Moha Softdrink Industries S.C., Ethiopia's leading beverage bottler, is in a precarious situation after seeing its founding General Manager retiring and facing a looming closure due to a web of problems that undermined its production.

The company, which has been bottling popular soft drinks under a license from PepsiCo for the past 27 years, is facing a critical moment as it approaches the end of its franchise and distribution arrangement with the global beverage giant. The change comes at a time of economic challenges, including a tight foreign currency squeeze that forced Moha to cease operations across its eight plants, depleting its inventory, after dispatching the last of 52,000 cases.

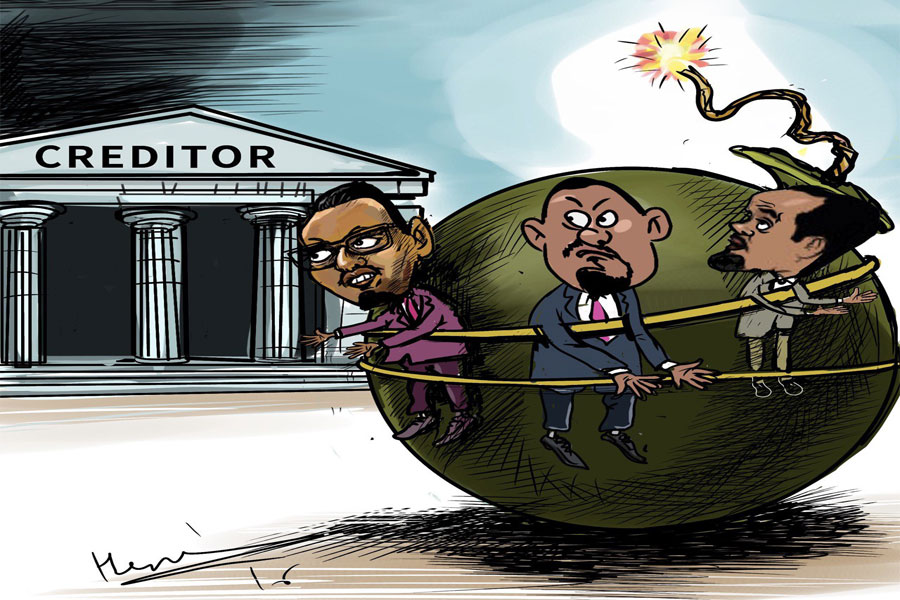

The cascade of events leading up to this moment was marked by the retirement of Getachew Birbo, at 75. His departure was set into motion by a letter from billionaire owner Mohammed Hussien Al-Amoudi (Sheikh), who holds the majority stake in the company. A transitional committee headed by Amanuel Muhe, previously an assistant to the Managing Director of Al-Sam Business Group, has been appointed to steer Moha through these turbulent times.

Amanuel's appointment, recommended by Midroc CEO Jemal Ahmed, is seen as a crucial step in re-asserting management stability and renegotiating the contract with PepsiCo. The international company has yet to accept the nomination of a candidate, however.

Amanuel has expressed confidence in the company's resilience.

"Moha will not close down," he told Fortune.

Amanuel is upbeat about the company's prospects, pledging that operations will resume "shortly" and an agreement with PepsiCo is nearing finalisation.

"Everything will be sorted out," he said.

His reassurances come as a relief to the trade unions representing workers across Moha's plants, who were informed of the impending operational resumption during a meeting on Saturday, December 9, 2023.

Moha Industries' journey began in 1996 investing over the years a 119 million dollars, after Pepsi Cola company was privatised to Al-Amoudi for 16 million dollars. Moha was incorporated subsequently, with shares listed under Al-Amoudi, his spouse Sophia and three of his brothers, Seid, Hassan and Abdela.

Under Getachew's management, the company saw substantial growth, expanding from its initial four plants to additional locations in Meqelle, Dessie, Gonder, Bure, Hawassa, and three more in Addis Ababa. The expansion not only increased its labour force nearly fourfold from the initial 900 but also boosted annual revenues to 4.6 billion Br, despite the forex crunch worsened since 2021.

The company's product portfolio is led by the fan favourite Mirinda, which holds a 65pc market share, followed by Pepsi at 20pc and 7-Up at seven percent.

Looking forward to taking a much-needed rest after long years of service, Getachew reflected on his tenure with a mix of pride and regret. He recalled a downward spiral beginning with the closure of four of Moha's plants in the northern parts of the country following the outbreak of war three years ago.

"Nothing was the same after that year," he told Fortune.

His biggest regret is not securing the annual 38 million dollars in foreign currency needed to import the Pepsi concentrate, which is essential for maintaining production.

"We needed at least two million dollars a month to maintain production, while 3.5 million dollars would be required to function at an optimal level," Getachew told Fortune. "Production should never have come to a halt."

For two years, PepsiCo has been issuing Moha Industries annual notices demanding it to revamp production or risk losing its franchise rights. The last notice the multinational company issued arrived a month ago, with a deadline.

The turmoil Moha Industries faced manifests broader issues within Ethiopia's manufacturing sector.

The share of manufacturing to the GDP has declined in recent years, falling to 4.4pc last year from 5.9pc four years ago. This decline is attributed to severe bottlenecks in securing foreign currency to import inputs. Moha's reliance on Dashen Bank for its foreign currency needs, where it holds substantial shares, has been a particular point of struggle, with the Bank witnessing a sharp decline in supply over the last three years.

The detention of Al-Amoudi by Saudi authorities and restrictions imposed on him to travel outside, as well as the outbreak of pandemic and war, exacerbated the crises, leading to a crunch in foreign currency.

Asfaw Alemu, president of Dashen Bank, chose not to comment on Moha's specific foreign currency problems.

"Foreign currency problems are a national issue," he told Fortune.

The potential closure of Moha has been a source of anxiety for its 4,200-strong workforce. Despite receiving full salaries for a reduced workweek, the uncertainty hovering over their employment prospect has been a significant concern. Trade union leaders have proactively sought intervention, reaching out to regional labour federations and confederations for solidarity.

According to Kassahun Follo, president of the Confederation of Ethiopian Trade Union (CETU), efforts are underway to involve the Ministry of Labor & Skills authorities to prevent layoffs.

"We've been trying our best to save the workers' livelihood," he said.

Kassahun remains hopeful that the resumption of operations at Moha's plants will provide much-needed job security for the employees.

Nonetheless, the anxiety among the workforce remains deep.

Melaku Woldemichael, president of the 400-worker union at the Hawassa Plant, speaks of the growing trepidation among the workforce as the operations of their factory slowed, with the threat of total termination looming.

"I'm extremely apprehensive," said a veteran of 35 years working at the Nifas Silk Lafto plant, who preferred to remain anonymous.

The sentiment is, however, shared across the company's workforce, reflecting the broader uncertainties in the country's economic environment.

Observers of the business landscape, such as Million Kibret, managing partner of BDO Consulting, point to the disparity between parallel and official exchange rates as a primary contributor to the challenges faced by manufacturers like Moha. Million rebuked the government's prioritisation list intended to address forex woes, arguing it has backfired, with only a few privileged entities obtaining and misusing limited forex.

"It's surprising to see forex has lasted as long as it did," said Million.

Million urged the authorities to overhaul economic and trade policies to meet the business environment's foreign currency needs. He suggested that liberalisation of the forex market and opening capital accounts as long-term policy responses could address some of the pressures companies like Moha face.

PUBLISHED ON

Dec 09,2023 [ VOL

24 , NO

1232]

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...