Commentaries | May 24,2025

Radar | May 27,2023

Fortune News | Feb 06,2021

Delicate Number | Jul 15,2023

Fortune News | Jul 17,2022

Fortune News | May 16,2020

Viewpoints | May 31,2025

Fortune News | Sep 15,2025

Viewpoints | Oct 20,2024

Featured | Jul 27,2025

Photo Gallery | 178266 Views | May 06,2019

Photo Gallery | 168471 Views | Apr 26,2019

Photo Gallery | 159253 Views | Oct 06,2021

My Opinion | 137058 Views | Aug 14,2021

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...