Fortune News | Jun 18,2022

Awash Bank shareholders voted to boost the paid-up capital to 55 billion Br in the next four years, a one billion dollars threshold in the current exchange rate. Achieving such height will make the first private bank the most capitalised in the league of private commercial banks.

However, the decision has raised eyebrows in the legal community that the directors of Awash Bank are in non-compliance with the commercial code that required submissions of a list of new shareholders subscribing stakes with the company before securing existing shareholders' concessions. They have decided to offer three billion Birr worth of shares to loyal customers over the past 28 years with half the premium value. Two billion Birr shares will be offered to the staff.

In the words of the Bank's President, Tsehay Shiferaw, the move is one way of preparing to compete with foreign banks anticipated to enter the domestic financial sector.

Awash Bank has maintained its reputation as the leading private bank in the market; hence its shares are most sought after by prospective shareholders. Its net profit from last year's operation climbed by a substantial 57pc to 5.3 billion Br, an amount equal to the capital threshold the central bank demands all banks to meet come 2026.

The Bank has recorded meritorious growth, increasing its paid-up capital by 25pc from last year to 10.2 billion Br, already doubling the ceiling put by the central bank way before the deadline in 2026. Dibaba Abdeta (PhD) marked the year as "commendable", despite instability, pandemic, drought and inflation.

The growth is mainly attributed to a significant increase in interest income and fees on foreign exchange dealings. The interest on loans, advances, central bank bonds and other deposits surged by 43pc to 14.1 billion Br. Its revenues from non-financial intermediation businesses showed impressive growth. Fees and commissions grew by 89pc to 4.9 billion Br, and gains on foreign exchange dealings surged by 33pc to a little over one billion Birr.

"It was a remarkable performance," said Abdulmenan Mohammed, a financial expert who closely follows developments in the domestic financial market. "The management of the Bank should take credit."

Earnings per share (EPS) significantly increased by 100 Br from the previous year to 570 Br, more than double the industry's average, a result that pleased shareholders.

Elias Negassi is one of the over 6,000 shareholders who bought 811 shares while working in the bank 20 years ago. He is delighted with the Bank's overall performance and appreciates Awash's management positioning to navigate through the entry of foreign banks.

However, he feels there are areas for improvement, particularly on the digital technology front. He worries that inadequately trained staff at a management level not adept at technological advancement can challenge Awash Bank.

"The Bank can face competition from foreign banks in this area," Elias said.

However, Mideksa Demssie, a customer service officer (CSO) at the Beklo Bet branch, attributed the successful year to well-trained and competitive employees. As a veteran Bank established in 1995 with 24.2 million Br capital raised from 486 founding shareholders, Mideksa agrees with Elias that Awash should be more forceful in embracing digital technologies.

The total loans the Bank advanced went up by 47pc to 126.9 billion Br, almost triple the industry average provided by private banks in the last fiscal year. Awash mobilises a deposit of a little over 148 billion Br through 725 branches, showing an increase of 45 pc, resulting loan-to-deposit ratio of close to 86pc. Abdulmenan finds this an "impressive achievement." However, the management of Awash Bank should carefully watch this ratio as further increases could undermine its liquidity. The deposit mobilised is nearly four times the average at private banks from last year.

The increase in income resulted in a substantial increase in expenses. Interest on deposits increased by 32pc to 4.4 billion Br, personnel expenses went by 63pc to 5.7 billion Br, and operating costs increased by 41pc to close to 2.3 billion Br. This is concerning, according to Abdulmenan.

"The management should keep an eye on the growing expenditures," he said.

Provision for loans and other asset impairment jumped by 63pc to over 860 million Br. According to the expert, executives of the Bank should work on this as the growth is very significant and needs serious attention.

Awash Bank's balance sheet has expanded immensely. Its total assets reached 183.4 billion Br.

The cash and balance of the Bank shot by 79pc to 32.04 billion Br. The liquid assets to total assets ratio went up by three percent to 17pc. Significant growth in deposits and high profitability must have contributed to the improvement, according to Abdulemenan. The Bank's non-distributable reserves and capital increased by 29.6pc to 15.8 billion br.

A commercial bank's Capital Adequacy Ratio (CAR) should be eight percent based on the floor set by regulators at a central bank. Awash's CAR dropped by two percent to 12.5pc in the reported year. The expert recommends that it is essential to raise capital as a precaution.

"It's one of the factors that led to the decision to raise the capital," Tsehay agreed.

PUBLISHED ON

[ VOL

, NO

]

Fortune News | Jun 18,2022

Fortune News | Apr 06,2024

Radar | Nov 04,2023

Fortune News | Mar 07,2020

Covid-19 | May 23,2020

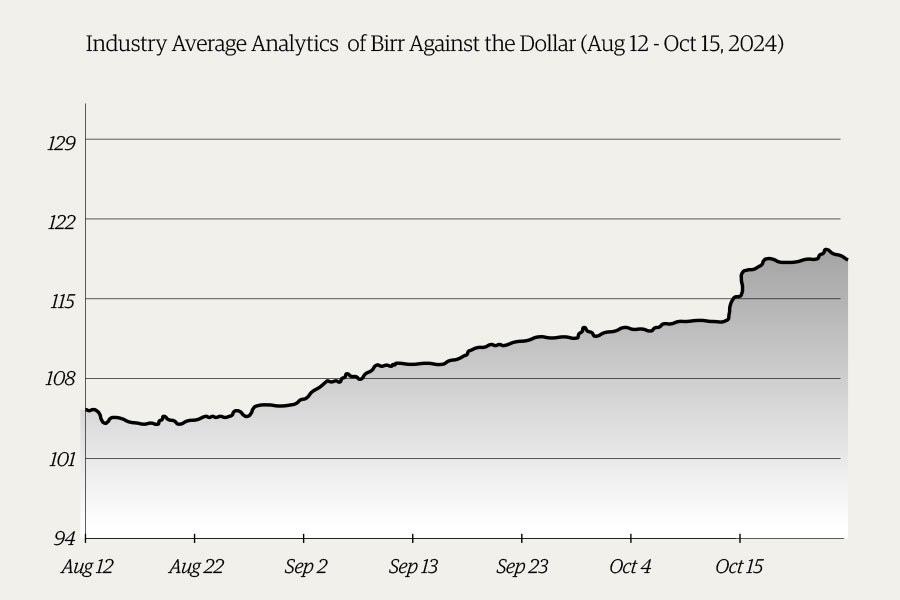

Money Market Watch | Oct 27,2024

Radar | May 14,2022

Radar | Oct 09,2021

Radar | Oct 18,2025

Radar | Apr 08,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...