Radar | Aug 22,2020

All of the commercial banks can now issue foreign currency debit cards to travelers, according to a new circular issued by the National Bank of Ethiopia (NBE). For the past two years, the state giant Commercial Bank of Ethiopia (CBE) has been piloting the project by issuing the international prepaid cards only to traveling high-level government officials.

Signed by Yinager Dessie (PhD), governor of the central bank, the circular stated that the pilot period has come to an end and all banks can begin the service as of the end of last month. The circular fully activated the directive that was approved in August 2018, allowing banks to issue foreign currency cards to travelers, who had been taking the foreign currency in cash. While enacted, the two-year-old directive did not have a clear timeline as to when the piloting would end and when the full service would begin.

To issue the cards, the banks should have an agreement with seven international card payment networks including American Express, Visa Card, Master Card, Diners Club, JCB, Union Pay and Discover. The banks should also install a card personalisation machine or outsource the project, establish a central clearing system, and put in place secure telecommunications infrastructure services. The banks can issue cards, which will be valid for two years, in currencies of the destination country or in dollars, euros and pounds.

Before acquiring the prepaid international cards, travelers should secure an international debit card license from banks, and the license will be subject to a yearly base renewal. While crediting the foreign currency to the international cards, the banks are allowed to charge travelers only 1.5pc of the value as a service fee.

Beyond crediting the cards with foreign currency, forex bureaus of banks are required to refund the card's unused foreign currency into Birr after checking the details of transactions and the account statement, according to the directive.

The initiative is not completely new. A few years back Dashen Bank, under the leadership of former President Lulseged Teferi, had applied to start the service. However, the proposal from Dashen was neither approved nor rejected.

The new directive enables Eth-Switch to take a role in the process, according to Yilebes Addis, CEO of Eth-Switch S.C., the operator of the national electronic retail payments switch.

"The company has a role in working on a local and international gateway," said Yilebes. "We can also issue international cards for banks, with our card personalisation."

On top of making payments for goods and services abroad, international cardholders can also make payments at local businesses that are authorised to accept payments in foreign currency. Hotels with over a three-star rating, duty-free shops, civil aviation, the immigration office, air ticket offices, and tour operators are among the local entities that are eligible to accept payments in foreign currency.

Local businesses that can accept payments in foreign currency are also required to get a permit from the central bank after producing contracts they have entered with international card issuers.

A lack of foreign currency is one of the fundamental problems of the country's economy. Over the past couple of years, the forex crunch has become severe. As of June 30, 2020, gross foreign reserve coverage stood at 2.5 months of imports of goods and non-factor services of the current fiscal year.

Due to the scarcity of foreign currency, the central bank has issued a directive that identifies the priority areas where foreign currency is to be allocated for import purposes based on the country’s needs. The directive determines the accessibility of foreign exchange based on the priority list areas provided. Travel is among the list of items that are exempted from the registration procedure, and customers can be served on-demand after producing required documents such as passports, air tickets and valid visas.

The foreign currency directive of the country also prohibited anyone residing in Ethiopia from holding on to foreign currency for more than 30 days.

The system will stop the foreign currency that was going to the parallel market, according to an expert who wishes to remain anonymous.

"Unused foreign currency has been going to the black market, which has a higher exchange value than at the banks," he said.

PUBLISHED ON

[ VOL

, NO

]

Radar | Aug 22,2020

Fortune News | Mar 09,2024

News Analysis | Jul 07,2024

Fortune News | Feb 26,2022

Radar | Sep 11,2020

Radar | May 21,2022

Commentaries | Nov 14,2020

Commentaries | Aug 14,2021

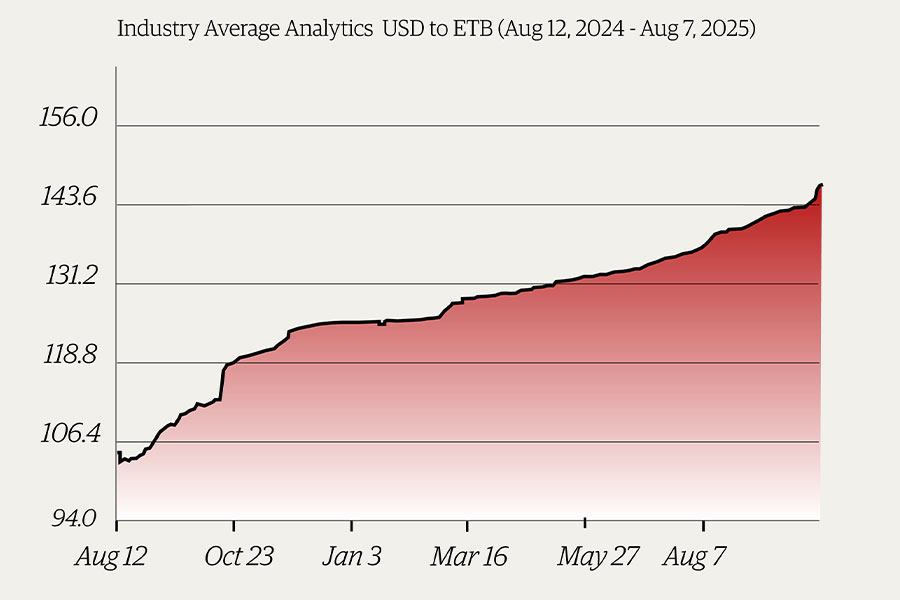

Money Market Watch | Oct 18,2025

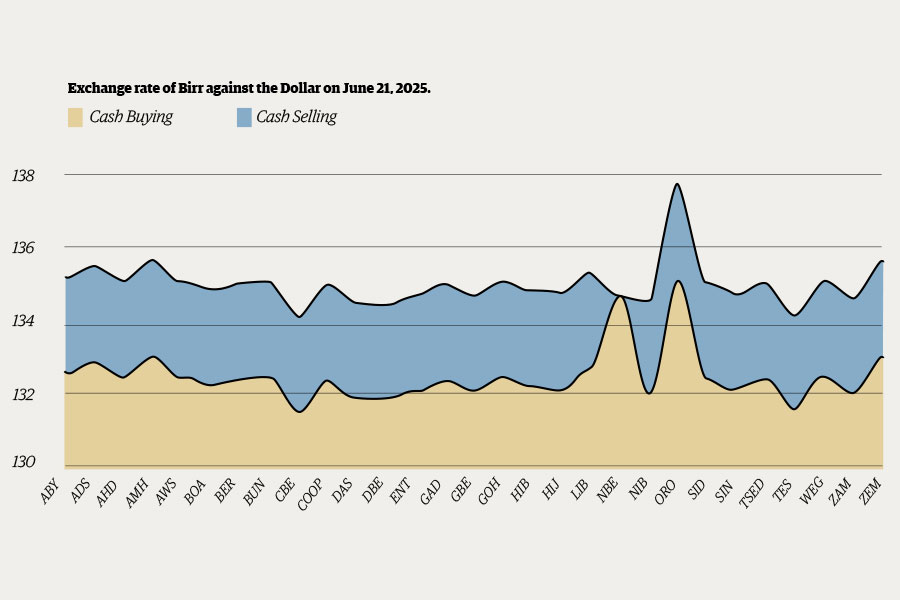

Money Market Watch | Jun 21,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...