Fortune News | Apr 10,2021

Feb 8 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

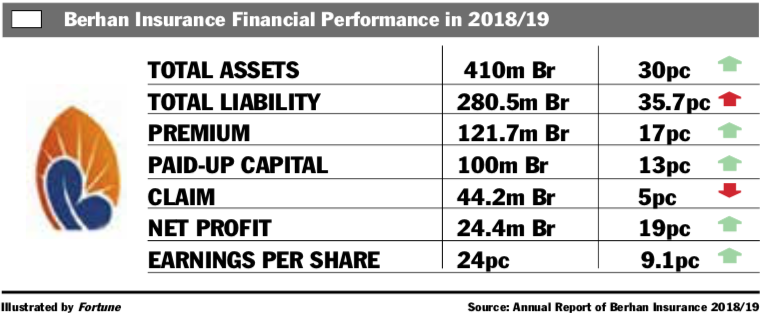

Berhan Insurance Financial Performance for the Fiscal Year 2018/19.

Berhan Insurance Financial Performance for the Fiscal Year 2018/19. Berhan Insurance, one of the late entrant insurance firms, managed to increase its net profit by 19pc in the last fiscal year.

The company netted 24.4 million Br in profit, and its earnings per share (EPS) also slightly rose by two percentage points to 24pc.

Considering the increase in profits, Berhan's EPS growth is very small due to the increase in paid-up capital, which rose by 13pc to 100 million Br.

Growth in underwriting surplus, a reduction in claims and an increase in interest income helped the company to perform well, according to Alemayehu Tefera, CEO of Berhan Insurance, which was established in 2010 with a paid-up capital of 9.7 million Br.

During the previous seven operational years, the company’s average loss ratio was about 73pc, according to Alemayehu.

The gross written premium of the company has increased by 17pc to 121.7 million Br, of which 79pc of it was retained. The retention rate also went down by three percentage points to 79pc.

Even though the rate fell, it is still reasonable, according to Abdulmenan Mehammed, a financial analyst with close to two decades of experience.

Daniel Wondimu, one of 1,600 shareholders and chairperson of the company's board of directors, says that last year was a challenging time for the insurance industry in general.

"Since many of the contractors stopped working," said Daniel, "the construction industry was almost slow."

Claims paid and provided in the last fiscal year declined by five percent to 44.6 million Br.

Alemayehu says that the company took underwriting measures to control risk, especially on motor insurance policies.

"We tried to avoid claims leakage," said Alemayehu.

The company also earned considerable interest income from deposits at different banks in the form of time and savings deposits, according to Alemayehu.

Income the company earned from interest increased by 13pc to 18.2 million Br, while dividend income fell by 17pc to 4.2 million Br.

More than 90pc of dividends was earned from the Insurance's firms investment in Berhan Bank, according to Alemayehu.

Berhan earned a commission of 4.3 million Br, an increase of 13pc, and forked out a commission of 4.3 million Br, a decrease of four percent. Commission the company pays has been declining for the past two consecutive years.

"This shows that commission expenses are well controlled," Abdulmenan commented.

The increase in income was accompanied by a rise in expenses. Salaries and benefits went up by 23pc to 24.4 million Br and other operating expenses went up by 14pc to 17.6 million Br.

The expert cautioned the management of the company to keep an eye on expanding expenses.

In the reporting period, Berhan was able to open three new branches, pushing its branch network to 15 with three more contact offices. It also made a salary raise to its 174 employees to adjust it with inflation and to be competitive in the industry.

The total number of insurance branches has reached 568 following the opening of 36 new branches in the last fiscal year.

Berhan's total assets increased enormously by 30pc to 410 million Br. Out of this, 155.8 million Br was held in time deposits and 52.9 million Br in shares and bonds.

The investment in time deposits, shares and bonds accounts for 50.9pc of the total assets. The ratio decreased by six percentage points from the preceding year.

This must have been due to the growth in the liquidity level of Berhan, according to Abdulmenan.

Conversion from Generally Accepted Accounting Principles (GAAP) to International Financial Reporting Standards (IFRS) also made some items on the financial statement increase notably, according to Alemayehu.

Liquidity analysis of the company shows that Berhan's liquidity level increased in value but decreased in relative terms. Cash and bank balances soared by 16pc to 37.6 million Br and cash and bank balances to total assets decreased to nine percent from 10.2pc.

The liquidity ratio of Berhan is close to the industry average of eight percent.

In the reported period the company has changed 10 old vehicles due to the increase in running costs and large repair and maintenance expenses, according to Alemayehu.

With a paid-up capital of 100 million Br, Berhan's capital and non-distributable reserves account for 26.2pc of its total assets.

This shows that Berhan is a well-capitalised insurance company, according to Abdulmenan.

The capital of the insurance industry overall increased by 49.5pc in the last fiscal year to reach 8.2 billion Br.

PUBLISHED ON

Feb 08,2020 [ VOL

20 , NO

1032]

Fortune News | Apr 10,2021

Fortune News | Jan 11,2020

My Opinion | Oct 12,2024

Fortune News | Feb 01,2020

Radar | Jul 15,2023

Commentaries | Jan 12,2019

Fortune News | Mar 14,2020

Fortune News | Jan 15,2022

Commentaries | Apr 01,2023

Radar | Dec 26,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...