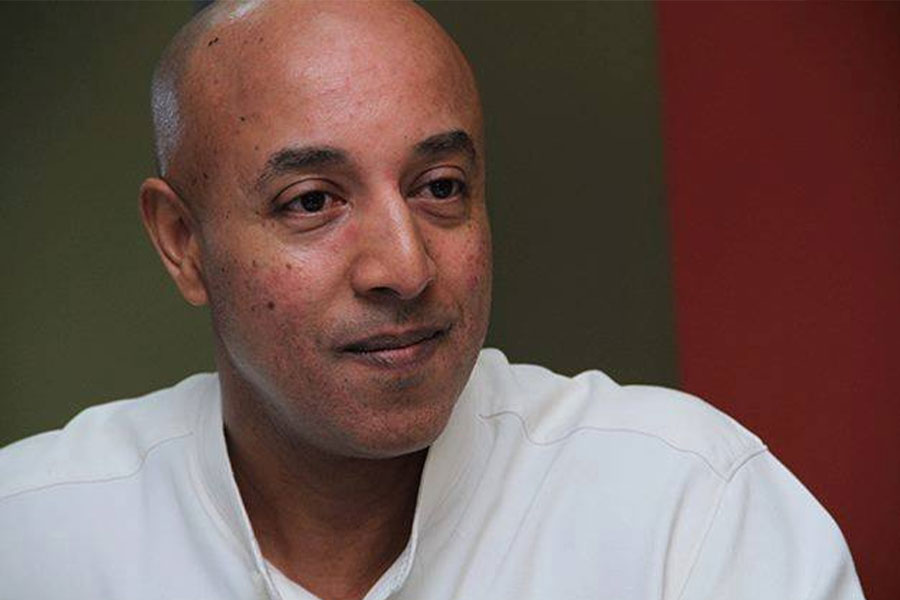

The Ethiopian Capital Market Authority (ECMA) has opened an investigation into suspected illegal fundraising by individuals and companies operating without proper authorisation. In a statement issued on Thursday, the Authority confirmed that prominent businessman Ermias Amelga and Genesis Investment Services PLC are among those under scrutiny for allegedly conducting unlicensed securities offerings in violation of capital market laws. ECMA said the investigation is being carried out in accordance with the constitutional principle of the right to be heard, with full respect for legal protections guaranteed by law. The Authority has established a dedicated unit to investigate breaches of capital market regulations, working in coordination with a technical task force that includes the Ministry of Trade & Regional Integration, Financial Intelligence Services, Ministry of Justice, and the Federal Police Commission. It urged the public to verify licensing status directly with the Authority before entering into contracts or making payments. It also encouraged individuals and entities to conduct due diligence with commercial registration offices to ensure legal compliance when forming business organisations.

[ssba-buttons]