Nov 4 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

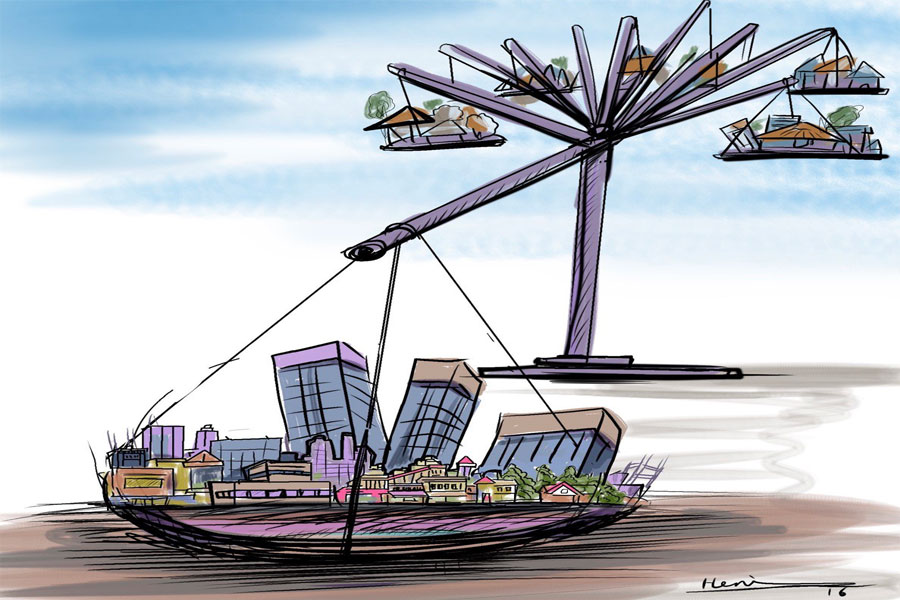

Farmers will be able to access loans from financial institutions using their landholding rights as collateral through a revised rural land administration bill which was passed to the Parliament last week.

Experts at the Ministry of Agriculture believe the bill will attune the registration and collateral-based loan access across the regional states.

According to the legal head of the Ministry Belete Seifu, farmers were challenged to obtain finance despite owning landholding rights to their plots. He believes the bill will address such issues and boost productivity while giving women the room to exercise their rights on the land.

"They lived from hand to mouth," he said.

The collateral-based access to loan scheme was put forth for the pilot in the Amhara, Oromia and Southern regional states three years ago allowing over 50,000 framers to access nearly 2.2 billion Br until August.

Since the pilot program began three years ago, the Commercial Bank of Ethiopia (CBE) and the Cooperative Bank of Oromia (COOP) have disbursed three billion Birr of loans to the farmers using the land holding certificate as a requirement.

The bill stipulates that creditors have a right to lease or sharecrop the land for up to 10 years in times of default.

Approximately 50 million fragmented framing plots exist nationwide, while the land holding certificate was issued for only half.

The Ministry has also developed a system for registration for rural plots dubbed the National Rural Land Administration & Information System.

According to Tigistu Gebremeskel, the rural land administration and use head at the Ministry, financial institutions were taken aback by the lack of clear stipulations on what to take as collateral if borrowers fail to repay the loan.

"We can capture the real data," said Tigistu.

Tigistu believes the bill paved the way for the amendment of the law approved by the National Bank of Ethiopia in 2019, which enabled a loan with a movable asset.

Agricultural finance is regarded as a decisive factor in farming production, helping the poor to maintain basic consumption, adopt advanced technology and raise incomes.

Oromia Regional State has begun implementing the scheme by revising the land law.

Berisso Feyissa, deputy head of the agriculture bureau of the region observes a reluctance from the financial institutions for fear of loss.

Farmers engaged in cluster farming get special offers.

Officials contemplate duty-free privileges of mechanisation are in the works while Berisso indicated that they favor the farmers through agricultural inputs such as fertiliser. He applauds the bill which also backs incentives for those engaged in cluster farming.

"We will keep doing what we were doing," he said, "We're backed by the law now."

Officials hope that once the bill is endorsed by the legislators' farmers could buy yield insurance policies to get compensation if the crop could not be harvested for various reasons.

Eshetu Setotaw has been a farmer for his lifetime in southern Shewa Wereda, Mingar Shenkora Kebele in Amhara Regional State.

A father of six, Eshetu was aware of the 50,000 Br loan obtained from Tsedey Bank. However, he believes the amount is next to nothing with the ever-increasing prices of commodities.

"I want half a million Birr to kickstart my children's business," he said, thinking of his two daughters who are unemployed after graduation.

The demand of financial institutions for such amount of loan is beyond his capacity.

"It's unbelievable," said Eshetu.

Tsedey formerly known as Amhara Credit & Savings Institute joined the banking industry with 7.75 billion Br subscribed capital in September 2022. The Bank granted loans for a group as a risk management mechanism.

Tseday has disbursed over half a billion Birr to 14,585 farmers with a 100,000 Br cap and a similar interest rate as commercial loans.

Agadj Getahun, the microfinance head at the Bank, said they did not experience a default in the four years of access to loans. He said that the amount was set after their experts assessed the adequate amount needed to relieve farmers who need cash to buy seeds or start small businesses.

Agadj observed the system serving as a relief to the framers who needed cash to buy seeds and to form small businesses besides framing.

"It will foster productivity and production," he said.

The draft proposes the establishment of modern land information to provide reliable data sources and use identification numbers.

An agricultural and development economist Shimelis Araya (PhD) believes that food security and boosting productivity are assured through adequate finance to the farmers who manage to produce beyond their consumption.

He argues subsidising the sector is needed beyond facilitating access to finance.

"Surplus agriculture is crucial to curbing food inflation," he said.

PUBLISHED ON

Nov 04,2023 [ VOL

24 , NO

1227]

Radar | May 18,2024

My Opinion | Nov 23,2024

Fortune News | Feb 26,2022

Radar | Sep 19,2020

Editorial | Sep 28,2024

Fortune News | Jun 12,2021

Radar | Apr 12,2020

Radar | Jul 13,2025

Fortune News | Jun 29,2025

Radar | Mar 11,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...