The youngest insurance firm has struck deals with an Indian-based technology firm to acquire a CORE solution, joining the industrial frenzy.

Regulators at the National Bank of Ethiopia (NBE) issued a directive compelling insurance firms to acquire an automated financial management solution in the next two years. They have issued similar requirements for all 38 microfinance institutions (MFIs), granting a three-year transition period to comply.

Bunna Insurance had initiated the bidding process to acquire a core insurance system before the central bank issued the edict.

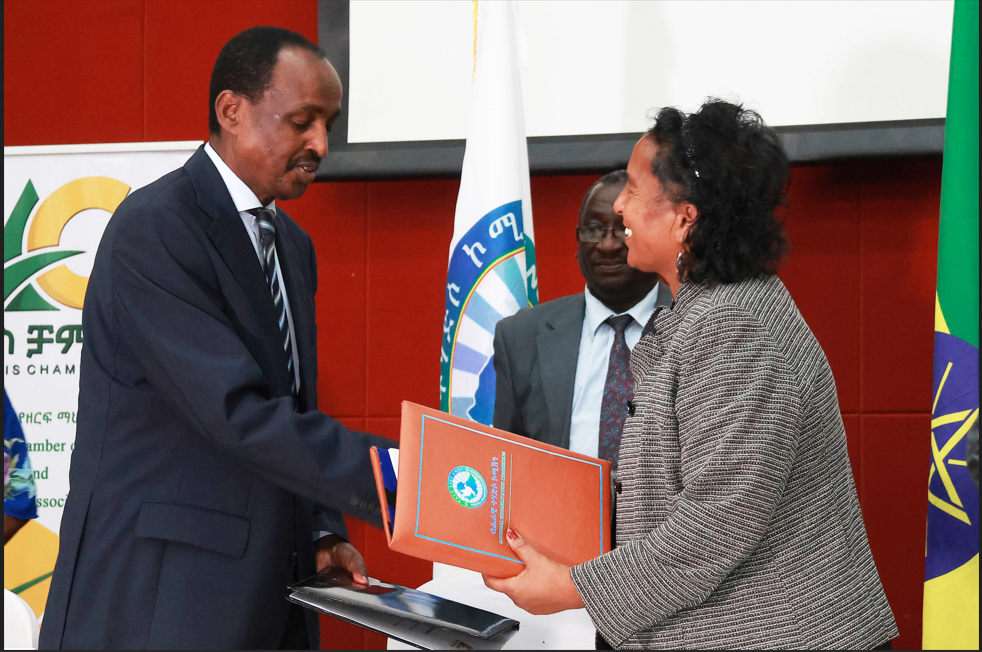

Senior executives of Bunna Insurance have picked Amity Software Systems to provide a centralised, online, real-time, electronic insurance solution, known by the industry’s lingo as a CORE. Amity’s system is expected to interconnect all 33 branches, 19 of which are in Addis Abeba. When completed, the complete project may cost the company nearly a million dollars.

Incorporated in 2013, Bunna Insurance was limited to non-life insurance policies until recently. Last year, the firm began offering its customers long-term insurance businesses of group, endowment, and mortgage life insurance policies. With a paid-up capital of 200 million Br, the insurer has 37,000 clients. Its gross written premiums reached 480 million Br, up by 43pc compared with the previous year.

Bunna Insurance executives hope the automation will enable these clients’ easy access to information on premiums and policy renewal procedures. Clients can also file claim requests remotely, says Dagnachew Mehari, chief executive officer (CEO).

Amity Software Systems has deployed its technologies in other African countries, including Kenya, Ghana, Nigeria, and Rwanda. The 36-year-old IT firm is familiar with the Ethiopian market. It entered to supply a digitalised enterprise resource management (ERM) system to Dangote Cement. Its executives say they are keen on expanding its presence.

“We’re preparing to participate in other bids,” Anil K. Saxena, managing director of Amity, told Fortune.

Dagnachew and his officers plan to obtain network infrastructure, hardware, and a database.

“We’ll float bids after receiving the specifications from Amity Software,” said Dagnachew.

Experts estimate that the spending Bunna Insurance executives are prepared to make could be on the high side compared to the company’s size. Bunna Insurance netted 34.6 million Br in profits last year.

Ebsa Mohammed, an insurance expert and manager at Alpha Consultancy, urges Bunna’s executives to ascertain the technology’s viability to cash in on the investment.

“Some firms have faced challenges in the past,” said Ebsa. “The systems they deployed failed to live up to expectations.”

Dagnachew ascertains that Bunna Insurance followed standard protocol before awarding the contract to Amity Software Systems.

“The management tested the system,” he said.

Ten companies responded to the tender the insurance firm issued three months ago. Half were shortlisted, including Turnkey Africa, a Kenyan-based solutions provider for the insurance industry. Beyontec, a US-based firm, was among the companies shortlisted by Bunna. Last year, the firm inked a deal with Ethio-Life & General Insurance to provide a system networking the 28 branches for 30 million Br.

Incorporated in 2008, Ethio-Life began its operations as one of the second-generation insurance firms. With a paid-up capital of 200 million Br and over 1,300 shareholders, the insurer provides life and general insurance policies to 3,000 clients.

Others are following suit.

Zemen Insurance, a peer of Bunna, floated a bid last week to select a consultant.

“We plan to deploy the core solution by the end of the year,” said Endalkachew Zelekew, the CEO.

In business since 2020, with 81.5 million Br paid-up capital, Zemen collected 80 million Br in premiums by the end of last year.

The same goes for Tsehay Insurance, a company incorporated in 2012. Last May, the insurer issued a tender to hire a technology provider. Its CEO, Kassa Lisanework, plans to select the winner in October.

About 10 insurance firms had transitioned to automated service provision. Awash Insurance, highly capitalised in the industry, brought Infusion Software Development Plc, an Indian software supplier, onboard eight years ago to deploy its system.

Another industry veteran, Nile Insurance, launched its automated financial management solution a decade ago. Last year, the 27-year-old firm upgraded the Prima 9 software to Prima 11. The firm selected Avento to automate its long-term insurance business operation available through 60 branches.

“We’re testing the technology before it goes online,” Nigus Anteneh, CEO, told Fortune.

PUBLISHED ON

Sep 03,2022 [ VOL

23 , NO

1166]

Radar | Feb 03,2024

Sunday with Eden | Jul 17,2022

Fortune News | Jul 13,2024

Radar | Jan 27,2024

News Analysis | Feb 03,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....