Radar | Jul 17,2022

Nov 4 , 2023.

In the corridors of economic policy-making, a quote often attributed to Albert Einstein should echo ominously: "The definition of insanity is doing the same thing over and over again and expecting different results." Whether or not the eminent physicist coined this aphorism remains a topic of debate. Nonetheless, its implications should resonate profoundly with those at the helm of Ethiopia's industrial sector.

Melaku Alebel, the minister of Industry, spearheads a campaign that resounds with the vibrant slogan: "Let Ethiopia Produce". Launched three years ago, he aims to breathe new life into a beleaguered industrial sector. Just last week, the Minister foreran this "movement" as the catalyst behind the resumption of 360 erstwhile dormant manufacturing plants. The culprits behind their earlier demise are a complex web of policy problems - mainly the forex regime - and cumbersome implementation.

A cursory glance at Ethiopia’s economic trajectory reveals an intriguing paradox.

Over the past decade, beginning in 2012, the economy, pegged to constant market prices, witnessed a twofold surge, catapulting to an impressive 2.3 trillion Br. The manufacturing domain mirrored this ascent, with its value output doubling from a substantial 54.6 billion Br during the same period. This upward trajectory, however, is not evenly distributed. The large and medium-scale parts of the industry enjoyed pronounced growth, starkly contrasting against the modest achievements of the small-scale and cottage sectors. The latter recorded half the value of the 108.2 billion Br generated by the large and medium-sized manufacturing companies last year.

Despite its burgeoning growth, the manufacturing sector’s contribution to the GDP remains a paltry 6.46pc. Most of this, over 90pc to be precise, stems from the large and medium scale subsector. It should serve as a puzzling disparity that Minister Melaku wrestled with recently, during high-profile events bracing the "Let Ethiopia Produce" campaign, flanked by the presence of Deputy Prime Minister Demeke Mekonnen, also the foreign minister.

A closer look into this campaign reveals an overarching "Let Ethiopia Produce" message and an ancillary policy directive: the promotion of import substitution. This quiet shift towards an ambition to self-reliance is being fervently championed by the Minister and his deputies, Hassan Mohammed and Tareqegn Bululta.

In a country besieged by structural scarcity of foreign exchange, where industrial productivity remains stubbornly stagnant and unemployment rates soar, the allure of import substitution as a panacea becomes evident. Ethiopia's import bill overshadows its exports by a factor of three; understandably, the urgency for policymakers to slam the brakes on imports gains credence.

Nonetheless, this pull towards import substitution is not a novel phenomenon. Historically, during the nascent 1960s, it emerged as the linchpin for countries seeking self-reliance, economic diversification, resilience, and innovation. It was the cure-all policy response touted to galvanise a fresh, young workforce, laying the foundation for sustained national growth. The allure of economic independence has long captivated countries, leading many to embrace the policy as a magic bullet for development and self-reliance.

Import substitution, as an industrial strategy, gained traction post-World War II, particularly in the newly liberated underdeveloped economies. It was seen as the essential remedy for post-colonial economies, eager to sever their umbilical ties with former colonial overlords.

Yet, as with many grand economic policy experiments, the devil, as they say, resided in the minutiae. Zoom in, however, and the policy paints a different picture.

While several developing countries fervently embraced the import substitution industrialisation paradigm, by the time the 1980s dawned, it was apparent that the promise of this policy was largely unfulfilled, especially in the African context. This shortcoming was not due to a singular cause but a confluence of geopolitical shifts, inefficiencies, technological stagnation, fiscal burdens, and macroeconomic misadventures.

The global landscape's seismic shifts, notably the Cold War's end, coupled with indigenous industries' inefficiencies, led to a perfect storm. Industries, once wrapped in protective policy barricades, failed to innovate or scale, leading to an abyss in technological advancement. The irony was palpable. Despite the loud and noisy calls for supporting domestic production, many sectors remained tethered to the apron strings of imported raw materials and capital goods. States' fiscal position was stretched as public coffers were drained to prop up beleaguered state-owned enterprises.

As the 1980s waned, the writing was on the wall. Countries such as Ghana, Tanzania, and Zambia, once the flag bearers of industrial import substitution, found themselves trapped in a whirlpool of fiscal deficits, mounting external debt, and economic stagnation. The policy's core tenet — to eschew imports in favour of domestically produced goods — though seductive in its simplicity - has, under the harsh lens of empirical scrutiny, revealed more pitfalls than triumphs. The subsequent dissection of the import substitution model, exposed a compelling case for its abandonment in favour of more open and equitable economic strategies.

Their collective epiphany was unequivocal: a recalibration was imperative and inevitable.

The baton was then handed to forces of market liberalisation, ushering in a wave of reforms premised on structural adjustments, trade liberalisation, and privatisation, the infamous policy prescriptions that led to the deindustrialisation of Africa. The Britton Woods Institutions - the World Bank and the International Monetary Fund (IMF) - with their prescriptive cocktails of economic remedies, were the new stewards of this paradigm shift.

The World Bank’s analysis of Latin American economies, characterised by hefty tariffs and quotas under import substitution policies, signalled a stark misallocation of resources. Industries coddled by protectionist policies tend to survive without global competition, but suffer from an innovation deficit and a dangerous detachment from consumer demands. Price distortions that erode consumer purchasing power and diminish welfare were evident.

The United Nations Conference on Trade & Development (UNCTAD) echoed this sentiment, noting the forfeited economies of scale and scope accompanying an insular market outlook.

Neither can the social stratification import substitution perpetuates can be overstated.

With capital-intensive industries mushrooming in urban settings, policymakers left rural areas in their shadow. This urban-centric industrialisation sows the seeds of social discord, disproportionately favouring the capital holders and those with access to the artificially insulated sectors. Policymakers frequently propped embryonic industries with subsidies and tax breaks, nurturing a dependency culture that skews national budgets. All the more, the withdrawal of state life-support often precipitates an industrial unravelling, exposing the unsustainability of import substitution policy.

Ethiopia's macroeconomic doldrums today face the same difficulties which compelled these countries to adopt import substitution as a flicker of light at the tunnel's end. Once again, a tectonic shift is ongoing in the international geopolitical arrangement, with the fiscal deficit widening, external debt rising, and the economy not growing as much. With their renewed efforts to resurrect the import substitution policy playbook, Melaku and his policy wonks should ask a question that lurks - pertinently. Central to the debate should be a fundamental premise.

Can they glean lessons from the past and avoid the pitfalls that ensnared their predecessors? Is this renewed dalliance with import substitution a sensible strategy or a perilous re-enactment of a bygone era?

A few optimists embedded within the macroeconomic policy squad may believe - rather ardently - that the country is uniquely positioned to pull this off. Their optimism may have anchored in a few precepts. Ethiopia today, unlike its African counterparts in the 1980s, enjoys a relatively more diversified economy. Technological advances in this era and a digitally connected world could offer a helping hand, enabling its industries to leapfrog certain stages and impediments.

Yet, naysayers, armed with the weight of historical precedent, caution against overzealous optimism. They point to the inherent challenges plaguing import substitution industrial policy. The spectre of protectionism, they argue, could impede innovation, leading to complacency amongst domestic industries. The strain on fiscal resources, a recurring motif from the past, could resurface with renewed vigour. It would be consumers who would be on the receiving end of industrial inefficiency and incompetence.

Minister Melaku and his team would do well to heed the wisdom encapsulated not only in the tales of ambition and aspiration but also in cautionary messages of miscalculation. However, time, that ever-unyielding judge, will tell. Yet, one thing remains clear: the audacity of their ambition is instructive.

PUBLISHED ON

Nov 04,2023 [ VOL

24 , NO

1227]

Radar | Jul 17,2022

My Opinion | Dec 19,2020

My Opinion | Apr 09,2023

My Opinion | Aug 26,2023

Addis Fortune | May 04,2024

Radar | Oct 19,2024

Addis Fortune Press Release | Oct 04,2024

Radar | May 27,2023

Life Matters | Aug 25,2024

Delicate Number | Aug 02,2025

Photo Gallery | 156788 Views | May 06,2019

Photo Gallery | 147074 Views | Apr 26,2019

Photo Gallery | 135640 Views | Oct 06,2021

My Opinion | 135276 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

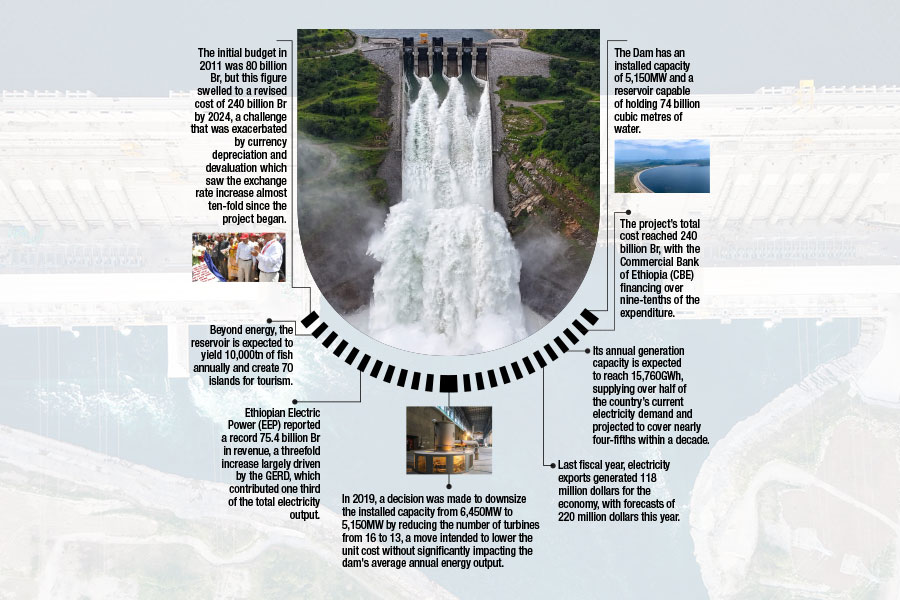

Sep 15 , 2025 . By AMANUEL BEKELE

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...