Fortune News | Mar 27,2021

Foreign suppliers may have been uninterested in supplying the Ethiopian cotton market, but this did little to dissuade a federal agency from pushing further. The Ethiopian Industrial Inputs Development Enterprise (EIIDE) has dispatched invitations to suppliers last week, stating its interest to buy 10,000tn of cotton.

The move comes following a failed attempt to buy the same volume last month. The Enterprise had wanted to buy 4,000tn of low- and high-quality and 6,000tn of medium-quality cotton. Although 15 suppliers bought the bid documents, only one showed up on January 25, 2022. It was forced to comply with public procurement laws, which proscribe public bids retendered when a single bidder appears.

Officials of the Enterprise have decided to give it another go, inviting 30 suppliers for a rebid scheduled to be opened at the end of March. Half these companies are those that bought the bid documents last month. Others were selected from a list of potential suppliers in a catalogue prepared by the Ethiopian Textile Industry Development Institute (ETIDI).

"If we're unable to procure [through the bid], the Enterprise will resort to direct procurement,” Endeshaw Legesse, director of industrial inputs procurement at the Enterprise, told Fortune.

Endeshaw attributes the lack of interest from suppliers to fluctuations in international cotton prices.

"They can't predict prices for the coming months," he said. "They aren't enthusiastic."

The cotton is to be distributed to 15 large textile industries and one wool factory after the Institute found a supply gap of 16,000tn. The textile industry requires an average of 55,000tns annually. Domestic production is expected to fulfil only 60pc of the demand this year, disclosed Mesele Mekuria, deputy head of the Institute.

The industry comprises 200 medium and large garment and textile factories and 3,000 small and micro-enterprises. The Institute has allowed six textile factories to import cotton for the last four years, giving them the nod to buy what they demand from overseas markets.

Bahir Dar Textile Factory is the largest of these textile plants, with the capacity to process 30,000tn of cotton a year. It sources cotton from commercial farms in the north and central Gonder areas of the Amhara Regional State but has struggled with shortages lately. Due to the shortfall, its plant was shut down for over a month, keeping 1,300 employees on its payroll. Established in 1961, the factory can produce 82,000sqm of fabric and 10,000 pairs of bed sheets a day. It uses 40pc of its capacity.

“The factory is unable to import on its own due to forex shortages,” said Mengistu Aregaw, chief executive officer (CEO).

Federal government officials consider the textile industry a priority sector in the country's industrial policy. Although Ethiopia has comparative advantages in terms of low labour costs, cheap inputs, and proximity to international markets, the textile sector has yet to realise its full potential. The federal government targeted to generate one billion dollars from textile exports by the end of 2015/16, but performances have fallen far short of the expectations. Last year, textiles generated 130 million dollars in export revenues.

A major hurdle is the lack of cotton, the most widely used raw material among garment and textile factories. Despite the availability of roughly three million hectares of suitable land, less than 100,000hct is cultivated annually.

Abera Rechi (PhD), an associate professor and director of the Ethiopian Institute of Textile & Fashion Technology under Bahir Dar University, worries that without creating strong integration in the cotton value chain, it will be difficult for both growers and textile factories to survive.

“Creating backward- and-forward linkages in the supply chain is essential," he said.

Abera believes encouraging such relationships would increase supply from cotton growers. The cotton supply gap has been created mainly due to security issues in Afar Regional State, the country's principal cotton-growing area. Cotton plantations in the region account for 80pc of domestic supply. Floods damaged part of the harvest two years ago, and the civil war in the north has cast a grim shadow on growers in the region for over a year now.

Farmland covered by cotton shrank 60pc to 40,000hct over the past five years, according to Melaku Telake, head of the Ethiopian Cotton Producers, Ginners & Exporters Association. Over the last few years, he saw cotton growers shift to sesame production due to the high cost of production, declining demand and lower revenues associated with cotton.

“Cotton production is laborious while there's a large market for sesame,” he said. “The shortfall in pesticides brought on by forex shortages has also exacerbated the situation.”

Security issues in Gambella and Benishangul-Gumuz regional states, other lowland regions where cotton grows, share the blame for falling productivity.

Mengistu, the CEO, says intermediaries are also an issue.

"They create artificial shortages," he told Fortune. "They hoard."

PUBLISHED ON

Feb 19,2022 [ VOL

22 , NO

1138]

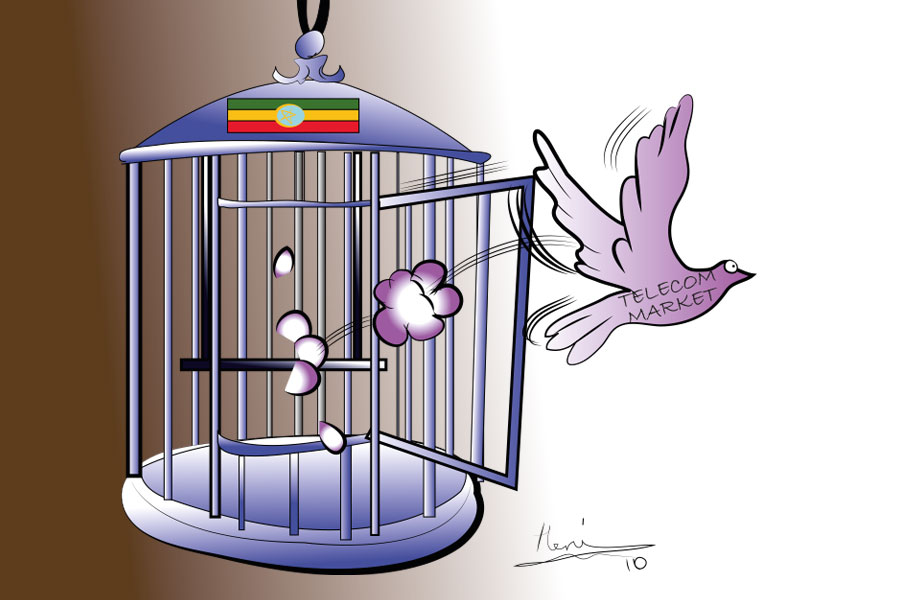

Fortune News | Mar 27,2021

Radar | Sep 10,2021

Featured | Sep 23,2023

Editorial | May 29,2021

Films Review | Oct 16,2021

Agenda | Apr 02,2022

Agenda | Oct 17,2021

Life Matters | Oct 23,2021

Radar | Jul 25,2020

Verbatim | Dec 19,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...