Editorial | May 02,2024

Jan 13 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

A rare experience in the construction industry, the price of reinforcement steel bars has witnessed a considerable decline with an average slide of 20pc at the end of 2019.

Beginning four months ago, the price of 12m-long rebar, which is used to strengthen concrete structures, with diameters ranging from six millimetres to 40mm has shown an average 35 Br decline.

A 4.75Kg, eight-millimetre-width rebar used to sell for 42 Br a kilogram, but now it is sold at 35 Br. The selling price of rebar that has a 42Kg weight and 24mm diameter has declined by two Birr a kilogram to 36.6 Br.

The price reduction is caused by a decline in demand, according to Gizachew Alemu, who has operated a family rebar and metal shop located in Teklehaimanot for the last four years. The family has been running the shop for the last three decades.

"Unlike the previous days, there is enough supply of rebar," Gizachew told Fortune, "but the demand for the product is low."

For the past several years, the price of rebar has risen significantly, and the market was hit by shortages due to the gap between demand and supply.

Rebar retailers also claimed that the number of contractors coming to buy rebar has significantly declined over the

past four months, which they

attribute to the slowdown in the construction industry.

The growth rate of the construction industry has also declined to 15.7pc in the 2017/18 fiscal year from what it was six years ago, 23.9pc, according to data from the National Bank of Ethiopia.

"Even the current buyers are not users," Gizachew said. "They're buying the rebar to stock it, anticipating that the price will pick up."

Rebar manufacturers have also felt the demand and price decline of the product.

Usually, the period between January and late April is known for the demand of rebar increasing, according to Wondiferaw Belete, the general manager of C & E Brother’s Steel Factory Plc, a company that is located in Bishoftu.

C & E Brother’s has been in business since 2008 after being

established with 200 million Br in capital and an annual production capacity of 500,000tn of rebar.

"This time, the demand is very low, and we're even selling our merchandise at a break-even price,” Wondiferaw told Fortune.

Currently, the company is manufacturing 25,000tn of steel, which accounts for only five percent of its total production capacity due to the foreign currency shortage to import raw material. The company imports 90pc of the raw material it uses.

In the country, there are about 190 companies registered to manufacture iron and steel products. These companies have an annual production capacity of 5.9 million tonnes of steel a year. Still the country spends over 1.3 billion dollars a year to procure 6.6 million tonnes of billets to meet the demand.

Mulugeta Gebremedhine (PhD), assistant professor at Addis Abeba University's School of Commerce & Marketing Management, says that the demand for material like rebar depends on the need of certain sectors.

If construction activities are weak, the price of the steel declines parallel with the demand decline, according to him.

The expert also relates the current macroeconomic condition of the country to the slowing down of the construction industry.

"In order to make the industry flourish again," said Mulugeta, "there should be stable and suitable macroeconomic indicators."

PUBLISHED ON

Jan 13,2020 [ VOL

20 , NO

1029]

Editorial | May 02,2024

Radar | Jun 04,2022

Commentaries | Nov 12,2022

Fortune News | Aug 26,2023

Fortune News | Aug 21,2021

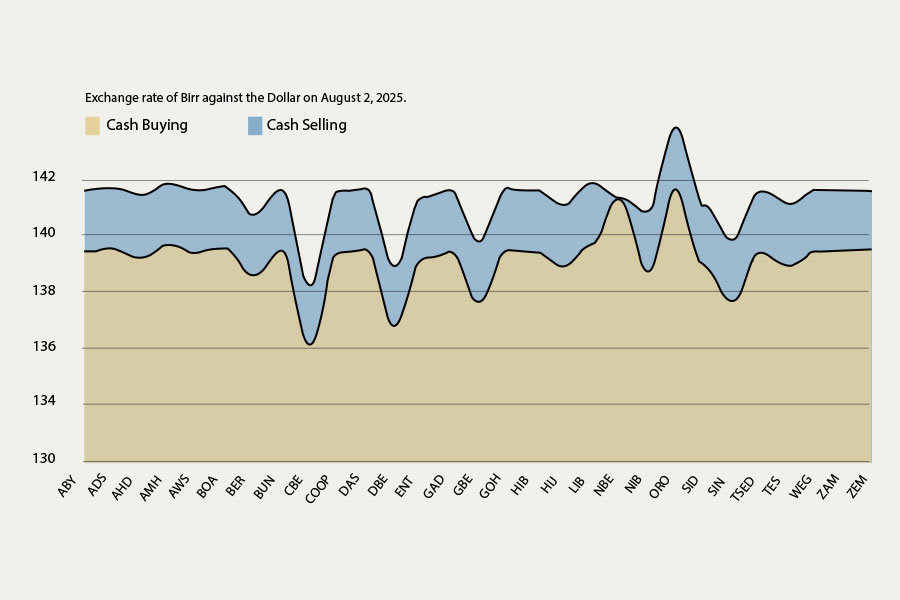

Money Market Watch | Aug 17,2025

Fortune News | Mar 28,2020

View From Arada | Dec 28,2019

Radar | May 06,2023

Fortune News | Feb 22,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...