The Bank of Abyssinia’s strategic focus on interest income has yielded notable results in the fiscal year 2022/23, placing it in a robust position, second only to Awash International Bank in profitability among private banks, despite the challenging economic environment marked by distressing foreign exchange constraints.

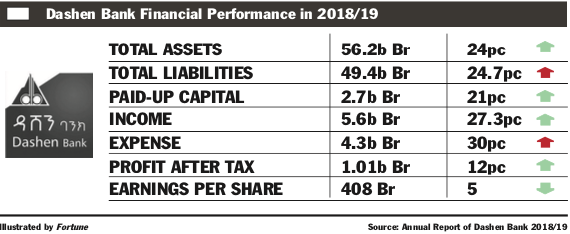

Abyssinia's profit for the year rose by 19.6pc to reach 3.87 billion Br. While industry analysts say it is commendable, this performance pales in comparison to the previous year's remarkable 141pc growth rate. Abyssinia's peers, including Dashen, Hibret, and Awash, reported net profits of 3.56 billion Br, 2.29 billion Br, and 6.99 billion Br, respectively, showcasing the competitive dynamics within the industry.

Nonetheless, Abyssinia's earnings per share (EPS) experienced a significant drop, falling to 39pc from 57pc.

Bekalu Zeleke, president of the Bank, attributed the fall in EPS to drops in foreign exchange earnings and the substantial recapitalisation the Bank undertook.

Over the past year, Abyssinia increased its paid-up capital by 43pc, reaching 11.9 billion Br. It is a move following a resolution shareholders passed during the general assembly held last year, which aimed to raise the Bank's capital to 8.3 billion Br.

Abyssinia's capital and non-distributable reserves, including the legal reserve, stood at 16.6 billion Br, with a capital adequacy ratio (CAR) of 10.8pc. While the CAR remains above the regulatory minimum, analysts suggest that Abyssinia's directors and executives should consider a substantial increase as a precautionary measure. Increasing demands and risks in the banking industry compel bankers to maintain a robust capital base for long-term stability and growth.

A key driver of Abyssinia's performance has been its increased lending activities. Interest on loans, advances, and central bank bills saw a significant increase of 46pc, amounting to 20.96 billion Br. This growth in interest income showed the Bank's strategic emphasis on lending as a primary revenue source.

"Our strategy was to focus on interest income," Bekalu told Fortune. "We offset the loss in forex."

However, it is a strategy that confronted limitations after the central bank imposed a credit growth cap at 14pc. The industry hopes to see this cap phasing out in December this year. Whether Central Bank Governor Mamo Miheretu lifts the cap remains to be seen, following his public pronouncement that inflation targeting at 20pc will be his top priority in the fiscal year 2024.

Bank of Abyssinia's non-financial intermediation operation has seen mixed results.

Service charges and commissions experienced a steep decline of 51.1pc, falling to 1.42 billion Br. This drop sharply contrasted with the 141.7pc surge in other operating incomes, which reached 514.76 million Br. Abyssinia's foreign exchange dealings continued to be challenging, marking the fourth consecutive year of losses in this segment. The foreign exchange income declined to 223.56 million Br from 774.2 million Br a few years ago, indicating a need for strategic reevaluation.

The London-based financial analyst Abdulmenan Mohammed (PhD) raised concerns over Abyssinia's trend in foreign exchange dealings and suggested a strategic overhaul to gain a reverse.

"The management's approach in this area will be crucial for the Bank’s overall financial health and competitiveness," said Abdulmenan.

Bekalu acknowledged the need to adopt a strategy to beef up the forex front.

"We'll focus on export," he told Fortune. "This is the only alternative left."

Another significant factor impacting Abyssinia's performance was the rise in expenses, including general administration costs, which rose by 5.8pc to 2.96 billion Br. Interest on savings increased by 45.15pc to 6.14 billion Br. This increase is attributed mainly to a surge in deposits and an upward adjustment in the average savings rates.

The rise is also reflected in the substantial increase in wages and benefits at Abyssinia, which soared by 69.2pc to 7.43 billion Br. Experts have pointed out that this surge in personnel expenses requires careful attention.

Bekalu justified these increases to shareholders by emphasising the stiff competition for human capital in the financial sector. The banking industry faces a major crisis in human resources. With new entrants vying for skilled experts, established banks like Abyssinia are pressured to retain employees with competitive benefits.

"We've to remain vigilant," he told shareholders.

The Bank of Abyssinia has been aggressive in its operation, opening 123 new branches during the year, bringing its total to 864 outlets. Its workforce also grew significantly, with 2,145 new employees joining, bringing the total staff count to 11,508.

Yared Kasiye, an auditor at Abyssinia's Airport Branch, noted the impact of the conflicts in the northeast on customers in construction and trading activities. These conflicts have led to a slowdown in deposit and loan activities, affecting the Bank's operations in these sectors.

Abyssinia's provision for loans and other asset impairments saw a sharp increase of 52.5pc, reaching 960.37 million Br. According to industry analysts, this substantial rise revealed a need for closer scrutiny of the Bank's credit management practices, especially given the broader economic challenge.

Abyssinia's total assets experienced significant growth, expanding by 26.8pc to reach 189.51 billion Br. The Bank disbursed loans and advances amounting to 143.8 billion Br, reflecting a growth of 28.9pc. However, this growth rate was lower than that of the previous year. Abyssinia’s loan size, larger than Dashen and Hibret, was the second-largest after Awash at 111.1 billion Br.

The Bank also saw a robust increase in deposits, mobilising 158.54 billion Br, an increase of 29.9pc. However, the loan-to-deposit ratio slightly dropped by 1.3 percentage points to 90.7pc, remaining on the higher side of the industry average. Abdulmenan cautioned that such a high loan-to-deposit ratio could lead to severe liquidity problems.

Abyssinia's liquidity level has been a concern, with analysts urging the executives to take measures to prevent further increases. However, Abyssinia's cash and bank balances grew by 14.5pc to 21.15 billion Br, but the ratio of cash and bank balances to total assets slightly decreased to 11.16pc from the previous year's 12.36pc.

Mekonnen Manyazewal, board chairman of Abyssinia, addressed shareholders who met at the Inter-Luxury Hotel on Marshal Tito Road, highlighting the multiple policy changes introduced by the government, from purchasing treasury bonds to amendments in the payment system proclamation. He praised Bekalu and his team for their resilience and employees' commitment to navigating these changes.

Shareholders expressed concerns over the mobile banking platform and customer service quality at branches. Some shareholders were dismayed to learn of the 160 million Br contribution made to Prime Minister Abiy Ahmed Adiministration's passion projects like "Gebeta Letiwled", a notable U-turn from their positive tone in the shareholders meeting held the previous year. Bekalu told the shareholders that the Bankers' Association determined the contribution quota among its members.

Tilahun Tsegaye, who bought shares worth 100,000 Br five years ago, was pleased with the earnings for his shares. However, he expects better performance in the future, suggesting improving customer services, reducing internal expenses, and promoting the institutional image to achieve this.

"We can do better," he told Fortune.

PUBLISHED ON

Dec 02,2023 [ VOL

24 , NO

1231]

News Analysis | Jan 19,2024

Radar |

Fortune News | Dec 09,2023

Fortune News | Feb 15,2020

Radar | Jun 18,2022

Radar | Feb 19,2022

Radar | Nov 26,2022

Radar | Dec 08,2024

Radar | Aug 21,2023

News Analysis | Nov 16,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...