Fortune News | Mar 26,2022

Aug 16 , 2020

By GELILA SAMUEL ( FORTUNE STAFF WRITER

)

Banks can now borrow foreign currency from international financial institutions and lend the forex to companies that engage in foreign currency generating activities.

Drafted by the National Bank of Ethiopia (NBE), the directive that was up for consultation with bankers last Monday, enables local banks to borrow from foreign banks in dollars, pound sterling, euro, Chinese yuan, Canadian dollars and Japanese yen. The directive also allowed the banks to act as intermediaries for local borrowers.

"It has become necessary to facilitate access to forex to foreign currency generating activities by allowing banks to intermediate in foreign currency through borrowing from external lenders," reads the draft directive.

The Foreign Currency Intermediation Banks directive also allows the local banks to maintain holdings of foreign currency by depositing it at the central bank or a foreign correspondent bank. While engaging with foreign currency intermediation, the banks are exempted from acquiring a permit from the central bank.

This foreign currency acquired through external loans is also exempted from the foreign exchange surrender requirements to the central bank. Usually, commercial banks are required to surrender 30pc of their forex earnings to the regulatory bank.

Banks that are going to engage in foreign currency intermediation must open a foreign currency reserve account at the central bank, and they are required to maintain five percent of the outstanding balance of the external loan. However, unlike the local currency reserve account, the balance in this reserve account will have an interest rate paid by the central bank.

The interest rate remuneration will be computed equivalent to the one-month London Inter-bank Offered Rate (LIBOR), a benchmark that banks use to lend to one another in the international interbank market for short-term loans. The rate serves different currencies with seven maturity periods of overnight, a week, and one, two, three, six and 12 months.

Local banks are allowed to access external loans with the prerequisite terms of having a grace period of three years from the principal payment of the credit to at least three years. The total repayment period will be at least six years, including the grace period.

In addition, the total cost of the external loan, including the interest rate and other expenses should not exceed LIBOR plus five percent.

In availing the loan to foreign currency generating businesses, banks have to make sure the loan does not exceed 60pc of the total project or the net worth of the borrower's business. During loan disbursement, the foreign currency will be deposited directly to the supplier of the borrower.

Also, the borrower has to open a foreign currency debt service reserve account within the lending bank. Within this reserve account, there has to be a minimum deposit balance that equates to the following year’s debt service by the borrower.

The minimum deposit balance in the reserve account is on top of the 30pc retention right of the borrower.

Dereje Zebene, president of Zemen Bank, appreciates the new initiative but has reservations about what will happen if a particular borrower defaults, saying that the pressure will haunt the local banks.

“Having insurance with foreign currency is going to be a bit pricey," he said, "and this price addition will be transferred to the borrower.”

The central bank recommends that before getting into this scheme, banks should first put in place polices and mechanisms to carefully administer foreign exchange risk. Banks can buy insurance coverage for their loan from a foreign bank, and the policy will be purchased in foreign currency. The premium has to be lower than the loan they have to pay or service.

If a bank wants to buy insurance, then it must secure the consent of the central bank by tabling the draft insurance contract.

A local bank that secures an external loan has to register the loan at the central bank within five business days of the contract signed with the creditor. The bank should also submit a report within 10 days after the end of each month to the central bank.

The system requires a stable foreign currency source in the country, and the country’s balance of payments needs to be settled first, according to Abudelmenan Mohammed, a financial expert with two decades of experience, who also argues that this move is being made too early.

“The currency risk management is going to be hard to manage, because the central bank has set a lot of prerequisites for lending but not on paying back the loans,” he said.

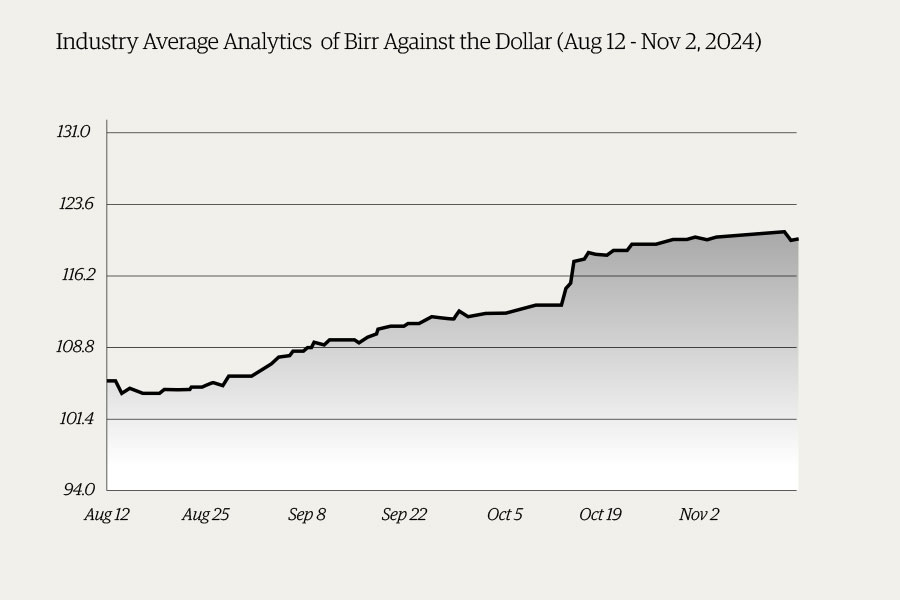

These borrowing businesses have a lot of inflated expenses in the country, and their operations are mostly completed in local currency, according to Abdulmenan, adding that due to the current depreciation of the Birr, it is going to be expensive for the borrowers.

“In addition to managing the risk, the interest rate on the borrower is going to be expensive," he said.

PUBLISHED ON

Aug 16,2020 [ VOL

21 , NO

1059]

Fortune News | Mar 26,2022

Money Market Watch | Nov 16,2024

Commentaries | May 25,2024

Fortune News | Jun 18,2022

Radar | Jun 08,2019

Fortune News | Jun 29,2025

Fortune News | Sep 01,2024

News Analysis | Jul 07,2024

Editorial | Nov 09,2024

Agenda | Aug 24,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...