Commentaries | Jul 27,2024

May 8 , 2021

By Eyob Tesfaye (PhD) , Eliamringi Leonard Mandari,

An amended National Bank of Ethiopia (NBE) directive increases permissible forex holdings by 15pc and eases restrictions on use. It is the right step to encourage inbound forex flows through the banking sector, write Eyob Tesfaye (PhD) and Elia Mandari, consultant at the UNCDF, which provides advisory services to the central bank.

Like other developing countries, Ethiopia has a vested interest in keeping as much remittance volume as possible flowing into the country despite the pandemic-related lockdowns that have reduced wages for Ethiopian migrants working abroad. Ethiopia, one of more than 30 member states which to date have signed on to the UK/Swiss-led Call to Action, has also undertaken a series of recent moves aimed at shifting more of its inbound remittances out of the unregulated informal channels, which distort the nation’s balance of payments data, and into the formal banking sector.

The latest of these moves, an amended directive titled, "The Retention and Utilisation of Export Earnings and Inward Remittances Directive," took effect on March 9, 2021. Along with attempting to dent the illegal foreign-currency market, the directive seeks to accelerate the use of formal banking services among remittance-receiving Ethiopian families.

Foreign currency reserves are an important element of any country’s monetary system. For Ethiopia, two major sources of foreign currency include the import and export sector and the remittances sent back to the country by the estimated three million Ethiopians living abroad. Regardless of origin, all in-bound foreign currency flows are subject to a 30pc surrender requirement: each financial institution in the country must sell nearly a third of all the foreign currency it receives to the central bank at the formally set foreign exchange (forex) interbank rate for the currency in question.

Under the previous directive, exporters and remittance recipients were required to open two separate retention accounts. One was for retention of 30pc of the remaining post-surrender forex inflows for an indefinite period, and a second account for the retention of the remaining amount post-surrender balance which was required to be converted into Birr within 28 days. Thus, only 21 dollars out of every hundred (30pc of 70pc) received as foreign currency could be held in that currency longer than 28 days.

The prior directive, which came into effect in 2020, had also limited import utilisation of the retained forex balances to a list of priority items. These included agricultural and manufacturing inputs, pharmaceuticals and medical devices, nutrition for babies, education materials, chemicals and some other basic goods. The general intent was to curtail foreign currency hoarding and black-market trading and direct precious forex resources towards socially useful commodities rather than high-end cars and other consumer luxury goods. The latter is often the focus for the elite most likely to access meaningful amounts of foreign currency.

The new directive removes the requirement of opening two separate bank accounts to retain the forex inflows remaining after the 30pc surrender. Exporters - and also, crucially, recipients of in-bound remittances - now have the right to retain up to 45pc of the forex balances after deduction of the 30pc surrender requirement.

The remaining 55pc (of the post-surrender 70pc) shall have to be converted immediately by the receiving bank into Birr at market rate and held as local currency by the recipient. Along with being 15 percentage points higher than the previous 30pc cap, the new 45pc retained forex balance can now also be utilised for import without restriction, provided that the account holder has the necessary business license.

Account-holders may also, at their discretion, sell all or part of their remaining forex balances at a freely negotiated rate not exceeding the prevailing foreign currency selling exchange rate. This policy aimed to discourage the parallel black market in forex trading, which currently has a significant gap compared to the legal market in terms of exchange rates offered.

The problems that the new directive seeks to address are complex and deeply entrenched. Solving them will require both a sense of urgency and some patience - and may also require a series of tougher measures over time. But the new directive's simplified account-holding requirements, the increased retention limits, and the relaxed restrictions on permissible goods for importation are all among possible ways to encourage inbound forex flows through the banking sector. It provides another incentive for migrants to use the formal banking channels and is another crucial step towards necessary reforms.

PUBLISHED ON

May 08,2021 [ VOL

22 , NO

1097]

Commentaries | Jul 27,2024

Fineline | Dec 10,2018

Fortune News | Dec 13,2021

Advertorials | Sep 13,2021

Commentaries | Oct 26,2019

Editorial | Mar 19,2022

Fortune News | Feb 03,2024

Fortune News | Oct 01,2022

Featured | Dec 28,2019

Viewpoints | Jun 22,2019

Photo Gallery | 156533 Views | May 06,2019

Photo Gallery | 146818 Views | Apr 26,2019

Photo Gallery | 135351 Views | Oct 06,2021

My Opinion | 135249 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

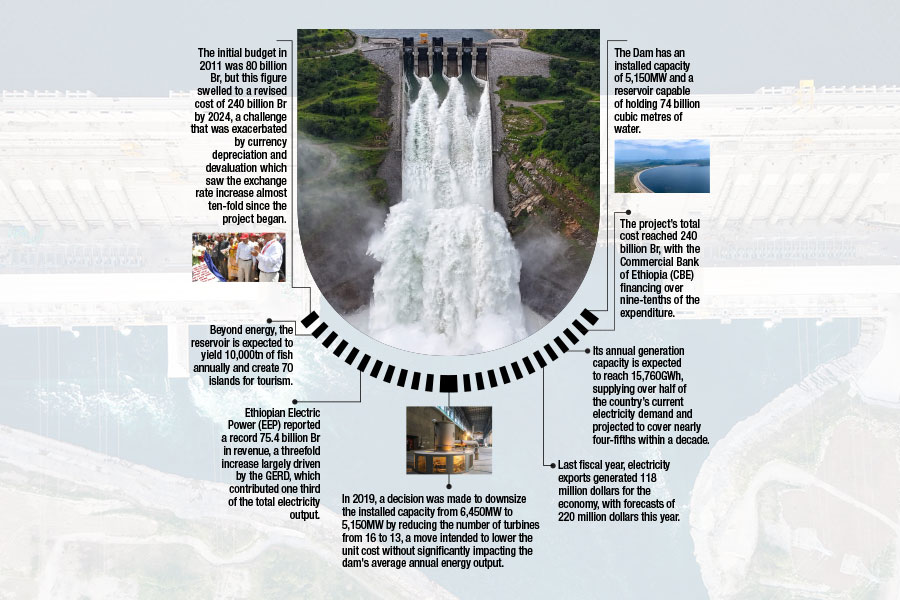

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...