Radar | Sep 04,2021

Sep 18 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Central bank regulators have instructed commercial banks to open letters of credit (LCs) for agricultural inputs and equipment importers with suppliers’ credit. It is a rare move in an economy wracked with a chronic shortage of foreign currency.

Supplier credit is a business practice that allows importers to buy products needed now, paying for them later under the terms and conditions agreed upon by the seller. Buyers are required to settle the bill within a year. Exporters and manufacturers have been enjoying a similar preferential treatment since last year, permitted to import machinery on credit as long as the procurement is directly tied to their primary business.

Fikadu Digafe, vice governor of the National Bank of Ethiopia (NBE), believe the decision will encourage investment in the agriculture sector.

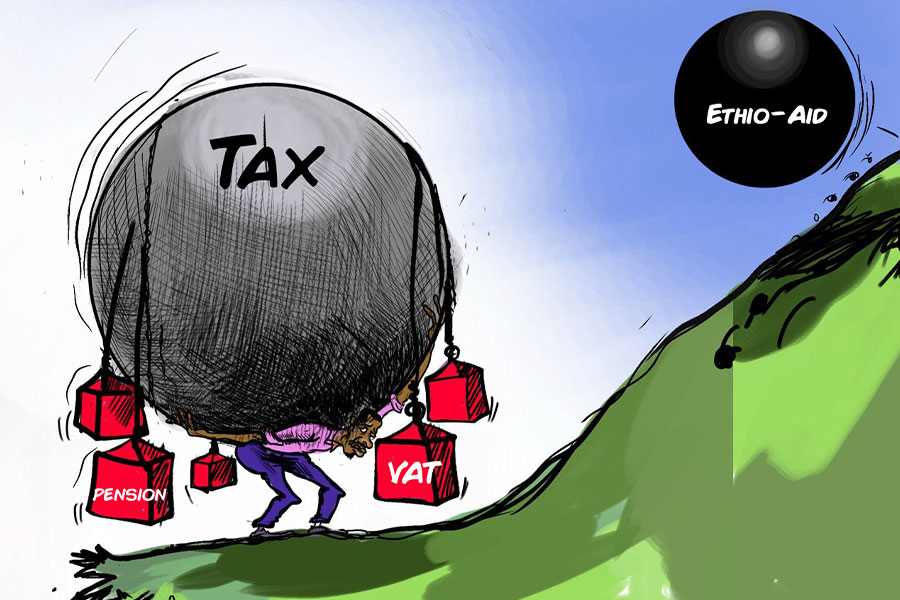

Importers of agricultural machinery have been exempted from value-added tax (VAT) applied to the sale of their products since 2020. Officials of the Ministry of Finance granted domestic tractor assemblers, which import knocked-down parts, a similar privilege three months ago.

Yet, few agricultural inputs, equipment and machinery have been imported in recent years due to the foreign currency shortage. Close to 4,100 tractors were imported over the past two years, bringing the number to more than 21,200. The country used to import 40,000tn of agrochemicals annually; however, volumes have dropped by more than half.

The central bank’s decision comes as commercial banks struggle with forex mobilisation.

For Sirak Yifru, head of trade finance at Nib International Bank (NIB), the decision is a promising start to addressing the foreign currency crunch.

“The forex shortage means importers are having a hard time opening letters of credit,” he told Fortune.

Girum Tsegaye, president of Berhan Bank, says the decision will shorten the time importers have to wait to gain access to forex.

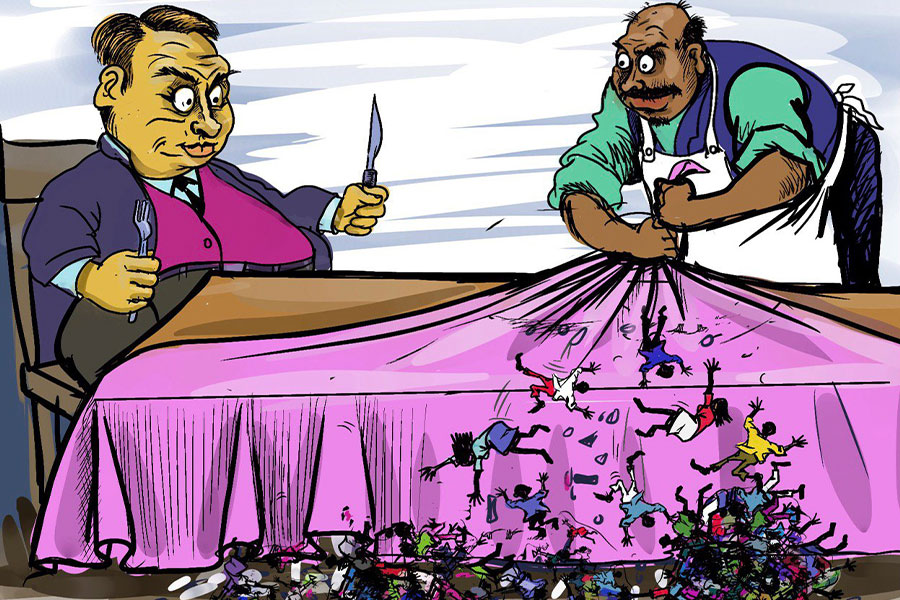

The forex crunch has been a spectre haunting the economy for years. Record-high export revenues of 4.1 billion dollars last year have not amounted to much in the face of import bills 10 billion dollars larger. Regulators have attempted to boost forex income by permitting forex transactions inside industrial parks and enabling foreign currency account holders to negotiate with banks on buying rates.

Nonetheless, forex remains a scarce resource even for industries identified by the central bank as a top priority.

An economy starved of forex has been the driving force behind skyrocketing rates in the parallel (black) market. A dollar was exchanged for 92 Br in the black market last week. It is nearly 40 Br higher than the official exchange rate at commercial banks and more than double the unofficial rate from two years ago.

Regulators attribute part of the disparity to alleged illicit export activities, where exporters retain earnings and import non-essential items for large profit margins. They claim that some exporters do so through offshore transactions, not within the central bank's jurisdiction.

The situation is dire for business, but some see the central bank’s latest decision as a small solace.

Fasil Melesse is a significant shareholder and general manager of Dawunt Trading Plc, incorporated 15 years ago with one million Birr capital. The company imports a wide range of products, including pesticides. Fasil has seen the forex crunch making his company’s business unviable. Dawunt Trading used to import agricultural inputs valued at three million dollars annually.

Fasil used to finance his import business with the foreign currency he earned from exporting agricultural commodities such as oilseeds. However, the unavailability of sesame in the market has curtailed this mode of operation.

“We shipped a small volume last year,” he said.

A central bank directive last January compelling exporters like Fasil to surrender 70pc of forex earnings from exports was another blow. The balance is to be shared between commercial banks and exporters.

The last few years have been tough on Abubeker Mohammed Sheikh Import & Export Plc, which imports agricultural equipment such as water pumps for irrigation. It has been over a year since it imported single agricultural equipment.

“We’re still waiting to open an LC for two million dollars,” said Abdulkarim Abduljewad, import manager.

Incorporated over three decades ago, the company has established strong business relationships with suppliers in India and China.

“We can secure supplier’s credit easily,” Abdulkarim told Fortune.

Experts attribute the success of the financing scheme to fostering trust between banks and importers with overseas suppliers. They caution that although trade credit can lessen the hassle for importers, strict oversight is crucial to making the scheme work.

“The government must monitor importers’ activities to prevent the misuse of the privileges,” said Atlaw Alemu, an economist lecturing at the Addis Abeba University.

PUBLISHED ON

Sep 18,2022 [ VOL

23 , NO

1168]

Radar | Sep 04,2021

Fortune News | Mar 16,2019

Covid-19 | Apr 03,2020

Fortune News | Jan 19,2024

Radar | Sep 27,2020

Radar | Jun 22,2019

Radar | Apr 24,2021

Fortune News | Dec 11,2021

Radar | Oct 08,2022

Radar | Oct 20,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 31 , 2025

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

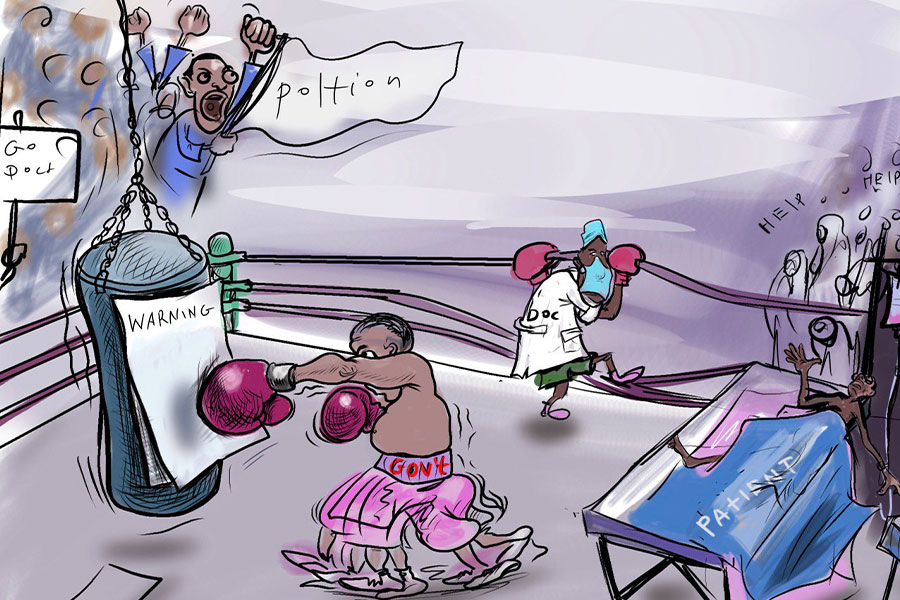

May 24 , 2025

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...