Fortune News | Mar 30,2019

Mar 27 , 2021.

In an unprecedented turn of irony, just as Ethiopia began an attempt to open up to the world economy, there is a likelihood that it could be stopped at the gates. As a series of condemnations by Western governments, international human rights advocates, and the global media against Prime Minister Abiy Ahmed’s (PhD) administration have arrived over the war in Tigray Regional State, the Ministry of Transport held a two-day summit at the Skylight Hotel welcoming investments in the transport sector.

The summit was a call for engagement by the private sector – both domestic and international – into areas that have been previously closed to it: from port-to-port development and railway operations to domestic air transport with no seat limits. It is a change in policy overdue for an economy facing obstacles from a logistics and transport sector choked by weak infrastructure, inefficiency and lack of competition. Unfortunately, it would have been an easier sell if Ethiopia was more identified with rapid economic growth, as it once was, instead of civil war, intercommunal conflicts and gross human rights abuses.

It could also mean that the country could lose out on the improving circumstances of the global economy.

Last year was nearly a universally bad period for the world after a global pandemic, the Novel Coronavirus (COVID-19), struck, leading to an economic recession. The initial shock and uncertainty have subsided but with several bumps along the way. Scientists developed a vaccine in record time. But just as it has begun to be administered, a new variant has struck, and cases have shown a sharp uptick from Brazil to Ethiopia.

Despite this, there is a reason to suspect that the global economy may be making a comeback faster than expected, potentially helping to lift countries like Ethiopia with it. Much of this has to do with how well the world’s two biggest economies – China and the United States - are expected to perform.

One of the few countries to have expanded its GDP last year, China has bounced back to beat expectations. With COVID-19 behind it, almost – new daily cases have mostly been in double-digits for about a year now – industrial output and exports have shown strong growth in the first two months of this year. Its economy is expected to rebound by 8.1pc this year, according to the International Monetary Fund (IMF). This should spell good fortune for the rest of the world.

The other promising news is half a world away in the United States. Despite having the highest number of deaths from this pandemic, cases have significantly declined from their highs in January 2021. It has also vaccinated over a quarter of its population, with a whopping average of two million doses being administered every day. This strongly suggests economic normalisation and the phasing out of lockdowns.

Of equal consequence to the world economy would be a fiscal stimulus in the United States amounting to 1.9 trillion dollars. This has led to the revision of most growth estimates made at the beginning of the year. The trade, investment and development wing of the United Nations (UNCTAD) revised US GDP growth up to 4.7pc. The Organisation for Economic Cooperation & Development (OECD) was even more bullish, revising its previous estimates in December by over a percentage point to 5.6pc, owing mainly to vaccine rollouts and the US stimulus.

Even with these pieces of good news, the global economy will likely not return this year to its pre-pandemic levels. But the turnaround in the circumstances for the world economy has consequences to which Ethiopia’s policymakers should pay close attention.

Of major importance is how the value of the dollar will fluctuate. Any government with a fiscal response amounting to 27pc of GDP – the combined amount of stimulus packages under both the Trump and Biden administrations – should expect a weak dollar. But the United States has an independent central bank – the Federal Reserve – likely to fight such inflation by raising interest rates. Counter-intuitively, investors are betting the dollar will be stronger going forward. They are not wrong, at least not yet, with the dollar strengthening starting in January.

All things being equal, for Ethiopia this should mean higher remittance and tourism flows, which together usually cover over a third of import bills. A stronger dollar will also give Ethiopian exports to one of its top destinations an edge as the Birr’s value declines comparatively.

There is bad news though, especially where dollar-denominated debts are concerned. Government and government-guaranteed external debts stand at 25 billion dollars, nearly a quarter of GDP. This does not include around 3.3 billion dollars of debt from state-owned enterprises (SOEs). The increasing debt stress has led the likes of Fitch to downgrade credit ratings already. Add to this a rising import bill for essentials such as fuel and wheat, and the stress on foreign currency reserves could cancel out the lift an improving global economy could have provided.

Abiy’s administration has not failed to see how the COVID-19 pandemic could disproportionately affect low-income countries. In an Op-Ed piece, the Prime Minister has argued for debt relief and an increase in the issuance of special drawing rights (SDRs). On the former, at least G20 countries have agreed on a limited debt service suspension, of which Ethiopia has already taken advantage.

Navigating out of these treacherous waters requires insight from policymakers to take advantage of the improving set of circumstances in the world economy and fend off the possibility of downward pressure on foreign currency reserves. The latter is just as much a political issue as it is an economic one.

The start of a war in the Tigray region last November has increasingly put the administration at odds with its traditional development partners. There should be no surprises here. Trying to resolve a problem of inherently political nature through the deployment of sheer force inevitably has consequences. They are knocking at the doors now.

The largest bilateral contributor of humanitarian aid at close to one billion dollars anually, the United States has raised concerns over what it considers an act of ethnic cleansing in the north. The European Union (EU), for its part, suspended budget support amounting to 107 million dollars last December, while its President has stressed that all foreign policy tools are on the table. He may mean imposing sanctions on institutions and individuals is not unthinkable if what the EU imposed on Eritrea last week serves as a signal.

More concerning could be the IMF and the World Bank's response, both of which are influenced greatly by the US and the EU over human rights abuses. Both have provided billions of dollars in development assistance over the decades. The IMF alone is in the middle of executing a 2.9-billion-dollar financing package to help Ethiopia’s economic reform. The World Bank, which has made over a billion dollars in commitments this year, has programmes in sectors ranging from agriculture to digitisation. Here too, leaders of both institutions are bracing themselves to be vocal against atrocities committed in Ethiopia in their respective engagements with Ethiopian authorities.

This web of engagements and responsibilities has been necessary for Ethiopia’s economic development, no less in responding to humanitarian crises. Losing these could mean the country also not getting a piece of a global economy expected to liberate itself from the burden of a pandemic's yoke.

Bowing to the international community's demands because it has a much bigger purse could be viewed as sacrificing national sovereignty. But the administration ought to remember that exhausting every effort to have cessation of hostilities in Tigray is not just good for the economy or merely a face-saving effort. It is also the right thing to do for a country whose people have gone through half a decade of unabated political instability and are starved for – and, indeed, deserve – certainty and normalcy.

PUBLISHED ON

Mar 27,2021 [ VOL

21 , NO

1091]

Fortune News | Mar 30,2019

Fortune News | Mar 16,2020

Fortune News | Nov 04,2020

Viewpoints | Apr 17,2021

Commentaries | Mar 20,2021

Viewpoints | Sep 23,2023

Radar | Apr 12,2020

Commentaries | Jan 09,2021

Viewpoints | Jun 01,2024

Radar | Aug 01,2020

Photo Gallery | 156852 Views | May 06,2019

Photo Gallery | 147144 Views | Apr 26,2019

Photo Gallery | 135707 Views | Oct 06,2021

My Opinion | 135283 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 15 , 2025 . By AMANUEL BEKELE

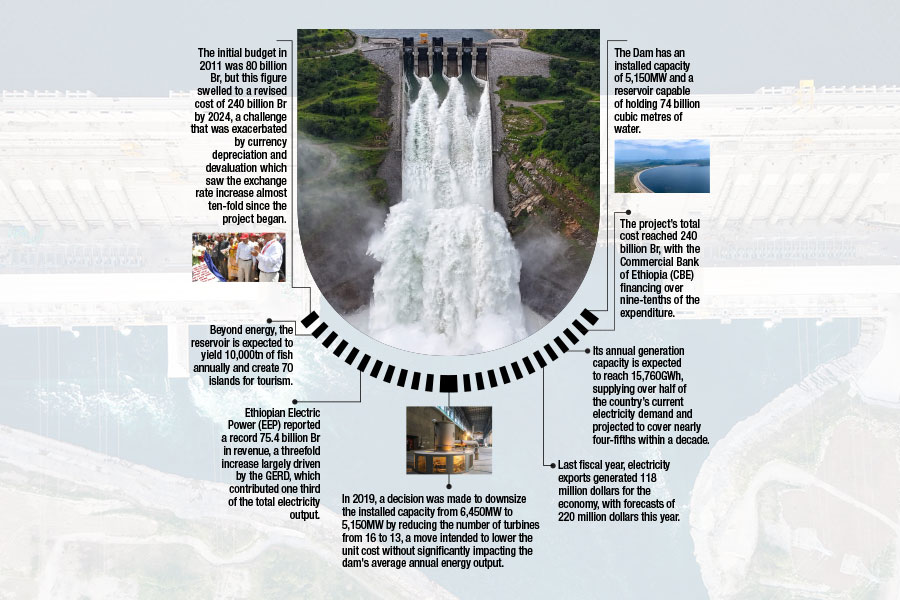

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...