View From Arada | Oct 14,2023

Pride and Passion

The Women Driving Leadership and Change in Banking and Payments Today

On International Women’s Day, we hear from four women leaders in their fields, about their own journeys, the importance of visibility and how equality and diversity have become powerful forces for change.

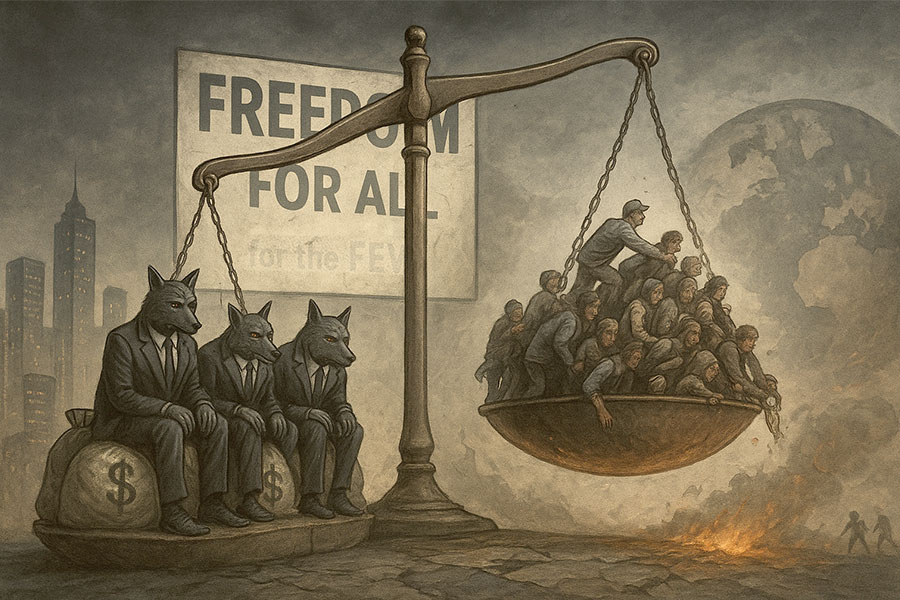

There is a smart, powerful phrase that underlines the importance of visibility and role models in life: “If you can see it - you can be it.”

And it has stronger resonance than most motivational slogans you might see printed on a coffee cup, as it speaks to the power of those who blaze a trail and shine a light for the next generation.

Up until very recently, young women looking to a career in banking, Fintech and the wider financial services sector might have had a long search for role models in leadership positions.

As many industries woke up to the importance of diversity, true meritocracy and open opportunity, much of the world of banking and financial services appeared to be behind the curve.

Or as one of the four women we talked to, Ana Nedeljkovic, says;

“Ask most people to picture a banker, and they’ll still see a man in a suit.” But this is changing. Fast.

On International Women’s Day, we hear from four women, leaders, mentors and champions for gender equality and opportunity.

All four are successful in their fields and passionate about encouraging the next generation of talented young women who are looking for a career in a sector where they can be a positive force for change and progress for people and communities across the world.

As banking becomes a daily-used tool and a resource that we all need at our fingertips and with the theme of International Women’s Day 2022 declaring “Gender equality today for a sustainable tomorrow” - these four women talk about real change and how to achieve it.

Pedzani Tafa

Chief Operations Officer, Botswana Savings Bank

“It’s important to have women in banking because we are an increasingly critical part of the decisions made on consuming banking products.”

Pedzani Tafa has risen to leadership positions over a dynamic 29 year career in banking, currently with a Bank that has a specific mission to mobilise people to save and plan for their future through inclusive, community-focused financial services.

Pedzani believes that women must show “courage and knowledge” to progress their careers - and will earn “respect through delivery.”

In common with many women in financial services today, Pedzani did not foresee a career in the sector when she was studying environmental science, but rather a career in education.

However, as many young graduates do, she applied for “anything and everything” and almost by chance, ended up working for a newly formed bank in Botswana.

The Chief Operations Officer for Botswana Savings Bank says that as she rose higher in her career, it sometimes felt like a “lonely place” where the absence of women in Executive roles was evident in meetings or around conference tables.

Pedzani believes, however, that this is changing, as the financial sector embraces diversity, and becomes aware of the importance and value of having all views, experiences and backgrounds in the mix.

“I think it’s important to have women in banking because women are an increasingly critical part of the decision making to consume banking products,” she says.

“We may still have this traditional view of the man being the head of the household.” “But today, in most cases when such decisions are made, women are a big part of it. Therefore, having women in leadership in the Bank is critical, when we tailor products, we have to think who are the decision-makers?”

“That perspective is so important, to be able to answer the question, “what would I want, as a woman, from a bank?”. I am able to bring in that perspective.”

Pedzani says that women are still, largely, in the lower-to-middle management positions and this has to change.

She believes in the qualities of empathy - not as a “soft” power but as a strength that women have that is vital for listening to and understanding the people they both work with and serve.

And Pedzani says banks have to understand that women can be both leaders and ambassadors, engaging with communities, using insight and rapport to build relationships in a world where financial services are becoming increasingly personalised and direct.

These interpersonal skills are also crucial in running teams and organisations. “I think this leadership style can really resonate with people,” says Pedzani.

“When I ask someone to give me feedback, and they say, “you know, you really made an impact on my life”, I will find that they have worked more effectively, contributing more.”

“It has been proven that people will often work more for individuals that lead them, than for the organisation itself.”

Annie Vidot

Chief Executive Officer, Seychelles Commercial Bank

“Yes, we are in a male-dominated field. But that should not stop us aspiring to success.”

As the first female CEO of her Bank, Annie Vidot is playing a central part in driving change at Seychelles Commercial Bank as they journey on a digital transformation and move to a full range of online banking services.

She started her career in the banking sector as a Loans Officer, continuing with her studies, taking on more responsibilities and rising to the CEO position she has today.

She says she did not start her career aspiring to be a CEO and didn’t even see herself in a management position. But as she gained in experience, in her educational qualifications and in her belief in her own potential, she was able to forge a path.

“I always say to my staff, especially those who are starting out, do your job well, educate yourself and take all of the opportunities that are given to you,” says Annie.

“I believe I have taken all of the opportunities that have come my way and as we are talking about women in banking and fintech, I think that is an important factor, having the confidence and belief that allows you to do this.” “Yes, we are in a male-dominated field. But that should not stop us aspiring to success.”

Annie says financial services in countries like Seychelles still have some ground to make up on their European counterparts for example, in areas such as advanced digital financial solutions and mobile banking technologies.

But she believes this radical change offers opportunities for young women and young people in general to venture into and play key roles in driving the transformation.

“I look at younger people who are very comfortable with technology, such as with using and developing apps and that offers a lot of opportunities as fintech changes and becomes more sophisticated.”

“For younger women, unfortunately, opportunities will not be served up on a plate and they will often come wrapped in challenges.”

Annie says that from her own experience, she sees young women coming into financial services who tend to regularly move jobs, and she wonders if they are moving to improve their own personal circumstances but losing out

on the career prospects that might come with persevering in the organisation where they are.

However, she says that ultimately, the power for career advancement rests with women themselves.

“Take the time to evaluate yourself, be prepared to adapt and grow and move forward. Don’t be discouraged, opportunities are there,” says Annie.

“You can continue with your education, learn more, take more responsibilities, make sure to ask for them, this is where the avenue will open for you.”

“And take the challenges, even if they feel intimidating, as a woman, often in a male- dominated place, you have to take them when they appear.”

Chinwe Uzoho

General Manager, West and Central Africa at Network International Payment Services

“When I go to meetings, I like to takethe seat at the front, I like to be heard.”

Based in Lagos, Nigeria, Chinwe Uzoho has an extensive background in retail banking, product development, research and innovation.

Now in a senior leadership position with Network International Payment Services, Chinwe says she has seen the opportunities for women increase greatly in the Fintech sector since she began her own career.

“Honestly, there are a lot of opportunities for women in Fintech today,” says Chinwe.

“Fintechs should stop gender stereotyped jobs, they should start creating openings for young female graduates by appointing more female analysts/coders/developers/product owners etc in the organisation.”

“Women can - and should - play bigger roles because organisations are beginning to realise that they need more women on board.”

“When I started my career over 25 years ago, there was the natural barrier of being a woman, and how to stay relevant and visible especially at the management level where I can speak up without being misunderstood. The performance pressure and trying to prove I am capable and qualified for that next promotion.”

“But the most important thing, is that if you know your worth, and you are competent, you can always compete. This is what gives you the confidence to compete.”

Chinwe believes that as more women occupy strategic positions in the financial services sector, organisations will increasingly recognise and value their contributions.

But she believes that women must have the confidence and courage to “speak up and make sure our voices are heard.”

“Women drive innovation, women are more productive, women have to work harder to prove ourselves and make ourselves heard.”

“Yes, it can still be a male-dominated world, but guess what? Men are always happy to have women there, because they know we will always bring our A-game. We have to.”

“And when you speak with confidence, when you offer insights and solutions, when you know your worth, they will listen to you. Don’t be intimidated, be are assertive, competent and know your professional worth.”

Chinwe says if there is one piece of advice she could offer young women looking to a career in banking and Fintech, it would be to make sure they do not settle for being in the background. In addition, female leaders should also inspire the young ones by establishing the right forum to train and mentor them, so that they can stay positive and build on their strengths without being intimated.”

“Unfortunately we can tend to shy away, we can take the back seat,” she says.

“When I go for meetings, I take the front seat, I like to be heard.”

Ana Nedeljkovic

Vice President, Customer Relationships at CR2

“When people come together from different backgrounds and cultures, you challenge each other in the most positive way, it brings innovation, energy, it brings change.”

Based in Dubai and working for CR2, a leading innovator and vendor in the Digital Banking Platform market, Ana Nedeljkovic believes “diversity” and “equality” should not be seen as worthy box-ticking exercises but as cornerstones for success.

Ana studied Law and Languages before doing an MBA, before taking a job with a major commerce and payment processing company in her native Belgrade in 2002.

That led to a career that has since brought her to Dubai, where she works in customer relationships.

Ana says she finds great personal fulfillment from her work, building relationships, seeing how digital banking is helping to transform and empower communities that may have previously been underserved or even locked out of the vital services many of us take for granted.

And she believes that the barriers that women may have encountered in Fintech and the wider sector have been steadily coming down.

“As women, we are definitely as equally educated as men are today,” she says.

“Collaborative thinking and working together with our male colleagues can bring different perspectives and approaches on how businesses should be led.”

“I am pro-diversity and equality, but not just for the sake of it. I definitely want to see women in top positions, because they have the skills and the talent to be there and they can bring so much to organisations.”

“Diversity is important and not only gender diversity.”

“What’s needed are people with different mindsets, different backgrounds, different perspectives, from all types of cultures.”

“When you are in one homogenous environment, then you start to think like everybody else.”

“When people come together from different backgrounds and cultures, you challenge each other in the most positive way, you will have contrasting opinions and insights, it brings innovation, energy, it brings change.”

Ana says that in the past, the stereotype of women as ‘just’ mothers, who will need time off to look after the kids, who will not be able to focus on their work, may have held women back. But this is changing.

“We know you can achieve that work/life balance, family responsibilities are shared now, and mothers naturally have to have focus and take responsibility,” she says.

Ana believes that organisations in her sector, and increasingly in the wider world, are realising that a true meritocracy, where people are judged fairly on their talents, their skills and their work ethic, is the way forward.

PUBLISHED ON

Mar 28,2022 [ VOL

22 , NO

1144]

View From Arada | Oct 14,2023

Obituary | Apr 27,2025

Life Matters | Nov 23,2019

Sunday with Eden | Jun 12,2021

View From Arada | Oct 18,2025

In-Picture | May 11,2025

View From Arada | May 14,2022

My Opinion | Aug 28,2021

Featured | Sep 07,2025

View From Arada | Jan 27,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...