Fortune News | Dec 07,2019

Bekalu Zeleke, president of the Bank of Abyssinia, and his executive team have a lot to smile about after seeing a vigorous operational year that led the Bank to consolidate its position in the industry as the second-largest, trailing Awash Bank. It was a noteworthy rebound from four years ago when the Bank lost ground as the fourth-largest private bank.

In several aspects of operations, from total revenues to net income and profit to asset position and return on equity, Abyssinia Bank had a momentous year that cheered shareholders to declare "many accomplishments despite the wide-ranging shortfalls."

"Under capitalised before, we've recuperated over the past years," Bekalu told Fortune.

But shareholders met at the Inter-Luxury Hotel on November 26 were reminded that Abyssinia Bank has more work to do to gain a foot on its equity size (lower by 164.2 million Br to Dashen's 14.38 billion Br) and earnings per share, a mismatch in its forex position.

Abyssinia Bank’s net profit growth surged by 141pc from the previous financial year to 3.24 billion Br, attributed to a substantial jump in revenues at 12.4 billion Br. The net profit growth has led to a 45pc increase in earnings per share to 14.20 Br.

Abdulmenan Mohammed, a financial statement analyst based in London, praised the result as “very impressive”, which should delight shareholders. However, the first-generation private bank posted a 3.2 billion Br net profit, short by 2.1 billion Br Awash Bank reported from the same period, and over a billion Birr larger than the average for the six largest banks.

The Bank’s interest on loans, advances and five-year central bank bills soared by 82.7pc to 14.35 billion Br from last year, driven by increased lending activities. Abyssinia Bank's loan size was the second largest at 111.1 billion Br; although its loan-to-deposit ratio (91.4pc) is the highest among its six peers and six percentage points above their average, non-performing loans ratio, at 3.3pc, remains lower than the average 4.9pc. The provision for loans and other asset impairments have declined by 5.4pc to 642.4 million Br.

The loan-to-deposit ratio should be "very concerning as it can cause serious liquidity problems, hence watched keenly", the expert told Fortune.

The non-financial intermediation income of Abyssinia shows a mixed performance in the reported year. Service charges and commissions increased by 19.5pc to 2.91 billion Br. In contrast, for the third year in a row, the performance of foreign exchange dealing declined, resulting in a loss of 774.2 million Br from 231 million Br last year.

“This should be concerning,” Abduelmenan cautioned.

He urged Bekalu and his team to devise a strategy to reverse the trend.

According to Bekalu, narrowing the mismatches between the forex position and total equity will be the focus of his management team in the current operational year. Beefing up capital, mobilizing more resources from forex and deposit, and deepening digitisation will be the other fronts of concentration, Bekalu disclosed to Fortune.

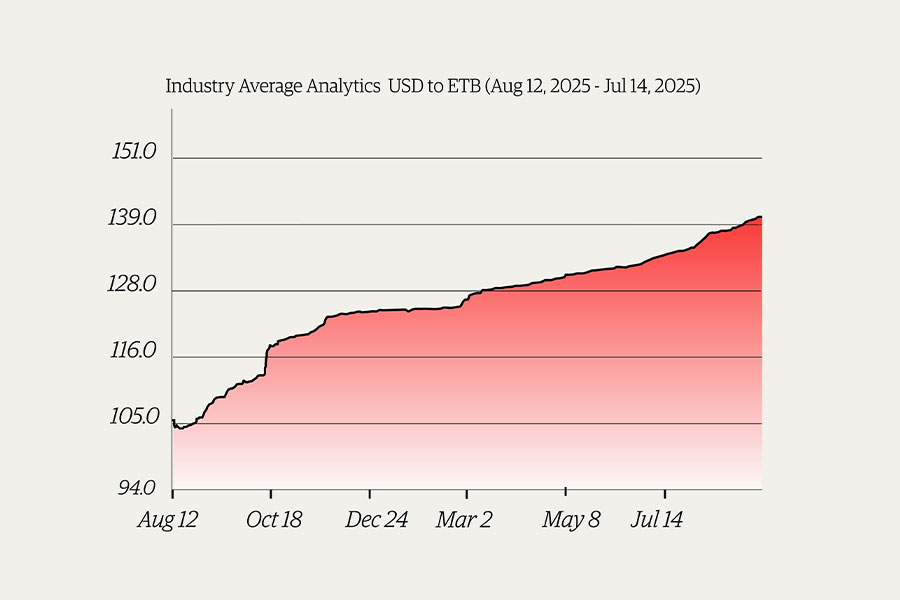

Tisonawit Getachew, business manager at Abyssinia's Global branch, attributed the growing loss in the forex front mainly to the surrender regulators at the central bank imposed last year on the industry as well as the widening gap in the parallel market. Although she was pleased with the Bank's performance during her six years of stay, she observed the number of exporters who were customers of Abyssinia discouraged by the central bank policy.

The Board Chairman, Mekonnen Manayazewal, echoed the sentiment. He conceded the operational year was marked by several policy changes, such as an amendment to deposit reserve requirements and foreign currency utilisation, which had unprecedented consequences on the Bank's performance and profitability.

However, Abyssinia Bank expanded its branch network by 125 service outlets, 115 new branches, and 10 sub-branches, bringing the total number to 748. An increase in saving followed this considerable expansion. Interest saving increased by 58.4pc to 4.23 billion Br due to a surge in deposits, 69pc more than the average for its peers. Salaries and benefits paid by the Bank soared by 35.9pc to 4.39 billion Br.

Abdulamenan cautions the management to pay attention to general administration expenses that shot up 78.3pc to 2.8 billion Br.

Frew Ayele, one of the 2,325 shareholders with 200,000 Br worth of shares, is unhappy with the pioneer private bank’s performance. He compared the return on shares he received from other private banks where he owns shares.

"I blame the decline of dividends on the huge salaries," he told Fortune.

The President contended that analysing earnings per share based on 100 Br and 1,000 Br par value could be misleading as Abyssinia's per value of 25 Br earned 56pc from last year's operation. The Bank paid shareholders 35 Br in dividends for every 100 Br invested, the second largest after 41 Br Awash Bank returned.

The five-year strategic plan launched in 2020 increased payments for Bank staff, said Tisonawit.

“It affected the first-year performance somehow,” she said.

Abyssinia Bank had capital and non-distributable reserves (including revaluation reserve) of 12.08 billion Br and a capital adequacy ratio (CAR) of 10.3pc, which is above the regulatory minimum but far lower than the two-year industry average of 18.5pc.

“Abyssinia needs to consider increasing,” said Abdulmenan.

Abyssinia is among a few private banks that have surpassed the central bank's capital threshold requirement of five billion Birr for 2026; its shareholders have passed resolutions to increase the Bank's capital to 8.3 billion Br.

The total assets of Abyssiniaa expanded significantly, increasing by 43.6pc to 149.45 billion Br. The Bank disbursed loans and advances of 111.58 billion Br, a rise of 48pc from last year and twice the industry average of 42 billion Br.

Abdulmenan described Abyssinia's growth in loans and advances as “very remarkable.”

The Bank mobilised deposits of 122 billion Br, growing by 37.3pc and triple the industry average. Abyssinia’s liquidity level increased in value and relative terms, with cash and bank balance increased by 52.9pc to 18.4 billion Br. The liquid to total assets ratio showed less than a one percent increase.

After investing over three million dollars and hiring multiple vendors and solution providers, Abyssinia Bank is at the cusp of pioneering end-to-end digital services. The Bank is to introduce "neo-banking" in the retail banking sector, allowing clients to open accounts and manage transactions online without visiting physical branches. The Bank is up to launch a consumer credit service, fully automated and undertaken digitally, Bekalu disclosed to Fortune.

PUBLISHED ON

Dec 17,2022 [ VOL

23 , NO

1181]

Fortune News | Dec 07,2019

Money Market Watch | Sep 21,2025

Fortune News | Jul 06,2019

Radar | Nov 20,2023

Fortune News | Jan 30,2021

Fortune News | Oct 08,2022

Fortune News | Dec 10,2022

Radar | Jan 07,2022

Agenda | Oct 10,2020

Radar | Feb 24,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...