Sunday with Eden | Jul 27,2024

Mamo Mihretu, the governor of the National Bank of Ethiopia (NBE), has outlined a comprehensive three-year strategic plan to overhaul the financial regulatory framework. It is a bold move signalling a significant shift in the history of Ethiopia's monetary policy, coming 10 months into Mamo's tenure as the 10th governor of the central bank. His predecessors rarely adopt a liberal position of central banking, setting inflation targets and fixating on price stability as guiding policy priorities.

Tewodros Mekonen (PhD), an economist and a founding director of the Ethiopian Securities Exchange (ESX), considered achieving price stability essential for long-term investment and macroeconomic stability. He anticipated it would take eight to 10 months for the central bank's recent decisions to significantly impact the country's price level.

Mamo's tenure comes when Ethiopia's economy faces several headwinds, including soaring inflation, tight foreign currency reserves, and a ballooning debt burden.

The Governor's strategic plan, tabled to Parliament last week, is designed to address these critical issues, setting an ambitious target of reducing the inflation rate to 20pc by the end of next year. Year-on-year inflation dropped to 27pc last month; nonetheless, due to domestic political instability and conflicts, global economic shifts and the ongoing conflict between Russia and Ukraine. However, some economists, such as John Hopkins' economics professor Steve Hanke, described Ethiopia's inflation as "surging and stunning", claiming it reached 60pc in November 2023.

In his address to Parliament's Standing Committee on Planning, Budget & Finance, chaired by Desalegn Wodajo, the Governor conceded the "shock after shock" that has beset the economy, blaming significant drops in development assistance from donors and loan freezes from Chinese banks as well as increased global trade barriers. Mamo characterised the declined financing as "the greatest funding squeeze."

Economists are far from impressed with his ambitious inflationary targeting, questioning his claim that inflation has dropped by five percentage points. According to anonymous macroeconomist, monetary policy measures take time to be effective because economic agents' behaviour does not change overnight.

"Inflation and inflationary expectations don't disappear immediately," he told Fortune. "It's impossible to tame inflation through monetary policy alone and bring it down to 20pc in three months. A Noble Prize for that."

A crucial component of Mamo's plan dwells on a thorough overhaul of the central bank's internal processes, including human capital recruitment, legislative reforms, and a significant push towards digitisation. These reforms are seen as vital steps in improving the central bank's regulatory capacity, operational efficiency and responsiveness to the dynamic economic environment. He told Parliament that an international bid is floated to hire consultants with hopes of improving human capital management while establishing a financial academy around the Qaliti area for the long haul.

"We want to make it [central bank] a place for professionals," he stated.

The Governor is also working on a bill to re-establish the central bank, emphasising the need for a research-driven monetary policymaking approach and expanded autonomy. Mamo believes this move to be a strategic shift towards modernising the financial sector, aligning it more closely with global practices. He is expected to present the bill to Parliament by mid-2024 that would allow the entry of and regulation of foreign banks, a significant step in the financial sector's liberalisation efforts.

Ethiopia is set to permit foreign banks to acquire stakes in domestic financial institutions, with the possibility of majority ownership still under discussion, Mamo told The Banker, a London-based magazine.

Governor Mamo's strategy includes a notable focus on increasing financial inclusion, with a target to nearly double the percentage of adults with bank accounts to 76pc in two years. This goal aligns with broader efforts to modernise the financial infrastructure, including digitising foreign currency management and ongoing consultations with international bodies such as the World Bank and the International Monetary Fund (IMF).

The Governor also addressed Ethiopia's external debt position, which is at around 28 billion dollars this year, nearly half owed to China.

The federal government has secured an interim debt-service suspension agreement (1.5 billion dollars) with its bilateral creditors. Coupled with the commencement of discussions on restructuring, a one billion dollar Eurobond maturing in 2024, Mamo and his counterparts at the Ministry of Finance are struggling to steer the economy towards stability. Since applying for the Common Framework treatment in early 2021, Ethiopia has maintained its external debt obligations despite facing payment pressures exacerbated by global and domestic shocks.

Experts see the suspension last week as offering a respite, allowing the re-profiling of looming payments and seeking macroeconomic stability, under an economic reform program negotiated with the International Monetary Fund (IMF). During a recent visit by the IMF's team, federal officials described the discussions as "very positive". However, the IMF remained ambiguous on the outcome of these meetings in its subsequent statements.

The persistent hard currency shortages have been a concern, but authorities like Mamo expressed comfort with the current situation. The debt-service suspension is hoped to improve foreign currency reserves further, supported by efforts to encourage export-oriented companies and foreign direct investments.

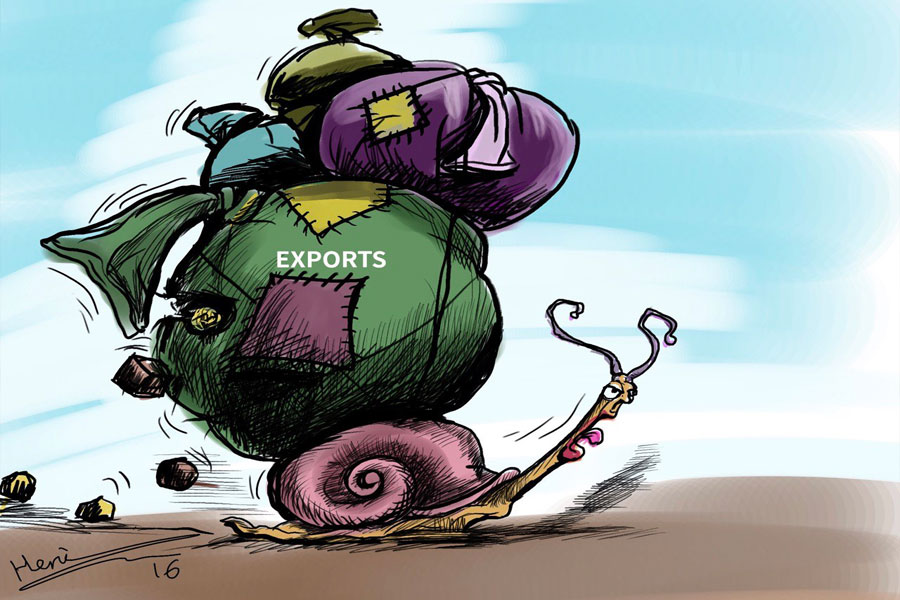

Ethiopia's foreign currency earnings were 24 billion dollars last year. Services accounted for 29.5pc while remittances forked a quarter at 6.8 billion dollars. Foreign direct investment and export earnings provided 3.4 billion and 3.6 billion dollars, respectively. Government borrowing and foreign aid contributed Nearly one billion and 1.1 billion dollars. However, the trade deficit was 14 billion dollars in 2021/22, registering a 30pc increase from the previous year. Recent data for the third quarter of 2022/23 signal that the economy will not fare any better as commodity exports plummeted by 17.1pc and global inflation rates remain high.

Legislators grilled the Governor, voicing concerns about various aspects of the central bank's operations, including overseeing currency trading and the gold trade.

The sharp decline in gold exports, attributed to a rise in illicit and contraband trade, was a particular point of contention.

Agumase Anteneh (MP), a standing committee member, claimed margins provided by the contraband gold trade are paid in parallel foreign currency exchange rates, double the bank rate. Agumase recalled his field visits to gold-producing sites in Beni Shangul Gumuz and Gambella regional states, stressing that the central bank should closely follow its agents.

"There're currency traders calling people off the street in front of your offices," he probed the Governor. "Too many intermediaries are there who siphon to illegal trade."

Gold exports in the year's third quarter have plummeted by 71pc.

Mamo acknowledged the problems and revealed the formation of joint committees incorporating various ministries and the army to address these issues.

"It would significantly boost our forex reserves," he told the legislators.

Recent regulatory measures, such as the credit growth cap of 14pc on commercial banks, were debated.

Wondwossen Admassu, a legislator, questioned the wisdom of restricting credit amidst lacklustre productivity, a low saving interest rate of seven percent and pending liberalisation of the financial sector.

"How would the banks remain competitive?" he inquired.

The central bank has tightened monetary conditions, reduced direct advances to the Treasury, and raised interest rates on emergency lending. The Governor defended these measures as necessary trade-offs in the broader context of controlling inflation and stabilising the economy, addressing his critics that such policy moves could undermine productivity and contradict the goals of financial sector liberalisation.

"Is our objective increasing the bank's profits?" Mamo was puzzled. "Or is it responding to the inflation concerns of citizens? Our priority is reeling back inflation."

Economists view the central bank's initiatives as critical to balancing issuing valuable financial instruments to the public and promoting growth.

Tewodros cited the declining direct borrowing to the central government as a long overdue measure to ensure fiscal discipline. He referred to countries like Kenya, where direct borrowing is limited by legislation, which could serve as a foundation for ushering in central banks' institutional autonomy.

PUBLISHED ON

Dec 02,2023 [ VOL

24 , NO

1231]

Sunday with Eden | Jul 27,2024

Fortune News | Apr 03,2023

Radar | Feb 03,2024

Fortune News | Sep 01,2024

Life Matters | Jun 21,2025

Delicate Number | Sep 28,2024

Editorial | Sep 23,2023

Radar |

Obituary | Sep 29,2024

Radar | Dec 25,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...