Fortune News | May 23,2020

Sep 29 , 2025

The Central Bank has unveiled a formal policy interest rate regime and an interest rate corridor, mechanisms long considered foundational in modern central banking.

Announced by the National Bank of Ethiopia (NBE) today, September 29, 2025, the change represent the most explicit articulation of monetary policy since the NBE’s inception. The introduction of the “National Bank Rate”, set initially at 15pc, is flanked by standing deposit and lending facilities. This corridor creates a band within which interbank interest rates are expected to fluctuate, thereby enabling the Central Bank to influence short-term liquidity conditions and, ultimately, broader financial market behavior.

The Central Bank also committed to conducting regular open-market operations (OMOs) and reviving a dormant interbank money market, components of a functioning monetary transmission mechanism.

Together, these tools are hoped to help policymakers shift from a regime of credit rationing, where the Central Bank directed credit flow, to one of price signalling, where the cost of money becomes the primary policy instrument.

A functioning and credible corridor sets a price for liquidity so that banks respond to the Central Bank Rate and the cost of borrowing or depositing money at the Central Bank, rather than waiting for directives. Open-market operations (the buying and selling of NBE's paper or government securities) are expected to deepen short-term markets and provide banks with a reference for setting deposit rates. A functioning interbank market is also expected to give banks a safety valve for their daily cash needs, reducing the urge to hoard liquidity.

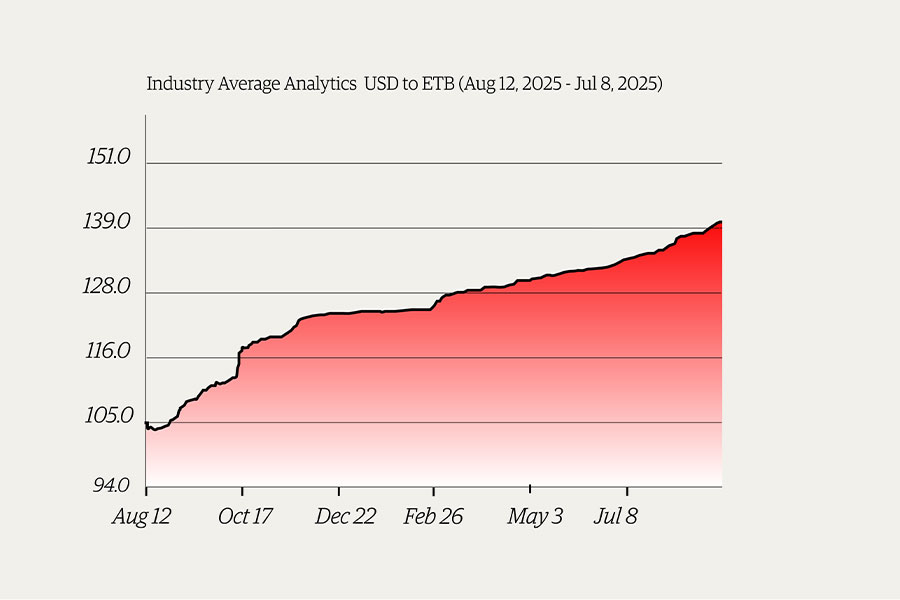

The statement Central Bank issued described these changes as part of a "macroeconomic environment of steady activity and a continuing disinflation trend," casting the new tools as vital to consolidating these gains.

The National Bank Rate becomes the main policy signal, with the standing deposit facility as the floor and the standing lending facility as the ceiling. The NBE announced that open-market operations will now be scheduled to absorb or provide liquidity as needed, ending ad-hoc measures.

Analysts foresee that the interbank money market will likely become more active, as banks are encouraged to manage liquidity actively rather than simply building up reserves. The NBE also restated its readiness to intervene in the currency market alongside open market operations to help keep financial conditions stable.

Fortune News | May 23,2020

Money Market Watch | Sep 14,2025

Fortune News | Sep 23,2023

Radar | Feb 26,2022

Fortune News | Sep 19,2020

Featured | Jan 05,2019

Commentaries | Apr 24,2021

Fortune News | Feb 04,2023

Fortune News | May 09,2020

Photo Gallery | 166712 Views | May 06,2019

Photo Gallery | 156958 Views | Apr 26,2019

Photo Gallery | 146187 Views | Oct 06,2021

My Opinion | 135931 Views | Aug 14,2021

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...