Photo Gallery | 153877 Views | May 06,2019

Mar 23 , 2025

By Abraham Hailemeskel

The real estate market is bracing for a transformative shift. Last year’s landmark legislation (Proclamation No. 1357) is set to reshape an industry long beleaguered by a lack of oversight and wavering consumer trust. The law, now supplemented by a draft regulation spanning five parts and 20 articles, seeks to instil accountability, transparency, and quality in construction, with industry officials and developers weighing in on its implications.

On March 1, 2025, officials from the Ministry of Urban Development & Construction and the Addis Abeba City Housing Development Administration Bureau convened a meeting with managers of real estate firms in Addis Abeba. Their objective was straightforward. They wanted to gather feedback on how the proposed rules could influence the market. At a time when rapid urban expansion and soaring property prices have become everyday realities, the discussion could not have come at a more critical moment.

The new legal framework targets some of the long-standing issues that have plagued the real estate industry. For years, transactions have been marred by uncertainty, and the absence of a rigorous regulatory regime has left buyers and investors vulnerable. The lawmakers' approach, articulated in articles five of the law and four of the draft regulation, spells out financial and technical requirements designed to enforce enhanced discipline among developers. Under these provisions, developers should provide proof of land lease ownership, demonstrate a robust organisational structure, and ensure that meet minimum size requirements of 1,500Sqm or a stipulated number of units for properties acquired through negotiations.

These conditions extend to the project’s planning and execution. Before a permit can be granted, developers should present a construction schedule and a detailed project study. The new licensing process also includes a set completion date, with extensions permitted only twice, except under extraordinary circumstances. Foreign investors are not left out of the picture; they are required to satisfy a minimum capital requirement in line with the investment law to qualify.

Perhaps one of the most defining shifts in the law is its emphasis on ensuring project completion before transferring properties to buyers. Under the new rules, a property has to be at least 80pc complete before developers can hand it over to buyers, unless the buyer explicitly agrees to an earlier transfer. Basic infrastructure such as electrical wiring, plumbing, mechanical systems, and sanitary works should be in place. This requirement addresses a persistent source of disputes where unfinished properties have been transferred, leading to considerable frustration among buyers.

To further enhance consumer protection, the legislation strictly prohibits misleading promotional claims and the collection of upfront payments before securing a building permit. Developers are now obligated to share comprehensive details about construction materials and architectural designs with buyers, thereby encouraging greater transparency in an industry that often operates in the shadows.

A noteworthy requirement in the new law is the encouragement for forming homebuyer associations. These associations are hoped to act as watchdogs by monitoring construction progress and tracking funds. In theory, this arrangement should enhance transparency and safeguard buyers’ interests. However, some developers have expressed concerns. They fear that active homebuyer associations might inadvertently complicate project timelines, particularly if they demand modifications that depart from approved plans or lack a full understanding of construction processes.

Financial oversight is a central pillar of the new regime. It introduces stringent measures for developers who sell units before a project is fully built. In such cases, developers deposit buyers’ payments into controlled, closed bank accounts. They should also provide indisputable proof of ownership, and resale of the property is strictly forbidden until construction reaches completion. The draft regulation goes even deeper into the specifics of fund management. It mandates that all pre-sale proceeds be placed in these controlled accounts, with withdrawals allowed only when specific project milestones are met.

For projects that have amassed more than 80pc of their sales revenue, no property may be sold or transferred until the project is fully complete. Once finished, funds are released in stages — 20pc, 40pc, and the final 80pc — corresponding to various construction phases. The phased release of funds is designed to ensure that money is used exclusively for the project and not diverted to other, unrelated expenses.

Critics argue, however, that such strict financial controls could complicate the financing for developers, particularly in situations where quick liquidity is necessary or unexpected costs emerge. The tight regulations might also create opportunities for under-the-table transactions, though proponents maintain that the overall benefits of consumer protection far outweigh the potential drawbacks.

Compliance with local building codes and zoning laws is another critical area under the new rules. Developers who fail to meet quality standards, misuse site allocations, or collect unauthorised advance payments face severe consequences. Licenses can be suspended for up to 90 days or revoked outright. In cases where a developer is found guilty of fraud, unauthorised money collection, or false advertising, the law mandates a ban from real estate activities for a year. The draft regulation emphasises these measures as vital to enhancing accountability in the market.

The new law is designed to make Ethiopia more attractive to foreign investors. By clarifying land access rules and outlining specific financial guarantees and incentives for large-scale projects, the authorities seem to want to eliminate the regulatory uncertainty that has long deterred international capital. This initiative could promote partnerships between foreign and local developers, paving the way for knowledge transfer and economic growth.

Dispute resolution under the new system is intended to be swift and efficient. Complaint committees at regional and city levels are empowered to handle grievances, ensuring that issues are resolved promptly without overwhelming the judicial system. If homebuyers are dissatisfied with construction quality, they have the option to approach the relevant complaint committee. This body will investigate the matter and issue recommendations, a process designed to restore trust and maintain the integrity of the real estate market.

Yet, the successful implementation of these measures will depend heavily on effective oversight and public awareness. Regulators should be adequately trained, and members of the public should be informed of their rights under the new regime. Additional resources and staff may be required to monitor compliance in regions outside major urban centres, areas where regulatory enforcement has historically been weak. This includes everything from scrutinising developers’ financial documents to verifying that construction milestones are, indeed, met.

Beyond addressing the immediate concerns of consumer protection and financial oversight, the law is expected to contribute to the broader urban policy goals. The country is experiencing rapid development, and housing shortages have driven up property prices, making affordability challenging. By enforcing standardised procedures and curbing speculative practices, the law could potentially stabilise or even reduce housing costs over time.

However, if the new rules are too burdensome, developers risk passing on the extra costs to buyers or, worse, abandoning projects altogether. The delicate balance between regulation and market flexibility will be a key challenge for policymakers in the coming months.

PUBLISHED ON

Mar 23, 2025 [ VOL

25 , NO

1299]

Photo Gallery | 153877 Views | May 06,2019

Photo Gallery | 144120 Views | Apr 26,2019

My Opinion | 134854 Views | Aug 14,2021

Photo Gallery | 132319 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Sep 7 , 2025 . By NAHOM AYELE

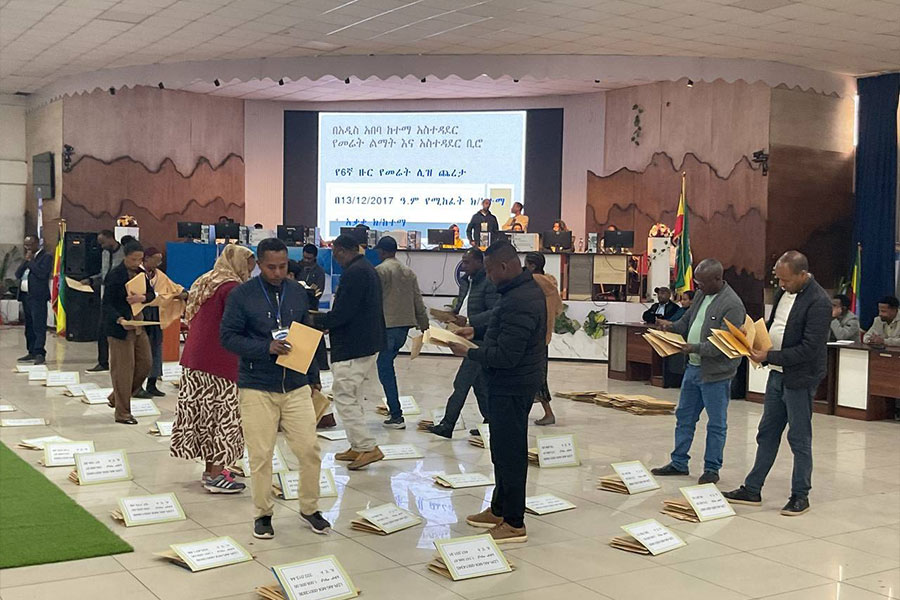

Addis Abeba's sixth public land lease auctions after a five-year pause delivered mixe...

Sep 7 , 2025 . By BEZAWIT HULUAGER

Brook Taye (PhD), the chief executive of the Ethiopian Investment Holdings (EIH), is...

Sep 7 , 2025 . By BEZAWIT HULUAGER

For decades, Shemiz Tera in the Addis Ketema District of Atena tera has been a thrivi...

Sep 7 , 2025 . By NAHOM AYELE

A dream of affordable homeownership has dissolved into a courtroom showdown for hundr...