The Birr has crossed a historic threshold, hitting an exchange rate of over 100 Br to the dollar last week — a wake-up call for the country's economy. Examining historical trends in official and parallel exchange rates since 1995, alongside the real effective exchange rate (REER) from 1987 to 2021, a dramatic shift is evident, particularly after 2015. The REER offers a broader perspective by accounting for inflation differentials and trade-weighted currency baskets. A prolonged decline leading up to 2000 indicated a real depreciation of the Birr, exposing deep-rooted economic vulnerabilities and structural issues. Even though the decline slowed from 2000 to 2015, the REER continued to drop, diminishing the country's competitiveness.

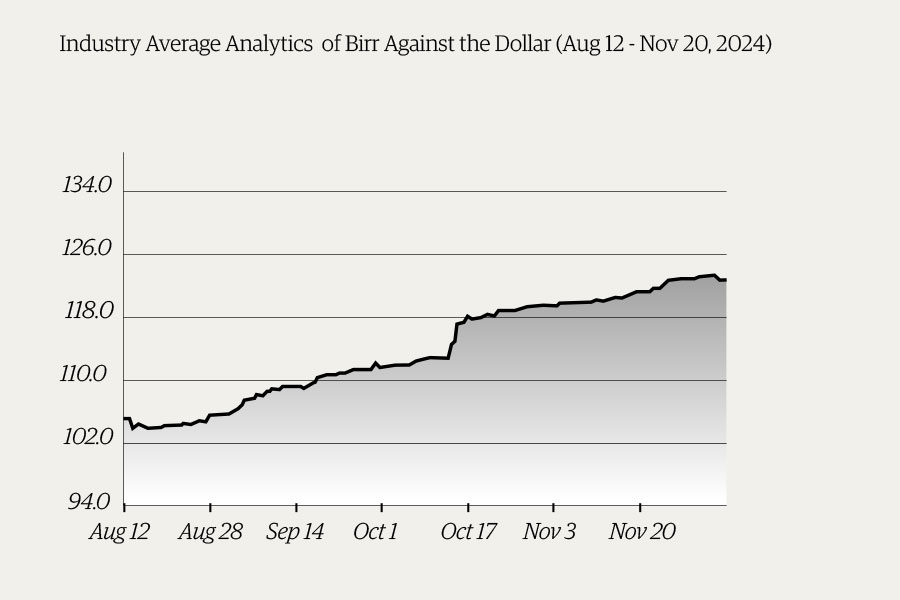

The rapid depreciation of the Birr unveiled successive governments' struggle to keep up with mounting economic pressures. This pressure largely stems from the parallel exchange rate, often serving as a more real barometer of market sentiment. While both rates followed a similar trajectory, a notable divergence emerged post-2015, intensifying the gap between the official rate and the market's real perception of Birr's value. The disconnect peaked after 2020, revealing the inefficiencies in the government's official exchange rate policy and the escalating market crisis.

Last week marked a crucial moment as the National Bank of Ethiopia (NBE) relinquished control over foreign exchange rates to market forces. The major policy shift signals a break from the NBE's previous efforts to manage forex shortages by rationing limited resources. The decision sent shockwaves through various sectors; a detergent manufacturer faced a staggering four million Birr loss following a seven million Birr import payment. The policy shift has also resulted in skyrocketing commodity prices, disrupting the export market. While some see potential benefits on the horizon, many remain wary of the ongoing turbulence. As the NBE phases out the priority list for foreign currency distribution, officials are hopeful for a fairer and more transparent process. However, new tax levies and VAT adjustments add to the crisis edible oil producers face, intensifying economic pressures. The quest for domestic sourcing also poses problems for the manufacturing sector.

Floating the Birr has laid bare the economy's inherent weaknesses. While it promises a more efficient allocation of foreign exchange resources, the widening gap between official and parallel rates reflects a growing distrust in the official figures. Policymakers are now realising that comprehensive economic reforms are crucial to restoring investor confidence and stabilising the currency. Economic experts are polarised over the decision to float the Birr. Some believe that despite the immediate challenges and looming inflation, the move could serve as a necessary and long-overdue correction to long-standing market distortions. For sustained economic stability, a robust infrastructure, along with peace and security, is vital. Strategic investments in sectors like education, health, and infrastructure, combined with fiscal discipline and tighter monetary policies, are essential to avoid reckless money printing.

Commercial banks were cautious last week, adjusting exchange rates erratically, determined to safeguard their liquidity reserves. Experienced bankers advocate for a real-time online system to manage foreign exchange and liquidity to stabilise the market and ensure fair practices.

PUBLISHED ON

Aug 04,2024 [ VOL

25 , NO

1266]

Viewpoints | Nov 12,2022

Fortune News | Jul 07,2024

My Opinion | Nov 14,2020

Commentaries | Jan 21,2023

Featured | Apr 30,2021

Fortune News | Apr 20,2024

Agenda | Jun 29,2024

Money Market Watch | Dec 08,2024

News Analysis | Jan 05,2020

Agenda | Nov 05,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...