Oct 5 , 2024

By Yehualashet Tamiru Tegegn

For over two decades, Ethiopians have clung to an optimistic belief that tomorrow will bring better economic prospects. Yet the realisation of this hope seems farther down the road than many anticipated. As economist Ralph George Hawtrey aptly noted, returning to currency stability after inflation is a painful and laborious process, much like the headache that follows overindulgence.

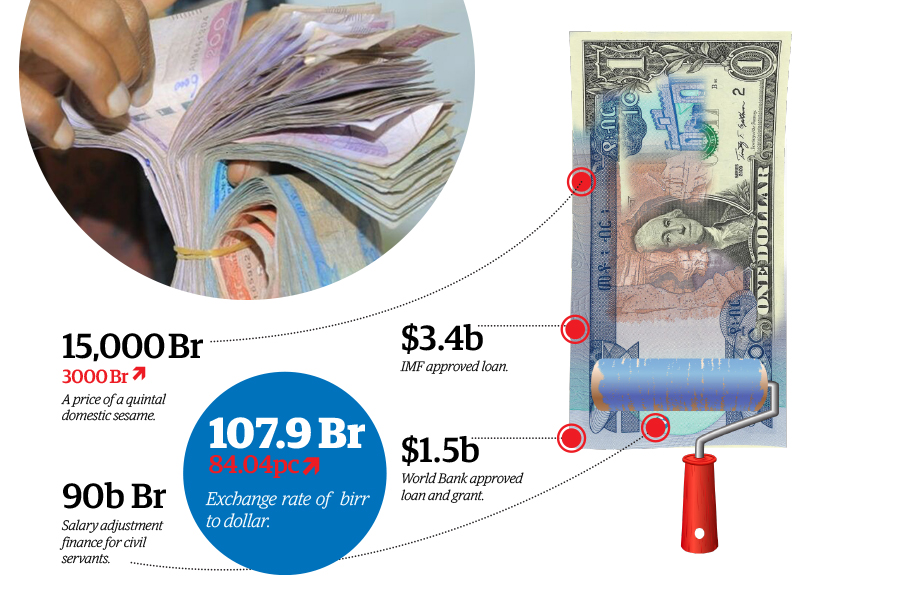

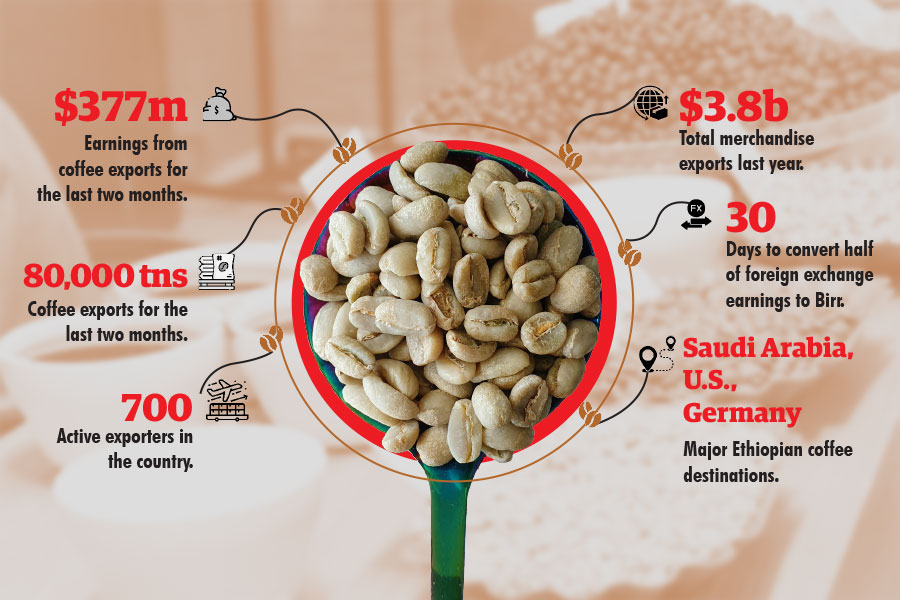

While many are captivated by the recent currency unification, the policy is only one facet of a broader suite of macroeconomic reforms. The authorities devalued the currency after shifting from a pegged to a floating exchange-rate regime, a key demand by the International Monetary Fund (IMF) to secure much-needed loans. The economy is transitioning from a government-led to a market-driven one, seeking to depoliticise economic activities and reestablish a clear divide between politics and the marketplace. However, these reforms are expected to contract the market in the short term, forcing many enterprises out of business.

A pillar of this transformation is the devaluation of the Birr against the US Dollar. This increases the country's external debt burden, elevates domestic prices, and slows economic activities due to insufficient imports.

As part of the agreement with the IMF, the federal government committed to cutting its expenditure and enhancing domestic revenue, reducing its active role in the economy. The government is expanding the tax regime and increasing tax rates, effectively signalling to the public that fiscal resources are constrained. Though not labelled explicitly as such, austerity measures — budget cuts, privatisation, and wage repression — are being implemented across the economy.

Austerity employs two primary tools: fiscal and monetary policies.

Fiscal policy, in turn, has two aspects: expenditure and revenues. On the expenditure side, austerity involves cutting public funds, particularly budgets for social spending like education, infrastructure, and healthcare. Governments are urged to reduce welfare and social expenses, avoid price controls on primary goods, eliminate unemployment benefits, and cease other activities that increase public expenditures and interfere with the market. The main goal of these budget cuts is to redirect funds toward servicing debts held by national or international creditors.

On the revenue side, the government is enhancing taxation mechanisms. For instance, it has amended the Value Added Tax (VAT) law and is planning to introduce property and environmental levies. These measures target boosting government revenue in line with austerity's objective to "save more, consume less."

The second tool of austerity, often referred to as "dear money" policy, increases interest rates and reducing the money supply in circulation. The immediate impact of higher interest rates is that borrowing becomes more expensive for everyone, including the government. This affects public expenditure on essential sectors like education and healthcare. For individuals, increased interest rates mean higher loan costs, leading to consumption dropping as disposable incomes shrink.

Consider the real estate sector. Many Ethiopians bought homes through bank loans. As interest rates climb, their loan repayments increase, leaving less money for other expenditures. On the flip side, higher interest rates encourage people to save more, which can increase the purchasing power of money as cash becomes scarcer in the market.

These policies also have long-term implications. Expensive borrowing discourages investment, increasing unemployment rates as businesses scale back or shut down. As private and public investments decline, the economy contracts. Reduced investment can lead to a decline in imports, helping to correct the balance of payments. To prevent capital flight and encourage investment, the government may reduce corporate income taxes and offer incentives to surviving businesses, often larger enterprises capable of weathering the economic storm.

While austerity is not inherently detrimental, it frequently results in short-term hardships for the public and businesses when governments cut public benefits and seek to increase revenues.

Another major reform is adopting an interest-based monetary policy, where market forces rather than government mandates determine rates. As interest rates rise, traders are dissuaded from borrowing, reducing the money circulating in the economy and helping to respond to inflation. However, reduced expenditures also lead to a decline in production and a slowdown in economic growth.

Perhaps one of the most transformative changes is reintroducing a capital market. Ethiopia briefly had a share trading market during the imperial regime before it was abolished after the 1974 revolution and the rise of the Derg regime, which adopted a command economy. Establishing a capital market is expected to increase the use of debentures - a form of debt financing - in the private sector, providing new avenues for raising capital or investing excess liquidity.

Companies can finance themselves not only through equity, by issuing shares in exchange for contributions, but also through debt financing. Large companies with established reputations and resources can find new ways to finance their core businesses in this system. Conversely, small and medium enterprises may struggle due to a lack of means or insufficient creditworthiness to attract public investment. This could lead to SMEs disappearing or merging with larger companies.

Prime Minister Abiy Ahmed (PhD) addressed this issue directly when speaking to Parliament. He noted that most banks should merge to compete with incoming foreign banks as the financial sector opens up. He made his administration's position clear that it would not want to see domestic banks fail because of the new financial reforms. His suggestion implies a consolidation to perhaps five or six robust banks.

Similarly, SMEs should consider merging to survive this challenging period and remain competitive against established large enterprises.

PUBLISHED ON

Oct 05,2024 [ VOL

25 , NO

1275]

Agenda | Dec 14,2019

Fortune News | Aug 04,2024

Fortune News | Dec 21,2019

Commentaries | Sep 10,2022

Fortune News | Oct 13,2024

Advertorials | May 27,2024

Fortune News | Dec 23,2023

Commentaries | Jan 14,2023

Radar | Jun 14,2020

Agenda | May 02,2020

Photo Gallery | 171584 Views | May 06,2019

Photo Gallery | 161822 Views | Apr 26,2019

Photo Gallery | 151558 Views | Oct 06,2021

My Opinion | 136308 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...