My Opinion | Jan 30,2022

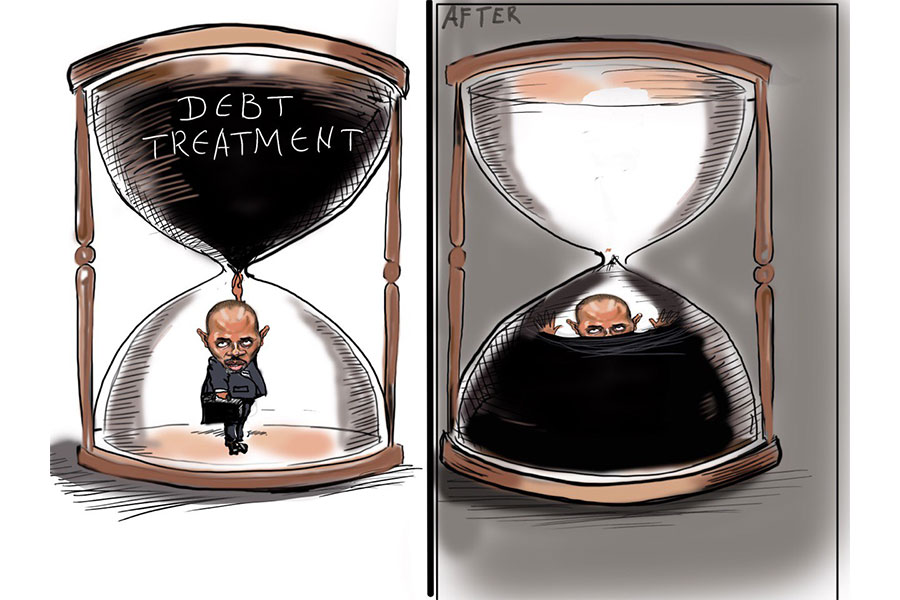

The Ethiopian Sugar Corporation (ESC) has placed loan applications with the state-owned Commercial Bank of Ethiopia (CBE) for 11.3 billion Br for rehabilitation works and servicing debts.

Nearly half of the loan amount (five billion Birr) is earmarked for servicing external debt, while a little over one billion Birr is for domestic debt obligations. If approved, the loan will be lumped into the Corporation's total debt of 70 billion Br registered early this year. The Liability & Asset Management Corporation (LAMC), established this year with a capital of 570 billion Br, has absorbed half of these debts.

The CBE has long served as a primary credit source for public megaprojects and state-owned enterprises (SOEs). The aggregate outstanding domestic debt of public enterprises reached 611 billion Br in loans and corporate bonds; the highest share is owed to the CBE.

According to a report from the Ministry of Finance, of loans disbursed in the past five years from external sources, seven percent has gone to the industrial sector, with the Sugar Corporation being a major recipient. However, LAMC has yet to settle the Sugar Corporation's balance, awaiting proceeds from privatisation and liberalisation activities.

Muluneh Aboye, vice president of credit management at the CBE, confirmed the Bank has received the loan request, but "nothing has yet been disbursed."

The Sugar Corporation was established as a state-owned enterprise in 2010 to develop sugar estates and production, including for the export markets. Nonetheless, it has faced operational difficulties in recent years, leading to consecutive losses. Many of the 10 plants under construction have yet to be completed upon schedule, including four sugar plants in Omo Kuraz of the Southern Regional State.

Several of the Corporation's projects have faltered in the past, and production remains below capacity. Zinabu Yirga, head of the Public Enterprise Holding & Administration, attributes this to a lack of rigorous feasibility studies and poor project management. He is bullish that the Corporation will address its mishaps.

"We've undertaken extensive reform works," said Zinabu. "It's one of the enterprises that promises to be profitable."

Part of the loan (3.36 billion Br) is earmarked to finance the completion of the plants under construction. Another 1.4 billion Br is expected to go into rehabilitation and annual maintenance works of eight sugar factories in operation. These factories have a combined production capacity of nearly four million tonnes a year.

Over the first quarter of this fiscal year, the Corporation sold over 50,000tn of sugar, generating 1.14 billion Br in revenues.

A few of the plants under operation have been undergoing maintenance since the rainy season and are expected to commence production in two months. Tana Beles Sugar Factory, built by China CAMC Engineering, carried out test production after its commissioning in June. It is scheduled to begin production this month, according to the Corporation's communications bureau.

There are five plants whose delays in starting operations keep the country importing sugar to meet a gap of 300,000tn a year. The domestic demand for sugar nears 700,000tn. Last week, the Ministry of Trade announced that two million quintals of sugar are in the process of imports.

The sugar estates that were heralded as answers to the deficit in supply and produce a surplus for the export markets have faltered and wallowed in debt. Eight of these are slated for privatisation. In July, Ernst & Young was hired as a transaction advisor after offering its services for 3.3 million dollars. The consultant has produced a transaction roadmap and is to conduct fieldwork to assess the factories, asset valuation and financial due diligence, Zinabu disclosed.

"We expect to finalise and float the tender within a year," he told Fortune.

Welkayit Sugar Factory, located over 1,000Km away from the capital in Tigray Regional State, is among those slated for privatisation. However, its fate remains uncertain as conflict continues to rage in the country's north.

PUBLISHED ON

[ VOL

, NO

]

My Opinion | Jan 30,2022

Editorial | Jul 17,2022

Radar | Dec 07,2019

Radar | Sep 02,2023

Fortune News | Dec 04,2022

Fortune News | May 08,2021

Commentaries | Sep 28,2024

Fortune News | Jun 25,2022

Commentaries | Sep 03,2022

Radar | Aug 21,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...