In-Picture | Mar 16,2024

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy at a crossroads, poised for transformative reforms but not without the requisite pain such shifts entail. He warned of an ominous period filled with seismic shifts in macroeconomic policy management, with transgenerational impact.

"Successive administrations will benefit from our fiscal policy orientations," he told Parliament. "I'll not go into the details now."

The Prime Minister forecasted a robust 7.9pc GDP growth for the year, more than double the IMF projected for the sub-Saharan Africa average. However, he tempered this optimism with a candid acknowledgement of the macroeconomic misalignments he argued were inherited from past administrations and vowed to address them through sweeping reforms. Abiy likened the necessary economic policy adjustments to the acute, albeit fleeting, pain of tooth extraction — a metaphor he used to signal his administration's resolve to deal with issues having immediate discomfort for long-term health.

"A dentist is usually at the receiving end of insults," said the Prime Minister. "Only to be welcomed once the source of pain dissipates."

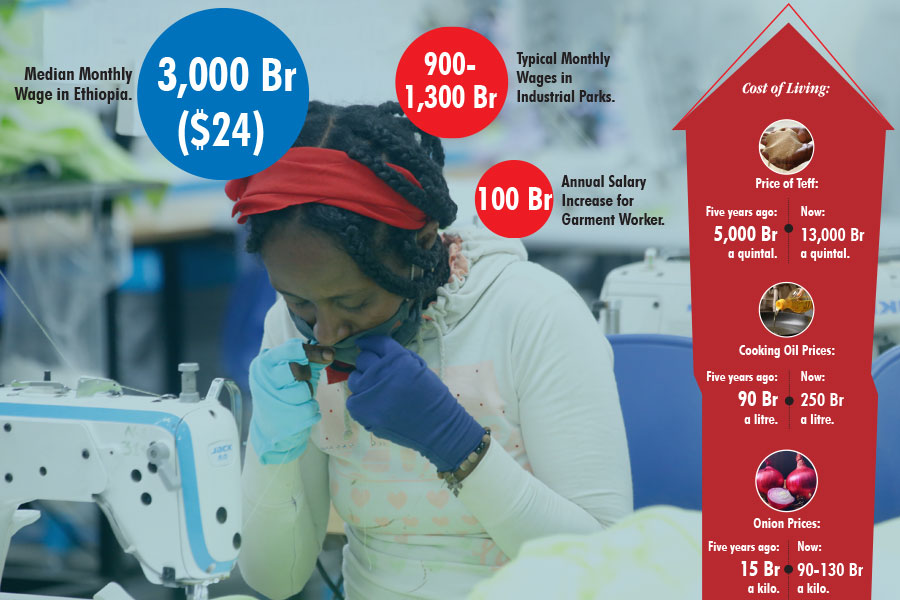

The Prime Minister's announcement comes against the backdrop of an economy under the firm grip of rampant inflation, 28pc for December, signalling a critical need for what he referred to as "pinching adjustments." Abiy's speech alluded to a period of significant transformation in macroeconomic policy management, suggesting that these reforms would serve as a legacy for successive administrations. While specific details were scarce, the promise of addressing longstanding economic maladies was clear.

The National Bank of Ethiopia (NBE) has unveiled a strategic plan set to span three years, targeting fundamental weaknesses in monetary policy and exchange rate management. A notable goal is revising the foreign exchange reserve management guideline by June 2024, alongside a shift towards a price-based monetary policy system that emphasises interest rates and open market operations.

The central bank's cautious approach to disclosing foreign currency management policy information was evident in Governor Mamo Miheretu's recent interactions with Parliamentarians. In December, he stressed the importance of discretion in public comments to avoid fueling speculation. Despite inquiries, details on the restitution of the foreign exchange investment committee remained scant, with an official noting its pending establishment.

"It's not yet been formed," Yenehasab Taddesse, director of foreign exchange monitoring & reserve management at NBE, told Fortune.

However, the Governor disclosed ongoing discussions with the International Monetary Fund (IMF) to enhance foreign currency management through structural adjustments.

Ethiopia's foreign currency reserve currently falls short of the optimal five month import, maintaining only enough for a few weeks. Despite this, foreign currency earnings last year amounted to 24 billion dollars, with significant contributions from services (29.5pc), remittances reaching 6.8 billion dollars and foreign direct investment short of 200 million dollars from the 3.6 billion dollars the economy generated from export earnings. Government borrowing and foreign aid contributed nearly one billion and 1.1 billion dollars. The balance of payments recorded a deficit of 63.6 million dollars during the fourth quarter of 2022/23, a diminished amount compared to the deficit of 307.2 million a year ago.

Economist Atlaw Alemu (PhD) observed a defacto floating foreign currency market, a parallel market system where most commodities are imported at nearly double the official exchange rates.

"They might as well try floating it," he told Fortune. "Everything else seems not to be working."

He believes that a committed improvement in capital and labour productivity could enhance the balance of payments, proposing that temporary shocks might yield long-term benefits if managed correctly.

Observers of the state of Ethiopia's economy blame underlying political and security issues that disrupt market linkages for monetary and fiscal crises.

The Prime Minister, addressing issues beyond the economic domain, including external pressures, the COVID-19 pandemic, and climate change, zoomed in on internal conflicts. He cited 'unspeakable' external pressure undermining the successful implementation of prior economic reforms. Nestled in the predominantly political pronouncements characterised by a spirited drive to address pervasive security concerns, the Prime Minister claimed "no single individual died from starvation" due to the expanding drought.

"Drought is a recurring guest in Ethiopian history," he said. "It should not be used for political purposes."

He emphasised his administration's efforts to address food insecurity exacerbated by drought, insisting on providing over half a million tonnes of food assistance to the Tigray Regional State and efforts to boost agricultural productivity through mechanisation.

Bartema Fikadu, an MP from the Ethiopian Citizens for Social Justice (EZEMA), expressed support for the wheat initiative as part of agricultural economic reform. However, he questioned whether efficient market chains existed for local consumption.

"Factories should not be short on supply if the country exports," he told Fortune.

The MP also pinned his hopes for responding to economic imbalances on the government's ability to deal effectively with the political frustrations that have become breeding grounds for insurgencies.

"Calibrated compromises on all sides," he noted, "reforms wherever necessary."

Several parliamentarians also raised concerns over the proliferation of conflict and the breakdown of a shared narrative steering Ethiopia's political course as the country's neighbours become evermore vocal over their regional anxieties and interests.

"The coming epoch is ominous," the PM responded. "It has become far too easy to acquire weapons."

The Prime Minister referred to the development of a global contradiction in which few have become 'drunken with money,' while many more languish under the throes of worsening poverty and deprivation. He dismissed the insinuations that Ethiopia could not repay its coupon bond payment last month, referring to the country's import bill of 7.5 billion dollars over the past six months.

"Ethiopia is much larger than that," he said.

However, an impending change to Ethiopia's forex regime policy has been a national talking point over the past year amid double-digit inflation rates and a forex crunch despite statements from the government being no more than open-ended remarks on the need for reform.

Observers like Tewodros Mekonnen (PhD) urge for nuanced analysis, arguing that the country's economic fate cannot hinge on single policy changes but requires a comprehensive understanding of the intricate relations between various macroeconomic factors. He argued that the real economy - investment, production, consumption patterns, and balance of payments - responds uniquely to forex regime policy changes depending on the particular conditions of its macroeconomics.

"There are no 'A' or 'B' type of solutions," he told Fortune.

PUBLISHED ON

Feb 10,2024 [ VOL

24 , NO

1241]

In-Picture | Mar 16,2024

Obituary | Oct 20,2024

In-Picture | Jun 29,2025

Fortune News | Jun 08,2024

Radar | Jun 22,2024

View From Arada | Jan 07,2024

Fortune News | Jun 13,2025

Fortune News | Dec 15,2024

Delicate Number | Aug 13,2022

My Opinion | May 25,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...