The tragic wreck off Yemen’s coast on August 3, 2025, where a wooden vessel packed with Ethiopian migrants broke apart, killing or disappearing nearly three out of every four passengers, is more than a maritime disaster.

It is a searing indictment of a country in slow-motion freefall, one whose internal fractures are now spilling across borders in the form of desperate human flows. Migration, at its core, is not an act of wanderlust. It is a forced choice, a last resort.

For centuries, Ethiopia was a recipient of movement, not a supplier. Pilgrims, traders, and refugees once found haven in its fertile highlands and trade corridors. Today, that history is being inverted. The country is haemorrhaging its youth and energy, not in a trickle, but in waves, each more desperate than the last.

This exodus is a perfect storm of pressures coming from political instability, economic contraction, climatic hardship, and an ossified ethnolinguistic federalist structure that binds land and opportunity to identity. This toxic convergence has made life untenable for millions.

The result is a migratory shift that bypasses internal mobility altogether. Instead of rural-to-urban migration, a traditional hallmark of economic transition, Ethiopia is witnessing direct displacement from villages to foreign deserts, detention centres, and watery graves.

The 1995 Constitution, while designed to empower ethnic communities through self-rule, has become an unintended straitjacket. By tying land rights and administrative control to ethnicity, it has frozen populations into historical geographies.

Inter-regional migration is discouraged informally. Families who resettled during past famines now find themselves declared “outsiders” in the very lands they helped cultivate. The result is an invisible walling-off of communities, with geopolitical fragmentation transformed into internal divisions.

This rigidity should no longer be viewed as a governance flaw, but rather as a humanitarian crisis. As climate change shrinks arable land, where average farm plots now measure a meagre 0.3hct, well below subsistence levels, the ability to shift within the country is crucial. But that option has been made difficult.

What remains is a flight across national boundaries, increasingly into the arms of smugglers, traffickers, and militia checkpoints.

Three main corridors have emerged, each fraught with peril and marked by demographic specificity.

The Eastern Route, leading across the Red Sea into the Gulf, is primarily trafficked by rural Muslim women, often lured into domestic work with little knowledge of what awaits them. Many are trafficked; many disappear.

Threading through Sudan and Libya, the Northern Route funnels urban males, often educated but economically stranded, toward the narrowing gate of Europe. They face beatings, ransoms, and the deadliest sea crossing on the planet.

Through Malawi and Mozambique to South Africa lies the Southern Route, walked by highland men from areas like Kembata and Hadiya. Many die before they even cross into Malawi, as evidenced by the suffocation deaths of 29 men in Mtangatanga forest last October.

The price of failure is high. Since 2014, more than 31,700 people have died or vanished in the Mediterranean alone. Over 900 Ethiopians have been killed overland in southern Africa during the same period.

However, these are merely the counted. The real toll, erased by sand, sea, and secrecy, can no doubt be far higher.

International responses, while visible, remain largely cosmetic. Patrol boats, detention centres, and skill-training programs treat the symptoms, not the disease. Aid programmes targeting “orderly mobility” may ease donor guilt, but they tacitly accept the inevitability of departure, outsourcing a domestic policy failure to foreign bureaucracies.

Equally troubling is the quiet political logic inside Ethiopia. Local authorities, faced with rising youth frustration and unemployment, view emigration as a potential release valve. By allowing the most restless to leave, they postpone unrest. The country is exporting its discontent in human form.

At the root is a failure to reimagine statehood for a changing society.

Ethiopia’s youth are not crossing borders because they see glittering futures abroad. They flee a homeland that offers them none. The physical manifestations, overturned boats, mass graves, and abandoned trucks, are only the final punctuation in a sentence long written by structural neglect.

Reform is both obvious and politically urgent. Delink land rights from ethnicity, reopen inter-regional mobility, establish a national land-leasing framework, and encourage cross-regional employment and settlement. Without these measures, no patrol boat or remittance can stem the outflow.

What is at stake is not beyond the safety of migrants or the statistics of disaster. It is the future coherence of the Ethiopian state. A country that once hosted the displaced is now displacing its own, not because they are lured by opportunity elsewhere, but because the idea of home has collapsed into hunger, fear, and paralysis.

The tragedy is not only how many leave, but how they leave: silently, dangerously, and with no intention of return. The hills that once welcomed pilgrims may soon be known not for their promise, but for the echo of departing footsteps, each one a measure of a country adrift.

Author: Digital Editor

America’s Second Salvo of Tariffs, Tectonics, Trade Winds Besieges Africa

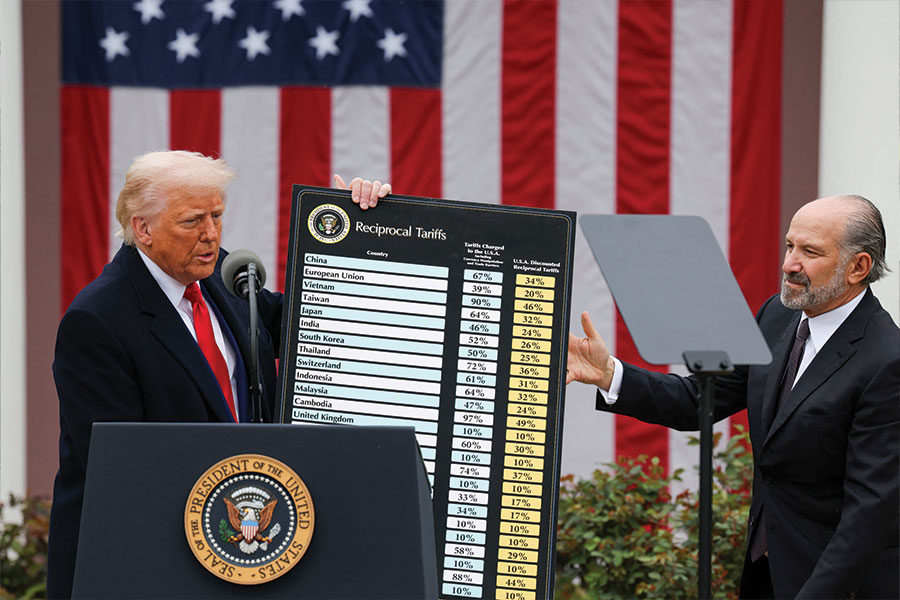

In a fresh tremor to Africa’s fragile economies, the Trump Administration’s second wave of tariffs, effective August 8, 2025, has landed with a jolt. Duties ranging from 15pc to 30pc now apply to imports from 22 countries, dragging the continent deeper into a global protectionist churn. The move heralds a departure from decades of partnership under the African Growth & Opportunity Act (AGOA) and marks a definitive shift toward zero-sum economics in Washington’s trade doctrine.

Previpus U.S. trade actions have usually focused on security-sensitive items. This time around, the net is wider, covering automotive parts, food products and industrial goods. According to an African trade negotiator, the cost of this protection is being borne by trading partners once considered allies. South Africa, the continent’s industrial engine, is hit hardest. A 30pc levy now covers key exports from auto parts and citrus to processed metals that sustain thousands of jobs. Pretoria warns the move “undermines long-standing trade relations and threatens economic growth.”

Diplomats see a clear signal. No partner, however strategic, is safe from Washington’s election-year calculus. Analysts say the measures flow more from domestic U.S. politics than joint growth agendas. Supporters argue African imports dent niche U.S. industries in swing states. Critics counter that supply chains will simply reroute to Asia, leaving American consumers with higher prices and Africa with fresh hardship.

Algeria and Libya also face 30pc duties. Tunisia’s rate inches down to 25pc, up by three percentage points. Ghana, Uganda and Nigeria remain at the 15pc floor despite years within U.S. programs. Lesotho and Madagascar still face major barriers despite partial relief.

For businesses, the volatility makes long-term planning nearly impossible, and small businesses across the continent feel squeezed.

U.S. imports from sub-Saharan Africa totalled about 39.5 billion dollars in 2024, down from a 2008 peak of 82 billion dollars when oil dominated. Crude’s retreat and fiercer competition caused much of that slide. The new duties threaten niche sectors, such as textiles, processed foods, and speciality minerals, that filled some of the gap.

Other powers are poised to benefit. China, already Africa’s largest trade partner, is courting governments rattled by Washington’s turn. India and the European Union (EU) are widening commercial diplomacy. Analysts warn that eroding trust could harden into lasting realignments.

Ethiopia, spared direct duties this round, is still exposed, however. Its industrial plan depends on predictable global rules. Inflation has cooled to 13.9pc from 30pc, according to official figures, yet foreign-currency shortages persist and the gap between the official and parallel exchange rates is widening. Any slide in export demand could stall factory expansion and complicate debt service.

The African Continental Free Trade Area (AfCFTA) may offer a platform for a collective response, but implementation lags. Heads of state have scheduled an extraordinary summit in Accra next month to hammer out a joint tariff response and contingency plans for vulnerable industries. According to legal experts, a unified front could amplify Africa’s voice in Washington, much as the EU wielded leverage over earlier U.S. steel tariffs. Fragmentation leaves states chasing piecemeal concessions.

Cameroon’s experience illustrates the danger. After absorbing April’s 11pc duty, Yaoundé expected stability. Instead, its rate jumped to 15pc with little notice. Timber and cocoa exporters are repricing contracts again and bracing for further surprises. Angola’s and Botswana’s cuts, meanwhile, give their diamond and beef shippers an edge over neighbours still paying higher surcharges, straining regional ties.

Finance ministers urge a shift toward self-reliance, arguing that the pandemic has proven that supply chains can be rerouted overnight and that building regional manufacturing should now be a strategic priority. Yet, capital and technology often arrive through open trade, and an inward turn could slow growth as Africa’s young workforce swells. Many officials prefer to keep courting foreign investors while demanding consistent rules from Washington.

For Africa, the choice is between enduring tariff volatility or crafting a buffer and accelerating intra-continental trade, investing in infrastructure and technology, and strengthening institutions that can absorb external shocks. Policy makers warn that the stakes stretch beyond economics, for prosperity underpins peace.

Factory managers from Durban to Dakar are already recalculating margins. Currency desks are bracing for fresh pressure. Investors studying the August list anticipate another review in early 2026 unless U.S. politics swing. The numbers tell one story, and the broader lesson is simple. Africa can no longer assume that U.S. trade policy automatically tilts toward partnership. In an era of transactional politics, the continent should define and defend its economic destiny.

The Trump tariff wave is about priorities and power. It demonstrates how one country’s domestic calculus can alter supply chains thousands of miles away. African leaders should speak with one voice or risk paying the price of decisions made elsewhere. Building a resilient, sovereign economic zone should no longer be an aspirational slogan. It is a strategic necessity for long-term peace and prosperity across the continent.

The Left’s “Everything Struggle”Is Undermining the Climate Cause

Progressives are caught in a trap of their own making. In an era of overlapping and mutually reinforcing crises, they have come to view every issue, from climate change and public health to energy, inequality, trade, and war, as part of a single, all-encompassing political battle: the “everything struggle.”

At first glance, this approach may appear compelling. These issues are interconnected, and no one lives in isolation. But, forcing every cause into a single battle has serious downsides. Arguing that reducing greenhouse-gas (GHG) emissions also requires abolishing capitalism, rethinking gender categories, and freeing Gaza is a formula for political paralysis. Even if each individual fight is worthy on its own, combining them often undermines the broad coalitions needed to achieve meaningful progress.

Progressives would do well to keep this in mind ahead of November’s United Nations Climate Change Conference (COP30) in Belém, Brazil. After the lacklustre summits in oil-rich Azerbaijan and the United Arab Emirates (UAE), many activists are hoping that COP30 will mark a return to progressive principles. In that spirit, thousands of climate advocates are expected to descend on Belém for the Peoples’ Summit, a gathering of civil society and climate groups held in parallel with the official negotiations.

Given today’s economic turmoil and escalating geopolitical tensions, the chances of global policymakers producing a bold climate plan at COP30 are slim. But even if they succeed, the broader climate fight is bound to fail without public support.

Alarmingly, support for the climate agenda appears to have declined significantly. From the United States and Germany to Canada, South Korea, and India, climate change barely registered as a major issue in recent elections. US President Donald Trump was re-elected on a platform of “drill, baby, drill,” while support for Green parties is collapsing across Europe as the far right continues to gain ground. And when climate change does come up, candidates advocating bold action are routinely defeated.

By now, it is obvious that the “everything struggle” is a losing strategy for progressive parties serious about combating climate change. Even worse, it fuels public scepticism about the viability of climate action.

To be sure, well-funded disinformation campaigns remain the primary cause of declining public trust. But overreaching by some progressive activists also plays a role. The People’s Summit manifesto is a case in point. Drafted by a broad coalition of NGOs and activists, the document denounces “false climate solutions” as “instruments for deepening inequality.” Only “socio-environmental, anti-patriarchal, anti-capitalist, anti-colonialist, anti-racist, and rights-based” approaches, it insists, can solve the “climate, ecological, and civilisational crisis.”

Though certainly well-intentioned, one should ask: Is this how broad coalitions are built, or is this how they unravel?

Most people do care about climate change. A recent IPSOS poll covering 32 countries across five continents found that 74pc of respondents are concerned about its impact on their own countries. However, when practical and technical solutions are dismissed as ideological betrayals, climate policy risks becoming little more than a quest for moral purity.

It was not always this way. While calls for sweeping change have long been part of the climate movement, and rightly so, its agenda once focused on sustainability: cutting GHG emissions, conserving resources, protecting forests, and preserving biodiversity.

Today, however, many activists view climate action as a revolutionary vehicle for dismantling the status quo and prompting a broad moral reckoning. The problem is that while the fervour of the “everything struggle” may energise activists, it tends to alienate the wider public. Most voters are looking for workable solutions, not a sermon on the need to reinvent society, especially when that sermon echoes the failed revolutionary fantasies of the past. They want clean air, clean energy, and a livable planet for their children.

But bundling those priorities with every perceived injustice in the world drives away the very people needed to achieve real change.

When fringe ideas take centre stage, mainstream support dwindles. By rejecting practical steps like nuclear energy simply because they do not “dismantle the system,” progressives risk trading impact for ideology. When responsibly managed, nuclear energy is a clean and reliable source, and electrification helps reduce emissions. Essential tools for advancing the climate cause are not betrayals of it.

When leaders gather at COP30, they should confront a set of urgent challenges, such as rampant deforestation, the toxic alliance between extractive industries and organised crime, and the growing inability of democratic institutions to deliver sustainable growth. While envisioning alternatives to the status quo remains both valuable and necessary, political leaders, especially on the left, should move beyond the “everything is everything” mindset and focus on what actually works, even if it does not align with radical utopianism.

When it comes to political rhetoric and global temperatures, less is more.

COP30 offers a unique opportunity to redefine sustainability as pragmatic realism before the climate movement drifts further out of touch with the concerns of ordinary people. If leaders and activists embrace pragmatism, they will have a mandate to act. If they choose to champion the “everything struggle,” the public will continue to tune out, even as global temperatures continue to rise.

Charity in the Rearview

A few days ago, I boarded a crowded taxi where a simple act of charity sparked a spirited debate. A woman handed money to a Syrian refugee, prompting a heated conversation about who deserves support more, a refugee or a local beggar. The moment felt raw and charged, pushing each passenger into an unplanned moral reckoning. It became a study in compassion, judgment, and the quiet assumptions people carry.

The woman gave a 50 Br note to a Syrian woman sitting near the roadside. Seconds later, an Ethiopian beggar, someone familiar with the area, approached her as well. This time, she offered him only a scornful glance and waved him away. That single act drew instant attention and discomfort from those inside the taxi.

A low murmur spread through the passengers before one finally voiced the shared discomfort. He asked why she gave money to the refugee but turned away the local man with such coldness. His tone remained calm, though the question struck a nerve. The woman, seemingly unshaken, offered a deliberate and composed response.

She explained that the refugees’ needs felt more genuine to her. She believed the woman would use the money to feed her family, having been forced to flee her home. In contrast, she recognised the local man as someone who drank heavily and avoided work. Her distinction hinged on perceived desperation versus chosen dependence.

Silence swept over the taxi as her answer settled into the space between us. Her argument, though controversial, carried weight and clarity. She positioned herself not as unkind, but as someone who considered the intention behind her giving. That distinction, however subjective, shifted the tone of the discussion.

After a brief pause, a younger passenger challenged her view with another story. He had heard that some Syrian refugees used donations to buy fast food or take luxury taxi rides. His implication was clear: not all acts of charity are used wisely. It questioned whether visible suffering always aligned with responsible use.

The woman met the critique without flinching. She acknowledged the possibility but defended her action. At least, she said, they spent the money on nourishment or progress. That, to her, was fundamentally different from squandering help with no vision for escape.

To reinforce her point, she shared a striking anecdote. An old woman, she said, had saved over 100,000 Br from years of begging, refusing to spend any of it. When the government demonetised the old currency, she lost everything because she never exchanged it. That story became a cautionary tale about misplaced purpose and missed opportunity.

The woman made clear she was not condemning every beggar. She admitted many faced conditions so harsh that begging became a necessity, not a choice. Still, she admired refugees who aimed for self-sufficiency. In her experience, some used begging as a means to an end, not a permanent condition.

She recounted seeing Syrian women pool their earnings to open shops and street food stalls. Some began selling perfumes or cosmetics, determined to rise beyond dependency. Their ambitions, however small, inspired her. She saw in them a hunger not just for survival but for dignity and transformation.

Throughout the exchange, I listened quietly, letting the words stir my own reflections. I understood the woman’s logic, even if parts of it made me uneasy. She spoke from observation, not malice, and her insight forced uncomfortable but necessary questions. When dependency becomes habitual, even well-meant charity risks becoming meaningless.

The conversation lingered in my mind long after I left the taxi. It led me to consider the broader implications of social reliance. In a society where dependency is normalised, ambition can easily wither. Structural inequality plays a role, but so does belief in one’s capacity to overcome it.

For those without safety nets, survival often fuels creativity and resilience. In contrast, guaranteed help might dull the urgency to act. This does not mean the poor should fend for themselves; instead, it demands that giving must empower, not entrench helplessness. The balance between empathy and expectation is delicate but necessary.

What began as a routine taxi ride turned into a revealing portrait of urban generosity and scepticism. The debate illuminated how people weigh need, intention, and personal responsibility. No answer was simple, and perhaps that was the point. Every act of charity carries with it an invisible calculus that says more about the giver than the receiver.

The Unseen Labour of Love

Every morning, my husband Mike gently wakes me for prayer. After we share that quiet moment, he says, “You should rest more before our daughter wakes up.” I sink back into sleep, even as the world beyond our walls buzzes with judgment. That contrast, between the sanctuary we have built and the expectations of others, is my daily reality.

Before our daughter was born, we spoke about the sacrifices we were willing to make. We agreed: we wanted to raise her ourselves, rooted in our values, discipline, and love—not leave her with strangers while we chased careers.

I once held a high-paying job that took me around the world and introduced me to influential people. The work fulfilled me, challenged me, and helped me grow. Walking away from that to raise my daughter was not easy.

Even those closest to us sometimes question our choice. Women ask Mike, “What does your wife do all day? Isn’t she bored at home with just a baby?” Some say, “Your husband is building a career while you do nothing. After all that education, shouldn’t you be more ambitious?” These comments often come from other women, many of them mothers. Strangely, men tend to say the opposite: they compliment our decision and say our daughter is fortunate.

Yet the core of the matter is simple: we made the decision together. I did not step back from work reluctantly or under pressure; I did it lovingly and intentionally. Society rarely sees it that way. Stay-at-home parenting is often viewed as wasted potential.

This reveals a deeper divide: a narrow definition of womanhood, where achievement only counts if it is visible and marketable. In that view, motherhood alone is not enough; it must be stacked atop a high-powered career to matter.

However, motherhood requires all the qualities people admire in the workplace: patience, multitasking, leadership, emotional intelligence, and crisis management. The only difference is that there’s no promotion or end-of-year bonus—just the quiet labour of shaping a human being.

Using your education to raise a thoughtful, emotionally grounded child is not a downgrade. It’s an opportunity. There is more power in shaping a life than in chasing status.

If you hold degrees, people assume you are wasting them by choosing full-time caregiving, as though ambition only counts when it is directed outward. But stay-at-home parenting is full-time, unpaid, emotionally taxing work. It can be repetitive, draining, and even isolating. Sometimes, your identity feels unclear. But the difficulty is not a flaw; it is the cost of something profoundly human and meaningful.

Despite what people say, I will never regret this time. I won’t wish I had spent less time with my daughter to be more “productive” outside. I won’t trade bedtime rituals or small, unnoticed moments. That is not wasted time. It is the most important work I will ever do.

This does not mean working parents harm their children. But choosing to be fully present at home has real, measurable value. It is not idleness. It is an investment.

Multiple studies have shown that children benefit when parents are consistently present during the early years. A national survey in Norway found that children whose parents stayed home early on performed better even into adolescence. Norway’s “Cash for Care” policy, which financially supported parents to stay home, tracked over 68,000 children and found positive academic and emotional outcomes.

Medical professionals echo this. Many paediatricians and child psychologists advise parents to stay home until at least age two. Early presence helps prevent separation anxiety, which is linked to behavioural issues, sleep problems, and difficulty regulating emotions.

But presence alone is not enough. Experts emphasise the importance of quality caregiving, consistent routines, and responsive parenting. Children thrive when their needs are recognised and met in real-time.

Quality daycare can support socialisation and cognitive skills. But studies often conclude that parental presence has a more substantial long-term influence. Stay-at-home parenting allows for consistent bonding, moral grounding, and uninterrupted guidance.

These early years lay the foundation for emotional and cognitive life. Intentional caregiving is not just nurturing; it is nation-building at the soul level.

Every parenting path includes trade-offs. Working mothers model ambition and independence. Stay-at-home parents offer rhythm, attunement, and emotional scaffolding. Both paths matter. What counts is choosing with intention.

Yes, I dreamed beyond motherhood. But I also dream within it: raising a daughter who knows our values because she lived them. Morning prayers, shared stories, and chores with meaning – these are acts of love, not duty.

If that unsettles others, it’s because it reminds them that women still have agency. We can choose presence over prestige, depth over validation. Motherhood is not a fallback; it can be a calling.

I hope we learn to support each other, regardless of whether someone chooses a career, caregiving, or both. Each path has a weight. Each deserves respect.

In the quiet of our home each morning, I rest as Mike leaves for work. That rest has purpose. It prepares me to be fully present when our daughter calls out, “Mama.” One day, I hope that presence echoes in the woman she becomes.

Who Owns the Seed as Ethiopia Opens the Gate to GM Maize?

Federal agriculture officials last week quietly opened the door to commercial plantings of genetically modified (GM) maise, a first for the country, a policy decision that should shift the debate from familiar health and ecological concerns to a harder issue.

Most GM varieties are patented. Farmers may not save, replant or trade seed from their own harvest. Instead, they have to return to the seed company every season, pay royalties, and agree to contracts that can lead to lawsuits if broken. In a country where more than 80pc of growers rely on informal seed networks, the new policy undoubtedly threatens seed sovereignty and, many argue, food security.

The policy sheds light on a broader question rarely discussed in public forums.

Should knowledge itself be treated as private property? Who owns the seed?

Contemporary intellectual-property law rests on the idea that a firm can claim exclusive rights over a gene sequence or a bit of code, even though every invention builds on centuries of collective effort. Stephan Kinsella, a libertarian legal scholar, criticises patents as “state-sanctioned monopolies that distort markets and criminalise natural behaviour.” His objection would certainly echo in the maise fields of Oromia Regional State as much as it does in Silicon Valley.

Knowledge is a cumulative, generational social project. Sophisticated GM maize descends from millennia of farmer-led selective breeding. Public science enabled gene editing. Locking such advancements behind patents pulls up the ladder after climbing. Imagine Uzbekistan claiming royalties for Al-Khwarizmi’s long division, absurd, yet patent laws transform shared heritage into corporate property.

The trouble is heightened because ideas aren’t scarce goods. Two people cannot swing the same hammer at once, but both can use a theorem or tune without depletion. Ideas copy at near-zero cost. Artificial fences, enforced by lawyers and courts, create scarcity where none exists.

Technology keeps punching holes in those fences. The internet freed books, music, and films from physical media. Memes pass freely, owned by none, while corporations raid meme culture for relevance—a one-way street taking from the commons and guarding the take.

Artificial intelligence (AI) deepens the tension. Vast models train on scraped, often copyrighted, web content. No single author claims the output, yet firms insist it’s proprietary. Independent creators, fearing lost income, side with corporate rights-holders who kept royalty gates high.

The architecture of traditional intellectual property (IP) law, which requires a human author, now strains in the wash.

Defenders of patents argue they reward inventors and advance progress, but the record is mixed. The battle over COVID-19 vaccines showed patents acting less as incentives and more as barriers. Taxpayers largely financed the formulas; still, when India and South Africa requested a temporary waiver on Covid vaccine patents from the World Trade Organisation (WTO), wealthier countries resisted. The delay, public-health groups say, costs lives across the Global South.

Agriculture experts whisper similar warnings. Seed companies promote GM traits as yield miracles, but their contracts often bind farmers to proprietary herbicides and restrict field practices. Courts in the United States (US) have repeatedly sided with companies against growers. The Canadian farmer, Percy Schmeiser, became a global example after Monsanto sued him in 1998 for allegedly saving seed that had blown onto his land. Vandana Shiva, the Indian scholar and activist, refers to the spread of patented crops as “epistemic colonisation,” arguing that it replaces diverse local knowledge with corporate science and turns farmers into consumers of technology they once helped shape.

Supporters retort that patents can offset research costs that are too burdensome for public budgets, yet many breakthroughs are already publicly funded. The TRIPS agreement, enforced by the World Trade Organisation (WTO) since 1995, obliges members to adopt strict IP rules. Critics in the Global South argue that these rules perpetuate dependency by standing between poor countries and the technologies they need.

Ethiopia faces that choice now. Approving GM maise could lead to higher yields, but the terms of access are crucial. If local breeders cannot legally cross-patented genes with indigenous varieties, and if smallholders are compelled to buy seed year after year under risk of litigation, the technology may tighten, not loosen, economic constraints. This note of caution should not be taken as a rejection of science. Rather, it is a reminder that who holds the title matters as much as what sits in the bag.

Ministry of Agriculture’s officials have said little about how they will police seed contracts or protect growers from inadvertent violations, but a stray kernel in a neighbour’s field can trigger a claim. Enforcement costs could fall on a legal system already stretched to its limits. Without clear safeguards, the introduction of patented varieties may shift bargaining power sharply toward multinational firms.

None of this argues that creators should go unpaid. But alternatives exist. Open-source software thrives without proprietary lock-ins, and public plant-breeding licences allow innovation while preserving the right to save and share seed. Economists have long noted that collaboration, rather than enclosure, often accelerates progress. The rapid dissemination of crop-breeding knowledge across Africa’s research institutes is one example.

Ethiopia’s policymakers say the country should adopt modern tools to feed a growing population and to buffer crops against climate shocks. That goal need not conflict with seed sovereignty. Allowing farmers, universities, and local companies to breed and distribute improved varieties under open or limited licences could anchor the benefits at home. The country has already shown an appetite for home-grown solutions, from teff genetics to drought-tolerant sorghum. Similar approaches in Maise could reduce reliance on imports while avoiding disputes in courtrooms.

The larger lesson reaches beyond Ethiopia, though. Intellectual property law, designed for an era of industrial scarcity, now governs an information economy where scarcity is often manufactured. As crises pile up from pandemics to climate change and widening inequality, the cost of withholding ideas grows. If monopolies delay solutions, they become part of the emergency.

Squeesing Stones for Silver, the State Pulls While Taxpayers May Duck

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand. Young dynasties, he observed, can fill their coffers with modest taxes, but ageing ones squeeze ever harder for diminishing returns. Six hundred years later, Arthur Laffer sketched the same idea on a napkin. Revenues start at zero when tax rates are nil, peak somewhere in the middle and subside back to nothing at 100pc.

Contemporary Ethiopian policymakers now find themselves perched on that curve, chasing revenues of 1.5 trillion Br. They have rewritten the income-tax law to push collections up from what, even by African standards, is a meagre take in relation to GDP. They should worry that higher rates may yield smaller returns as they risk forgetting what shapes people’s capacity to pay.

Ethiopia may appear to be a single economy, with unified monetary, fiscal, exchange-rate, and tax structures. Look harder, and the fabric is fraying.

Start with money. In July 2024, the National Bank of Ethiopia (NBE) abandoned its cumbersome credit quotas in favour of an interest-rate corridor, designating the overnight interbank rate as its operational target. By October, a fully fledged interbank market had sprung to life, designed to meet the liquidity needs of every bank. Interbank and Treasury-bill yields soon rose above inflation, the first genuine nationwide transmission of monetary impulses.

But the transmission remains partial. Rate changes resonate in a handful of big banks headquartered in Addis Abeba, while rural lenders and micro-finance outfits, marooned in shallow markets, continue “evergreening” loans and barely budge their prices. The Central Bank’s levers pull on the capital, while the periphery runs on local liquidity rhythms.

Treasury cash flows reveal a similar patchwork. Regional governments now conduct more than half of public spending, yet their own revenues cover scarcely a third of their mandates. The federal grants intended to level the playing field rely on outdated data that flatters some regional states and starves others. Some states run perpetual deficits and seek ad-hoc borrowing approvals, behaving like mini-economies with distinct fiscal cycles.

Tax enforcement is equally uneven. On paper, Ethiopia has a single code, but in practice, it has several. Value-added tax compliance reaches 80pc in Oromia Regional State, but tumbles below 40pc in Somali and Benishangul-Gumuz regional states, and remains over 90pc in the capital. Corporate-income receipts track local zeal as much as legal rates. The patchwork hosts multiple fiscal micro-systems, each with its own health.

When the Central Bank attempted to unify the official and parallel markets, the premium widened, reaching above 170 Br to the dollar last week. Researchers have demonstrated that the gap is influenced by trade openness, crop output, and public-sector corruption, rather than geography. Yet, in practice, parallel rates diverge, with border towns and rural hubs quoting markedly different spreads. Areas flush with diaspora remittances enjoy premiums 10 to 15 percentage points lower than regions with weaker links. A recent Central Bank injection of 150 million dollars into the auction system barely rippled beyond big cities.

A national economy can scarcely function without shared stabilisers. The federal budget, now aligned with a National Medium-Term Revenue Strategy, tries to harmonise regional incentives. Formula-based transfers, recalibrated annually, are designed to reflect shifts in borrowing, spending, and revenue across the federation. However, the formulas update rarely, and a meaningful equalisation remains elusive.

Faced with these fissures, policymakers may be tempted to reach for standard blueprints, most likely copied from the International Monetary Fund (IMF) playbooks. It would include, but not be limited to, strengthening institutions, deepening markets, and widening the tax base.

Undoubtedly, these fixes matter. Medium-term fiscal frameworks, modern forecasting, and digital data (from e-payments to social registries) could indeed sharpen stabilisation and disaster response. A professional policy-analysis unit at the Central Bank, along with legal autonomy for its rate-setters and the publication of monetary committee minutes to the public and market actors, would anchor expectations. The tax authority could harness data analytics, streamline exemptions, and plug VAT and income tax leaks.

Phasing out credit caps, dematerialising government securities and building a secured repo market would give the economy a yield curve and anchor short-term rates. A thorough map of the foreign-exchange hinterland could enable the Central Bank to save its dollars for truly disorderly episodes while allowing more flexibility the rest of the time, thereby shrinking the premium. A national disaster-risk fund and rules-based limits on regional borrowing can help impose discipline and smooth shocks.

Even the neatest frameworks buckle unless the revenue base broadens. A recent study recommends tighter VAT exemptions, stricter excise-stamp checks, and full implementation of the revenue strategy to bring the tax-to-GDP ratio up to peer norms. Benchmarking potential and coaxing small firms from the shadows would make income taxes track growth more faithfully.

However, these policy remedies, though worthy, may not be enough. Extraordinary times call for fresh tools.

One is to legalise community finance co-operatives rooted in “Idir” and “Iqub,” the traditional rotating savings clubs. If given modest access to the Central Bank’s liquidity at a spread above the policy rate, and embedded in mutual-guarantee schemes, they can be instrumental in funnelling funds to micro-enterprises and small farmers. In doing so, they can convey monetary signals that commercial banks do not typically provide.

Another novelty could be the establishment of peer-to-peer foreign-exchange hubs in regional capitals and border towns. Tapping diaspora and farming co-operatives, the hubs could match buyers and sellers through mobile money rails. Smart-contract auctions, run by simple SMS, could publish bids and offers, trimming the spread between the official and parallel rates while honouring local diversity.

A Central Bank Digital Birr used in cross-border payments could sidestep capital controls. A “digital lockbox” would convert remittances instantly into local money, funnelling diaspora savings to domestic lenders. A narrow trading window for convertible tokens would undercut smugglers, illuminate flows and let the Central Bank gauge pressures in real-time without opening the floodgates.

Raising revenue without revolt might rest on a visible “social dividend”. Small levies on mobile-money transfers could be allocated to a ring-fenced fund for clinics, schools, and roads, disbursed through participatory budgets at district assemblies. Citizens would see the link between taxes and services, turning compliance into a vote of confidence.

True fiscal federalism need not wait for perfect equalisation. The federal government could test competitive performance grants through “innovation endowments” for states that meet targets on vaccinations, school completion, or clean water. Tying cash to results designed with local councils would unleash peer pressure and replace handouts with shared ambition.

These ideas may eschew one-size-fits-all templates. However, they build on community bonds, outcome-driven grants, digital platforms and participatory checks. They do not throw out prudence, but insist that policy be felt in villages as well as boardrooms, that markets be partners rather than targets.

Contemporary Ethiopia feels like a federation of disparate fiscal and financial micro-systems, each charting its own currents under the illusion of a single economic community. However, a coherent national macroeconomy remains more ambition than fact. If officials hope to climb the Laffer Curve rather than tumble down its far slope, they should knit those fragments into a single fabric. Otherwise, heavier levies will indeed harvest thinner yields, as Ibn Khaldun warned, and Ethiopia’s grand revenue quest will remain a mirage.

“We’ll go to the extent of confiscating their money.”

Central Bank Governor Mamo Mihretu, in a video briefing last week, warned business owners caught trading in the parallel foreign exchange market, after the value of the Birr spiked to over 170 to a dollar. The Governor blamed illicit currency trade for a 28pc premium on the official rate.

67986

The gigawatt-hours supplied to data mining operations by Ethiopian Electric Power (EEP) in the 2024/25, accounting for 27pc of national electricity production. It is equivalent to 43.1pc of the annual average output expected from the Grand Ethiopian Renaissance Dam (GERD), 15,760gWh, offering a sense of the energy appetite of server farms across the country.

A Bold Tax Reform for A Better System

The federal government has recently implemented a key reform to keep the economic reform program alive at a time when the world’s supply of foreign capital is drying up, while demand for resources to finance the increasing economic and social development is higher.

In the three years beginning in 2020, external financial flows to Latin America and the Caribbean fell by 14.5pc and to Africa by 6.8pc, according to data from the United Nations Conference on Trade & Development and the OECD. For sub-Saharan Africa, the slide continued last year with another two percent drop, and forecasts point to a 16pc to 28pc fall in 2025.

The 2.3 billion dollars less for Latin America and 5.3 billion dollars less for Africa could be part of the reason that jolted Ethiopian leaders into pushing domestic resource mobilisation to the top of their to-do list. The room for manoeuvre, however, is limited.

Debt-service costs on older loans remain substantial. Domestic revenue accounts for only 6.3pc of GDP, less than half the yield of peers and far below the economy’s potential. Policymakers concluded that tinkering would not do the job.

A decade-old income-tax law, unchanged in any meaningful way for nearly a decade, has now been amended to address present-day macroeconomic priorities, digital transformation, the emerging capital market, and other structural shifts.

The effort began two years ago with a stack of studies. A comprehensive audit of tax administration weaknesses from both tax authorities’ and taxpayers’ perspectives was conducted, including a review of double-tax treaties, a detailed examination of personal income tax design and its associated costs, and a policy-costing exercise for every proposed solution.

All these feed into the “national medium-term revenue strategy” blueprint for broadening the tax base while keeping investment attractive and improving economic conditions for the fiscal period of 2024 to 2028.

The government implemented this reform with the aim of addressing the key structural and policy bottlenecks, as outlined in the Strategy. Small businesses feel the changes first, with the old presumptive-tax system leaves taxpayers with high compliance costs and baffles tax authorities. Turnover tax was levied at two percent on goods and 10pc on services, based on gross sales on top of the presumptive income tax, which complicated the administration of the tax for these small & microenterprises.

In its place is a simplified progressive presumptive income tax, with the turnover tax scrapped altogether. Officials believe this simplification will ease the cost of paying tax and the burden of tax on micro-enterprises and enhance the country’s image as a place to start a business.

The previous tax regime, with 99 business categories, 199 income brackets, and nearly 2,000 scenarios, was too complex, nudging Ethiopians toward consumption and the grey economy. Moreover, the amendment redefines reinvestment to include profits ploughed back into a firm, exempts dividends that stay within the corporate family, and wipes out tax on dividends used to pay for subscribed shares that lift a company’s capital, encouraging ndividuals to invest.

By relieving intra-business dividend transfers of tax, officials hope to coax more savers into formal equities.

Taxpayer categories, previously split into three, are consolidated into two, with thresholds adjusted to reflect inflation and business realities. For sole proprietors and property owners, the annual exemption jumps to 24,000 Br, a 333pc leap that the ministry calls a pro-savings nudge, despite tight fiscal space.

Macroeconomic changes over the years have pushed up wages and prices, while income tax brackets have remained unchanged. The minimum portion of a salary exempted from tax rises to 2,000 Br a month from 600 Br, again a 333pc increase, while brackets shift upward to limit bracket creep and keep the system progressive.

The government reminds critics that the lower public salary went up 320pc last year, cushioning households before the new thresholds kicked in.

Still, enforcement remains the central headache.

Only 37pc of registered businesses pay any income tax, and state-owned enterprises, claiming roughly 10pc of GDP, supply over 45pc of federal large-taxpayer revenue. To capture chronic non-filers and inaccurate filers, the latest law introduces a minimum alternative tax of 2.5pc of turnover, equivalent to a 30pc profit-based tax on businesses, assuming a less than 10pc profit margin. It aims to address the growing issue of tax evasion among certain businesses, echoing global minimum-tax drives aimed at curbing profit-shifting and base-erosion manoeuvres.

The digital economy, almost impossible to police with the old toolkit, falls under the same umbrella. Rather than invent a new income tax, the amendment closes loopholes that allow online platforms to escape taxation. Passive-income rates on interest, dividends, royalties, and capital gains adjust to match international norms and protect the government’s taxing rights under its network of double-tax treaties.

Public debate, however, has centred on the employment-income exemption. Some advocates urge lifting the monthly cutoff above 2,000 Br, arguing the rising cost of living warrants more relief. The exemption is not a minimum wage, but rather a slice of income exempted from tax, and increasing it without offsetting revenue would erode regional budgets.

Employment income tax contributes around 35pc to 45pc of regional tax overall tax revenue, peaking at 70pc in some jurisdictions and government levels below the regional states, such as woredas, kebeles, etc. Absent new revenue sources, raising the threshold again could force payroll cuts or money printing, options likely to stoke inflation and erode purchasing power further and exacerbates poverty.

The ministry estimates show that today’s changes alone cost at least 0.21pc of GDP in revenue. The Ministry of Finance, addressing Parliament’s Plan, Budget & Finance Standing Committee, said the federal government “is fully committed to make further reforms” but has to act in phases, “without compromising public finance.” Federal transfers to cover local shortfalls are off the table until economic growth restores fiscal capacity.

The overhauls balance relief with realism. Replacing blanket exemptions with targeted salary adjustments for the lowest-paid public workers offers more help to vulnerable households than broad cuts that benefit top earners, too.

The reform agenda, which incorporates market-friendly regulation, capital-market development, and digital-service rollout, depends on reliable domestic financing now that foreign inflows are dwindling. By modernising the income-tax code, the government hope to boost revenue, encourage investment, and maintain its debt sustainability without stifling enterprise.

The government believes that the new framework sets the stage for better compliance tools, including e-filing, real-time sales data, and tighter links to the nascent capital markets.

They invoke an Amharic proverb, “YalewunYeseteNifug Ayibalim,” (roughly translated to “no one scolds the giver who shares what little he has.”

The line, they say, captures a government offering relief even while revenue needs soar.

Whether the gesture wins broader trust, and with it better compliance, remains the test. For now, the overhaul provides the economy with a modern tax code tailored to today’s economy and a fairer distribution of the burden across sectors, incomes, and technologies.

The amendment is in fact the bedrock for the competitive, inclusive, and resilient economy the government pledged to build.

From Roses to Cutting Flower Exporters Find Fresh Market in Fragrant Foliage

The eucalyptus foliage has brought the floriculture industry, long anchored in roses and a handful of summer varieties, grafting a fresh branch onto its export portfolio. Growers in the country’s mid- and high-altitude horticultural cluster are moving beyond blooms to cultivate stems of Silver Dollar (cinerea), Baby Blue, Parviflora and Lemon Bush, aromatic greens prized by florists in the Gulf and Middle East for their silvery sheen and peppermint- or citrus-scented.

The shift owes much to a single and sticky fact of logistics. Addis Abeba sits only about 2.5 to 3.1 flight hours from major Gulf airports, roughly a third of the seven-to-eight-hour haul from Vietnam, the region’s dominant supplier for the past 15 years. The shorter hop keeps foliage fresher and, as crucially, slashes freight costs to between 1.30 dollars and 1.37 dollars a kilogram, far below the four to five dollars a kilo that shippers pay from Southeast Asia.

Until recently, such numbers meant little on the ground. Local customs rules bar agricultural exports that lack a government-approved minimum selling price, and the National Bank of Ethiopia (NBE) had never set one for eucalyptus foliage. Farms would cut perfect stems, watch them wilt for want of clearance and toss them on the compost heap. The practice felt like burning money, yet the bureaucratic deadlock endured for three years.

That changed only after Afri-Flower Plc, an Ecuadorian-owned farm outside Addis Abeba, put eucalyptus sprays front and centre at an international horticulture fair in the capital in the first week of April this year.

Within weeks, the Ministry of Agriculture, the National Bank and the customs authority introduced a floor price, subject to periodic review against global benchmarks, that finally legalised exports. Afri-Flower quickly loaded pallets for Gulf buyers. Gallica Flowers, a French-run venture nearby, and Friendship Flower, a Dutch outfit, followed, expanding acreage and laying drip-irrigation lines to push supply. More farms, eager to fill unused plots, are lining up planting orders.

Eucalyptus foliage grows in open fields without the heated greenhouses or high pesticide bills that roses demand, making it a cheaper and more environmentally palatable venture. Contract-farming schemes with out-growers are on the drawing board, potentially opening jobs for rural youth and women and diversifying smallholders’ incomes.

Ethiopia’s romance with eucalyptus is anything but new. When Emperor Menelik II founded Addis Abeba in the late 19th Century, he feared the capital would run short of fuelwood and timber. In 1895, he imported eucalyptus seeds from Australia, waived taxes for growers and handed out seedlings, igniting a forestry revolution. Today, roughly over half a million hectares, by one measure, eight times the size of Kenya’s coverage and five times that of Rwanda’s, are covered by eucalyptus, the largest expanse in Africa.

Botanists count 55 species thriving in Ethiopian soil, among them Eucalyptus camaldulensis and teratons. Seeds and cuttings, which are not available domestically, are sourced from Europe, Latin America, and Israel. Once rooted, the shrubs handily withstand the mild and highland climate.

Eucalyptus plantations have historically been criticised for depleting water resources and displacing native species. But, agronomists argue that the new foliage varieties, grown on limited land and harvested as shrubs rather than tall timber, present fewer risks. Farms are experimenting with intercropping legumes to maintain soil health and using drip irrigation to limit runoff. They also tout the crop’s potential social dividend. Under proposed contract-farming deals, households could plant quarter-hectare plots and sell weekly cuttings to packhouses, earning regular cash without clearing additional forest.

Deploying the tree as a cut-foliage crop is a novel approach. The four commercial varieties now sprouting on flower farms differ markedly from the tall plantations of old. Their juvenile stems stay compact, their leaves emerge round and waxy, and when bunched, they serve as “fillers” in mixed bouquets shipped to bouquet processors in Europe and the Middle East before landing on supermarket shelves or mail-order doorsteps.

Market demand is rising as fashion swings toward textured greens in floral design. Gulf florists cite eucalyptus’s “unique texture and aromatic properties” and its role in advanced arrangements. With freight bills low, domestic growers see an edge over Southeast Asian rivals. A Saudi wholesaler interviewed at the Addis Abeba fair noted that “one extra day in the air dulls the scent,” making proximity king. On price, Ethiopia also appears competitive. Even at the new floor, stems undercut Vietnam’s landed costs.

The economics suit a flower belt searching for a steadier footing. Over the past decade, rose exports have faced volatile prices and outbreaks of disease. Diversifying into hardy greens spreads risk. It also taps under-utilised land. Many farms hold concessions larger than current cultivation, a legacy of the early 2000s boom when investors leased highland tracts in anticipation of endless demand. Some of those hectares now lie fallow. Eucalyptus, with minimal input needs, promises to bring them back into production.

Nonetheless, export volume remains small, partly because propagation material is still imported and nursery capacity is limited. Transport links, while shorter than Asia’s, rest on a single hub-and-spoke network at Bole International Airport, where cargo space can tighten during peak coffee season. Industry executives say they are lobbying Ethiopian Airlines Cargo for priority loading windows and negotiating with freight forwarders to hold the line on rates.

For the government, the venture fits into its broader agenda to boost non-coffee horticulture exports. The national foreign-exchange reserves remain thin, and officials have long courted agribusiness that can bring fast dollars. Flower exports reached 651 million dollars last year, according to the Ministry of Agriculture, but growth has slowed. Eucalyptus foliage, though still niche, could push the figure higher and diversify market risk.

Whether the momentum lasts may depend on sustaining quality and navigating regulatory tweaks. The National Bank reviews minimum prices quarterly; a sudden jump could erode competitiveness. Farms also need to keep a lid on pests and maintain uniform leaf colouration, traits Gulf buyers scrutinise closely. Extension agents from the Agriculture Ministry have begun visiting fields, offering advice on pruning cycles and nutrient management.

In the longer term, Ethiopia’s eucalyptus foliage story could mirror its earlier rose success, provided expansion remains measured and data-driven. The highlands offer plentiful land between 1,800 metres and 2,400 metres in altitude, ideal for the crop, and labour is abundant. But lessons from the past caution against over-planting and neglecting market signals. Stakeholders recall the glut of hypericum and gypsophila stems a decade ago that briefly drove prices down.

For now, growers should adopt a pragmatic approach, starting small and securing contracts before scaling up. Afri-Flower plans to add 25hct next season, while Gallica targets 15. Friendship is focusing on rootstock trials before committing to larger blocks. Each says it will reserve part of its land for ongoing rose or summer-flower production, preserving diversity as a hedge.

Ethiopia, IFAD Sign 69.2m Dollar Deal to Promote Lowland Resilience

The Ethiopian Government and the International Fund for Agricultural Development (IFAD) have signed a 69.2 million dollar grant agreement to implement Phase II of the Lowland Livelihoods Resilience Project (LLRP II). The grant agreement was signed by Finance Minister Ahmed Shide and IFAD President Alvaro Lario. The project targets climate resilience and improved livelihoods for three million people in pastoral and agro-pastoral communities. Co-financed by the World Bank, LLRP II covers eight regions and focuses on climate-smart livelihoods, commercialisation, rangeland management, and disaster risk reduction. The initiative builds on the achievements of Phase I, notably in early warning systems and climate-resilient agriculture. The signing took place during the UN Food Systems Summit held in Addis Abeba on July 29, 2025.

Loading your updates...

Loading your updates...