Viewpoints | Jan 26,2019

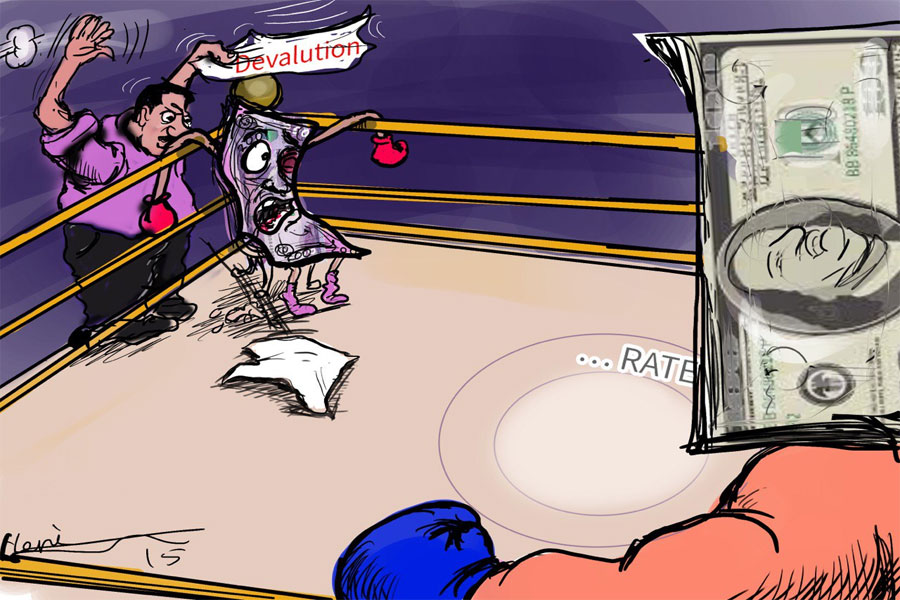

If former Minister of Finance Sufian Ahmed had said the foreign exchange shortage is structural and will remain with Ethiopia for decades to come, that is precisely what Eyob Tekaleign (PhD), state minister for Finance, would want to see changed. The foreign exchange crunch should stop defining the Ethiopian economy, Eyob declared early on last week, standing before members of the international community, briefing them on the new economic reform agenda conveniently characterised as “homegrown”.

The audience was receptive to the "ambitious" reform the administration of Prime Minister Abiy Ahmed (PhD) rolled out and agreed it is "doable".

"The Reform Agenda is our pro-job, pro-growth, and pro-inclusivity pathway to prosperity," said the Prime Minister. "Join us on this path."

In the making for over one and a half years, the tabled reform agenda sees a major departure from the previous dogmatic approach in its aim to rebalance macroeconomic fundamentals and sustain growth. A team of experts from the Ministry of Finance, the macroeconomic team of the Prime Minister, and the National Bank of Ethiopia (NBE) designed the plan to be implemented in the next three years. In his address to the international community, the Prime Minister praised members of this group as "Ethiopia's finest minds."

Bringing the private sector to the forefront, the reform aims to create jobs, address the foreign currency shortage, push down inflationary pressure, reduce debt stress and address access to credit problems while capitalising on the unlocking power of technological advancement.

"Acknowledging that the next chapter of Ethiopia's growth and development requires a more active private sector, we opened up key economic activities to private investment," said Abiy, appearing before an international audience gathered at UNECA, on Monday, September 9, 2019. "We moved the needle further than many had anticipated, and we continue to push further with renewed vigour and enthusiasm."

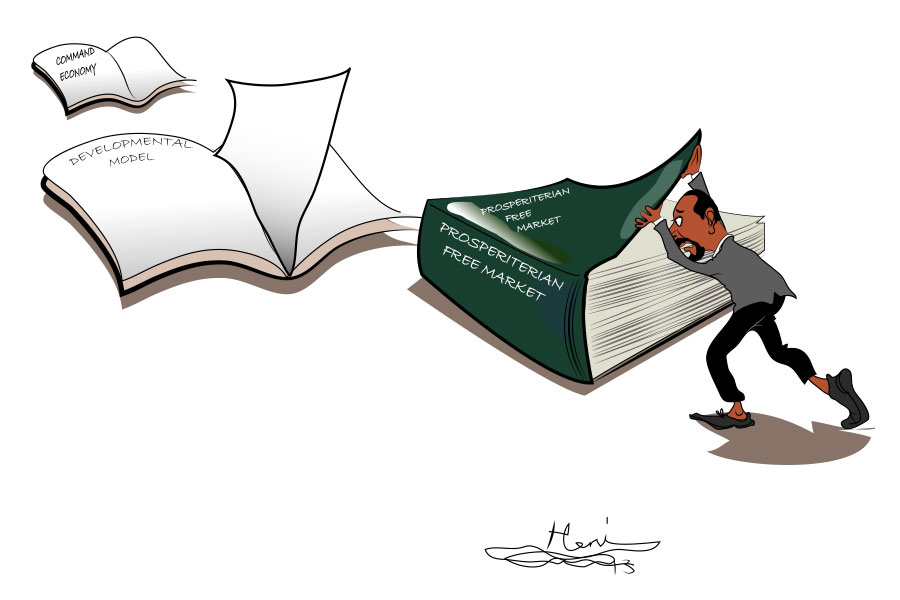

His enthusiasm is evident in his administration's determination to depart from two decades of statism in economic policy making, perceived as having a mixed outcome. The Prime Minister pins his hope on the reform agenda to "propel Ethiopia into becoming the African icon of prosperity" by 2030. It is the year he wants to see his country join the list of middle-income countries, thereby moving the goal post by five years from what was designed in the two generations of growth and transformation plans.

From the Sustainable Development & Poverty Reduction Programme (SDPRP) of the 1990s and the Plan for Accelerated & Sustained Development to End Poverty (PASDEP) of the 2000s to the transformation plans of the second decade of the 21st century, policymakers had believed in the might of the activist state in effecting an economic miracle. Eyob has acknowledged the successes of such a miracle, which has brought impressive growth in GDP and per capita income as well as expansion in the provisions of infrastructure and social services in health and education.

The statist policy has helped the country reduce child death significantly while cutting back the ratio of the population that lives in abject poverty by half.

Zemedeneh Negatu, a consultant and board chairman of Fairfax Global, noted that one good thing about the tabled plan is recognising past achievements and capitalising on them.

Eyob Tesfaye (PhD), a macro economist, Eyob Tekalegn (PhD), state minister for Finance, Mamo Mihretu, a senior adviser to the Prime Minister and Zemedeneh Nigatu, global chairman of Fairfax

"It's built on the successes of the last 15 years," Zemedeneh told Fortune.

These achievements and growth were driven by public investments financed through the mobilisation of domestic savings and prioritisation of credits, according to Eyob.

"[However], the economic progress has not been entirely successful in inspiring structural transformation," said Eyob.

His admission in what ails the economy was hailed by members of the Development Assistance Group (DAG) as "candid". Formed in 2002, it is a group comprising 22 multilateral organisations and countries, co-chaired by the World Bank and Sweden, which are providing financial support for Ethiopia. Eyob accepted the challenges that come along in the form of inflationary pressure, a massive trade deficit, a chronic shortage of foreign currency and increasing unemployment.

The reform agenda was designed in response to these constraints, as well as the inefficiencies in the economy, according to Mamo Mihretu, senior policy advisor to the Prime Minister. He also serves as Ethiopia's chief trade negotiator and is a member of the team that authored the reform agenda.

Foreign currency shortages, access to reliable electricity, corruption, bureaucratic inefficiency, poor internet services, and access to finance have been the most problematic factors in doing business. The expansionary fiscal policy appears to have crowded out the private sector’s access to finance, and might have contributed to high inflation, which has averaged about 15.5pc since 2005. As a result of the persistent current account deficit, foreign currency shortages have become one of the defining binding constraints to businesses, according to Eyob.

"Rapid increases in external debt in the context of poor project executions and export performance led to a high risk of debt distress," he said.

As of last March, the total outstanding debt growth of Ethiopia stood at 26.9 billion dollars, of which a large share of the debt was owed by state-owned enterprises. In addressing these problems, the reform agenda outlines three responses: macroeconomic, structural and sectoral reforms.

The responses at the macroeconomic level aim at re-balancing and safeguarding financial stability through encouraging savings to get invested in the financial system, strengthening public sector finances, controlling inflationary pressure, improving access to land and developing capital markets. Maintaining a "prudent fiscal policy stance and mobilising foreign currency through privatisation and concessional loans" are also the macroeconomic objectives of the reform.

On the structural front, the reformers focus on creating a conducive investment climate for the private sector by amending legal frameworks, administrative procedures and policies. The reformers want to see a facilitating bureaucracy, away from one that is there to "police".

Source: Ministry of Finance

It also considers overhauling the logistics, power and telecommunications sectors, identifying them as key enablers. Priority sectors in agriculture, manufacturing, mining, tourism, technology and creative industries were identified in the sectoral reforms. The reformers hope these are sectors with the potential to create millions of jobs and generate revenues.

The administration of Prime Minister Abiy pledges to tighten fiscal belts, strengthen public sector finances, shed debts, increase domestic resource mobilisation, as well as ensure financial discipline and sound economic management.

"The reform agenda is close to my heart," said Abiy.

Eyob Tesfaye (PhD), a macroeconomist, views the reform plan as remarkable, profound and excellent in terms of forethought. He believes most of the reform areas have already been forwarded to policymakers as recommendations for the past couple of years and it shows the government has begun to listen.

"This is a major departure from the past," said Eyob. "The commitment is huge."

What differentiates the current plan from the previous ones is its emphasis on supply-side reform, according to Eyob, the macroeconomist.

"The programme seems to focus on enhancing the efficiency gain," he said. "It also keeps macroeconomic stability at the core."

Nonetheless, it will not be without a price tag. On top of the mobilisation of domestic savings and privatisation proceeds, the implementation of the reforms will require significant external financing, according to the macroeconomist.

"The additional external financing is expected to be mobilised from multilateral and bilateral development partners in the form of concessional and de-risked financing," said Eyob.

Vera Songwe (PhD), executive director of the Economic Commission for Africa, appears to be one of the very few individuals the authors of the reform forwarded the document to in advance. She was able to narrow down the cost to realise the reform agenda to 10 billion dollars. The breakdown is 60pc in new foreign direct investment and the remaining is to be paid to bring down the amount of Ethiopia's external debt exposure. Ethiopia also needs to increase its GDP per capita to over 2,200 dollars, from the current 769 dollars, while electricity coverage should double from it current 44pc.

Adanech Abebie, minister of Revenues, has the toughest task cut out for her to boost domestic resources mobilisation to 20pc of the GDP for the economic reform programme the administration of Prime Minister Abiy Ahmed (PhD) rolled out last week at the UNECA. The reform is authored by a team of policymakers, including Yinager Dessie (far right), governor of the central bank.

Achieving such an ambitious goal requires Ethiopia to emulate the road traveled by countries such as China, Laos and Vietnam. These are countries that have managed to score an impressive record in increasing their per capita income four-fold while boosting electricity coverage to 100pc.

If Ethiopia wants to follow in the footsteps of these countries, Songwe advises, it should achieve a ratio of domestic savings mobilisation against GDP of 20pc, from its current 11pc.

The reform agenda is not also free from some omission in its selection of sectors for sectoral responses. Experts point out that it failed to consider the energy sector as one of the key productive sectors, with a far-reaching impact on the economy. Zemedeneh sees urbanisation is also overlooked as one of the components and should have been accorded higher priority.

"Since urbanisation is occurring rapidly across the country, giving focus to it early on would help to achieve growth and prosperity," he toldFortune.

Beyond omissions, Eyob, the macroeconomist, fears that the challenge will come while bringing the plan down to earth. Lack of institutional strength could be one of these obstacles manifested during implementation, for many of the institutions have no previous experience in addressing economic problems comprehensively.

For State Minister Eyob, this should be of no concern.

"The capacity building of the implementing institutions is one of the critical areas spotted in the reform," he told Fortune. "Creating a focus of efficiency on the institutions by restructuring them to build capacity is one of the focus areas of the reform plan."

His Ministry and the National Planning & Development Commission, where he had briefly served as a commissioner last year, will be overseeing the implementations of the macroeconomic and financial reforms. The Ethiopian Investment Commission, along with the Ministry of Innovation & Technology and the Ministry of Trade & Industry, will be tasked with following up the private sector reform. The Planning Commission will also coordinate the reforms in the real sector.

The reform rolled out last week appears to be one canvassing a series of other initiatives seen in the past couple of months as a continued roll-up of new reforms meant to address challenges in the economy. Last year, the Office of the Prime Minister formed a high-level committee that has been tasked with easing the burden of doing business. Another committee was also formed lately to work on attracting foreign direct investment and creating three million "decent and sustainable" jobs.

PUBLISHED ON

Sep 14,2019 [ VOL

20 , NO

1011]

Viewpoints | Jan 26,2019

News Analysis | Dec 02,2023

Sunday with Eden | Nov 18,2023

News Analysis | Dec 09,2023

Editorial | Mar 06,2021

Editorial | Dec 17,2022

Fortune News | Aug 16,2020

Fortune News | Mar 16,2024

Viewpoints | May 25,2019

Fortune News | Mar 28,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...