Fortune News | Feb 29,2020

The leading private commercial bank cemented its place in the industry with an impressive performance that saw it make strides on nearly all CAMEL fronts.

Awash International Bank (AIB), the first private bank incorporated following the domestic liberalisation of the financial sector almost three decades ago, netted 3.4 billion Br in profits, recording a 31pc jump. The figure puts Awash well ahead of its close competitors. Dashen Bank, the second-biggest name in the industry, registered half the net profits over the same period.

“Last year, Awash registered big achievements on all fronts,” said Dibaba Abdeta (PhD), board chairperson of AIB, during the annual shareholders meeting held on November 27, 2021, at the Hilton Hotel.

Awash Bank has managed impressive feats in capital adequacy, asset quality, management, earnings, and liquidity, otherwise known in the industry lingo as CAMEL. Its balance sheet has seen growth on a massive scale, recording a 40pc increase in paid-up capital and a 44pc surge in total assets. The Bank's paid-up capital shot up by 40pc to 8.2 billion Br.

In a period marked by the COVID-19 pandemic and economic slowdown due to war, Awash Bank has boosted its revenues from non-financial intermediation businesses. Gains on foreign exchange dealings surged by 76pc to 755.64 million Br while fees and commissions soared by 63pc to 2.62 billion Br. This achievement was despite the requirements by the central bank to surrender 30pc of foreign currency earnings, which has been eroding the forex reserves of Awash, reads a statement from Tsehay Shiferaw, president of Awash, in the Bank's annual report.

Expenses went up in tandem with the rise in income.

The Bank's total expenditures rose by 35pc, reaching 8.9 billion Br. Personnel expenses, which grew from 2.2 billion Br to 3.5 billion Br, were a major factor. This has made up nearly 40pc of total expenditures while interest expense, which went up by 24.5pc to 3.3 billion Br, accounts for 37.1pc.

The growth of personnel and other operating expenses needs the management's attention, says Abdulmenan Mohammed, a financial statement analyst and a keen observer of the financial sector.

The growth is attributed to the salary scale adjustment at the beginning of the financial year and significant branch expansion, according to Ebisa Deribie, director of marketing and communications at Awash Bank. Last year, the Bank opened 100 branches, bringing its branch network to 566. Awash also hired 2,058 new employees, pushing its total workforce to 12,188.

Awash Bank's earnings per share (EPS) have fallen for the second consecutive year despite the significant leaps. The value sits at 470 Br, down from 510 Br the previous year.

Taye Aseged, one of the Bank's 4,369 shareholders, says the earnings this year are not as bad as the challenges Awash Bank faced during the reporting period.

“Branches located in Tigray were not operational last year,” said Taye, who bought 20 shares in 2009, paying 27,000 Br at an auction, 35pc higher than the par value. He owns 1,400 shares with a par value of 1,000 Br.

“Although the returns are not much considering the loss of Birr's purchasing power, the EPS is still the highest among private banks," he said.

Awash Bank’s growth in profit after tax was mainly attributable to a 25.5pc increase in interest income, which accounts for 72.1pc of the Bank's total revenue of 13.7 billion last year. A 52.8pc rise in loans and advances contributed to the surge in interest income. The Bank disbursed 30.3 billion Br last year.

Awash, which started operations in 1995 with 24.2 million Br in equity raised from 486 shareholders, is now the most capitalised private bank and the only one whose paid-up capital exceeds the minimum requirement of five billion Birr set by the central bank last fiscal year. The capital injection came following shareholders' decision during an annual meeting to raise the paid-up capital to 12 billion Br within three years.

"Awash should pursue a capitalisation policy that maximises the returns of the shareholders,” said Abdulmenan.

Taye, the shareholder, believes the Bank's capitalisation strategy is on the right track. According to him, Awash Bank needs to prepare for the competition that lies ahead when the financial sector is opened to foreign banks. Taye is one of many shareholders that decided to recapitalise the returns they received last year.

Awash's total assets had hit 128.7 billion Br by the end of the last fiscal year. Its deposits also grew by 44.3pc to 102.3 billion Br. This is due to strong efforts made to enhance the Bank's wallet share and an aggressive expansion of its customer base, according to Tsehay.

Close to two million new customers opened deposit accounts with the Bank last year alone.

This makes Awash the second-largest commercial bank in deposit mobilisation, next to the state-owned Commercial Bank of Ethiopia (CBE), whose deposits stood at 735 billion Br last year.

Awash's liquidity level, however, shows a reduction as indicated by its loan-to-deposit ratio, which increased to 84.11pc from 79.7pc in 2019/20.

Abdulmenan cautions that further increases could undermine Awash Bank`s liquidity position. The liquid assets to total assets ratio also went down to 13.61pc from 19.49pc.

“This should serve as a cue for the Bank's management to be vigilant of their liquidity level,” said Abdulmenan.

However, Ebisa contends that the management gives a lot of emphasis on the liquidity level by monitoring the status of non-performing loans (NPL), which stood at 1.9pc last year, well below the five percent ceiling enforced by the central bank.

PUBLISHED ON

Dec 11,2021 [ VOL

22 , NO

1128]

Fortune News | Feb 29,2020

Radar | Dec 16,2023

Fortune News | Mar 12,2022

Commentaries | Nov 30,2019

Radar | May 14,2022

Radar | Aug 26,2023

Radar | Dec 17,2022

Radar | Apr 03,2021

Fortune News | May 28,2022

Radar | Sep 10,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

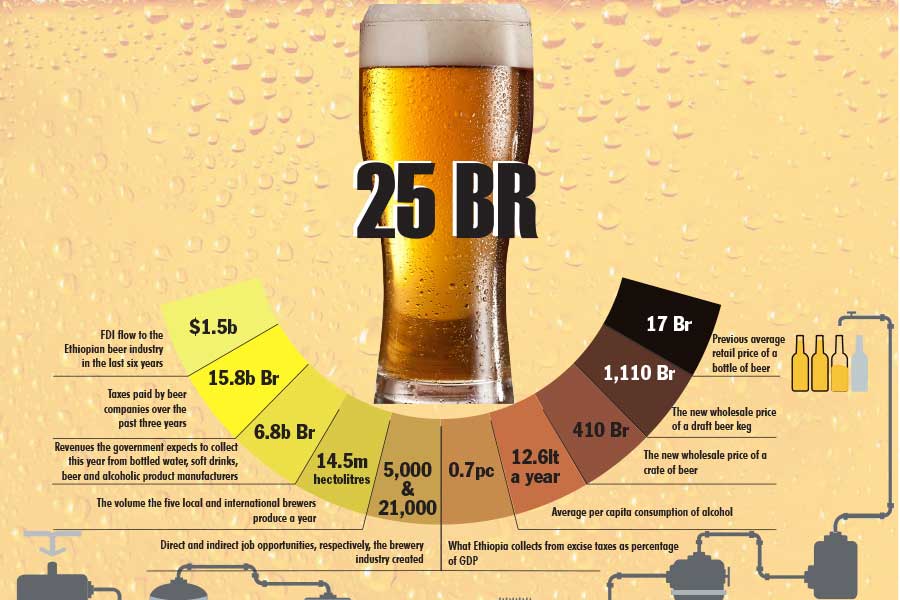

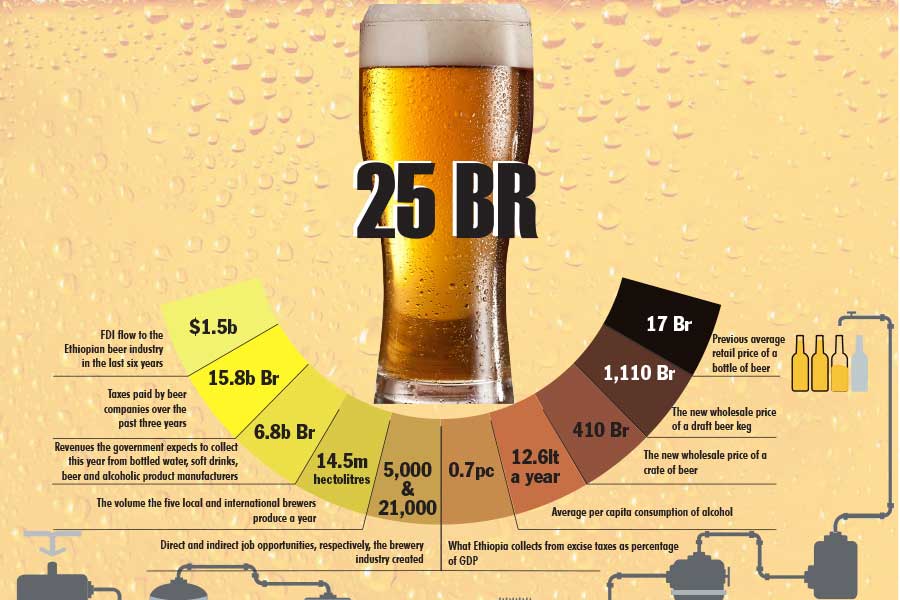

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...