Editorial | Aug 14,2022

The banking industry is experiencing a transformative period under the oversight of National Bank of Ethiopia (NBE) Governor Mamo Mihretu. Last month, the central bank introduced five new directives that sought to enhance corporate governance and asset classification for the industry. These directives mandate the creation of comprehensive databases for related party transactions and the continuous updating of credit profiles, with a three-year compliance timeline for commercial banks. Industry figures such as Neway Megersa of Siinqee Bank and Dereje Zenebe of Zemen Bank have supported these changes, although they advocate for a more flexible implementation schedule. Neway stated the necessity of technological investments to comply with new regulations, while Dereje believed in improved liquidity and financial stability benefits. Dereje captured the essence of the reform, stating that "banks now belong to depositors more than they do to shareholders." Central bank authorities believe these directives are poised to enhance transparency, risk management, and depositor empowerment while addressing systemic risks associated with bad credit.

Despite the general optimism, some concerns remain. Dawit Keno of Hijra Bank, an interest-free institution, criticised the new regulations for not sufficiently catering to the unique needs of his segment. He called for establishing a dual banking system and creating a dedicated department within the central bank to oversee interest-free banks. Nevertheless, Dawit remains optimistic about the central bank’s new monetary policy framework, which seeks to ease liquidity constraints. The NBE has shifted from a quantity-targeting approach to an interest-based market model, setting policy interest rates at 15pc and conducting biweekly auctions. Governor Mamo described this as a "major shift" intended to address macroeconomic imbalances and facilitate a dynamic interbank market.

The proactive position by the NBE is part of a broader three-year strategic plan introduced seven months ago, which seeks to restore fiscal and monetary stability. The plan, along with a draft proclamation to re-establish the NBE’s autonomy, shows the central bank's resolve to strengthen its regulatory role. Industry veteran Eshetu Fanatye noted that substantial technological upgrades are essential to meet the new requirements, viewing Governor Mamo's tenure as a period of calculated and strategic reforms.

PUBLISHED ON

Jul 13,2024 [ VOL

25 , NO

1263]

Editorial | Aug 14,2022

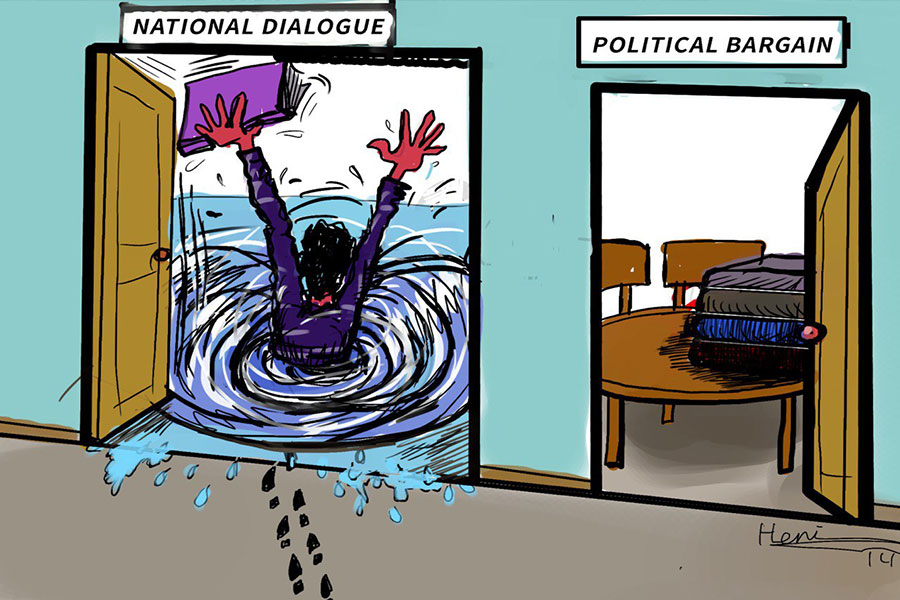

Money Market Watch | Sep 14,2024

Radar | Jul 11,2021

Radar | Mar 02,2024

Editorial | Jun 22,2024

Delicate Number | Aug 02,2025

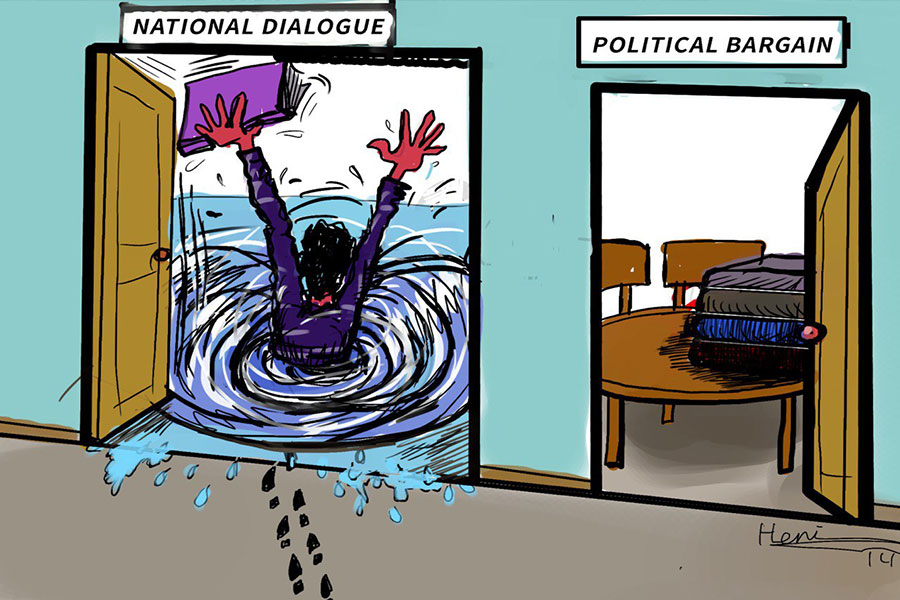

In-Picture | Oct 06,2024

Agenda | Aug 26,2023

Viewpoints | Jun 07,2025

Radar | May 31,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

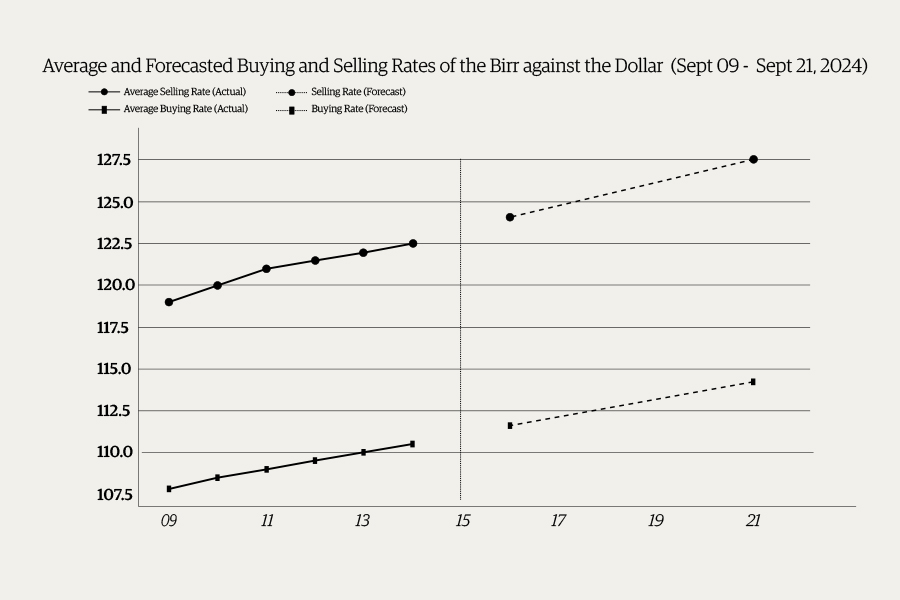

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...