Radar | May 15,2021

Oct 28 , 2023

By

In the thriving world of international commerce, few sectors have witnessed the meteoric rise and shift that the flower industry has seen. Over the past few decades, floriculture has transitioned from traditionally domestic to a high-stakes, highly globalised business. As economic climates change and consumer preferences evolve, so does the landscape of this multi-billion-dollar industry.

Historically, Europe, the Middle East, and North America have been the dominant consumer markets in the flower trade. Countries near the equator have found favour due to advantageous climatic conditions and relatively cheap energy costs. The Netherlands has long been the reigning champion, but Colombia, Kenya, Ecuador, and Israel are not far behind in the pecking order. Ethiopia is also blooming globally, climbing into the top five, while Israel’s influence seems to be wilting.

However, this growth trajectory has seen its fair share of hurdles. Market demand appears to be plateauing, with an overabundance of flower supply tipping the scales. Forecasts suggest a subdued growth rate of three per cent for the last three years in Western Europe’s cut flower markets. Discerning consumers and evolving trade requirements have pushed the industry towards the brink of change. The surge in demand for sustainably produced and distributed products means producers must step up or step out. Margins are dwindling, and the traditional playbook of the flower industry is being rewritten.

The future leans towards transparent supply chains, with direct trade channels gaining prominence over traditional auction systems.

Technology is another game-changer. The Flora Holland auction, a notable marketplace, has witnessed over 56pc of its rose transactions through its remote buying system, ‘KOA’. European wholesalers have capitalised on the digital wave, with online storefronts allowing for real-time trade. This paradigm shift makes information exchange crucial, emphasising accuracy and promptness.

A new leaf is turning in the European flower trade. Social and environmental standards are now at the forefront, thanks to changing consumption patterns, media scrutiny, and advocacy by non-governmental organisations. The market has certification schemes, best practice codes, and consumer labels. Retail giants are cultivating their bespoke standards, further fragmenting but undeniably elevating the importance of industry benchmarks.

The global arena is rife with competition as leading flower exporters – the Netherlands, Colombia, Ecuador, Kenya, and Ethiopia – battle for market share in Europe, the Middle East, and North America. This intensified rivalry stems from a stagnating demand and an influx of large-flowered roses from Africa that have started matching, if not exceeding, international quality benchmarks.

With Colombia trailing, Ecuador has been aggressive, expanding its floral footprint in Europe and pre-war Russia. Eastern Europe, in particular, has embraced Ecuadorian blossoms. Colombia, not to be outdone, is eyeing niche markets, a domain traditionally ruled by Dutch and African flowers. Before the war with Ukraine, Russia has been a lucrative market for Kenya and Ethiopia, and the quality of their produce speaks volumes.

Across the Atlantic, the North American market is a hotbed of competition. Ecuador harbours ambitions of increasing its market share there, while Kenya grapples with logistics, even without import duties. Direct flights between the US and Kenya might be the missing link, a topic currently under discussion between the US airlines and the Kenyan government.

The global flower trade story is incomplete without shining a spotlight on Ethiopia.

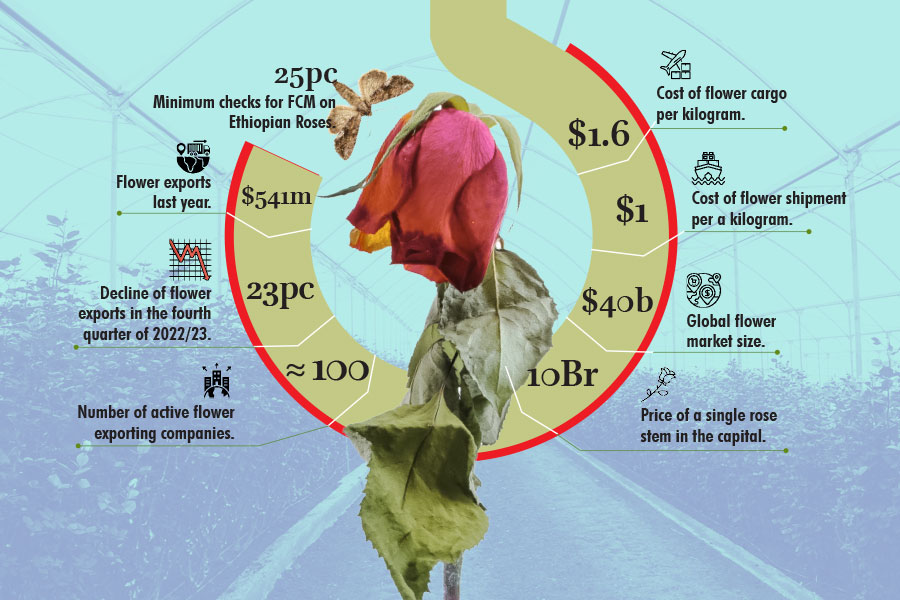

From a modest 840hct production area in 2004, the country now boasts roughly 1,600hct allocated to floriculture. The growth is evident in the exports too – a leap from 46,000tn in 2004 to an impressive 291,000tn in recent years. The foreign currency earnings from this sector have witnessed a three-fold jump from 196 million dollars in 2004 to 660 million dollars in 2015.

The primary blossoms of choice are a diverse range of summer flowers, including roses, carnations, statice, alstroemeria, and lilium. Such is the sector’s significance that it evolved to be second only to coffee in foreign currency earnings. Last year, it recorded a 22.5pc growth over the previous year’s earnings of 246.5 million dollars.

However, growth has not been a bed of roses. Land scarcity, crucial for expansion and new entrance, has curtailed existing and prospective investors from realising their full potential in the global market. High-tech developments and stringent supplier criteria will continue to shape Ethioipa’s prospect in the cut-flower sector, determining participation. Its future prominence in the industry hinges on its adaptability to the evolving conditions.

So is the global industry so intertwined with nature its survival will depend on its ability to evolve and adapt, much like nature.

PUBLISHED ON

Oct 28,2023 [ VOL

24 , NO

1226]

Radar | May 15,2021

Agenda | Jan 16,2021

Viewpoints | Dec 16,2023

My Opinion | Jul 20,2024

Commentaries | Mar 18,2023

Radar | Jan 27,2024

My Opinion | Jun 19,2021

Exclusive Interviews | Jan 05,2020

Viewpoints | Jun 28,2025

Fortune News | Feb 10,2024

Photo Gallery | 179183 Views | May 06,2019

Photo Gallery | 169379 Views | Apr 26,2019

Photo Gallery | 160270 Views | Oct 06,2021

My Opinion | 137160 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...