Fortune News | Jul 13,2019

Mar 21 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

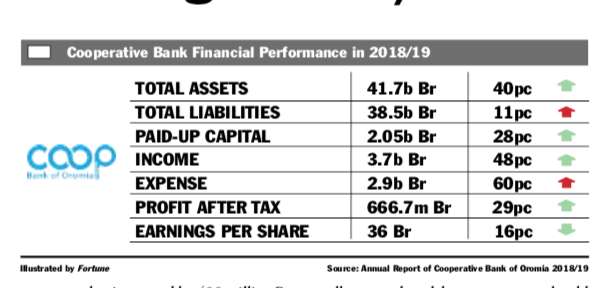

In the reporting period, the Bank netted 666.7 million Br in profit a 29pc increase from the preceding year.

In the reporting period, the Bank netted 666.7 million Br in profit a 29pc increase from the preceding year. Cooperative Bank of Oromia, the 15-year-old bank, registered considerable profit growth in the last fiscal year, yet earnings per share (EPS) slid slightly.

In the reporting period, the Bank netted 666.7 million Br in profit a 29pc increase from the preceding year. However, its earning per share (EPS) fell by six Birr to 36 Br, a level that is quite similar to what it was in 2017. A massive injection of fresh capital caused the reduction in EPS.

Last year the Bank's paid-up capital grew by 28pc to 2.1 billion Br. Two years ago, shareholders of the Bank had decided to triple the paid-up capital of the Bank to three billion Birr.

The Bank performed well in a year that presented both positive opportunities and challenges at global, national and also the industry level, according to Fikru Deksisa (PhD), board chairperson of the Bank.

Several factors contributed to the improved profit performance. The considerable increase in total revenue is the primary factor for the remarkable profit performance, according to Abdulmenan Mohammed, a financial analyst based in London, the United Kingdom.

The five-year plan that was rolled out two years ago and revised last year has helped the Bank to register a strong performance, according to Deribie Asfaw, president of the Bank.

The Bank’s interest income soared by 52pc to 2.8 billion Br, fees and commissions surged by 54pc to 544.9 million Br and gains on foreign exchange increased by 18pc to 242.5 million Br.

"The surge in all revenue items is very impressive," said Abdulmenan.

A considerable expansion in expenses was accompanied by increased income. Interest expenses soared by 67pc to just above one billion Br, salaries and benefits increased by 37pc to 959.03 million Br, and other operating expenses exploded by 65pc to 923.3 million Br.

"The expansion of expenses at Coop Bank is concerning," comments Abdulmenan, "So the management should closely monitor expenses."

In the last fiscal year, the Bank opened 91 branches and recruited over 860 new permanent employees, leading general and operational expenses to increase by over 340 million Br and salary and benefits also increased to over 260 million Br. Interest expenses also increased by 400 million Br due to growth in saving deposits.

The Coop Bank has the highest expense-to-income ratio in the industry at 79pc, whereas the private bank average is 70pc.

This shows that Coop-Bank uses resources inefficiently, according to the expert.

"It should come up with a cost rationalisation strategy to keep the expense-to-income ratio at least to the average level," Abdulmenan said.

In the last fiscal year provision for impairment of loans and other assets of the Bank dropped by 31pc to 29 million Br.

“This is a huge reduction," commented Abdulmenan. "This shows that credits are well managed, and the management should keep up this practice."

The Bank has four customer segments, all of which have a relationship management team who followed up on the status of loans and advances, according to Deribie.

"We also have a recovery team who intensively engaged with unhealthy or sick loans and advances for an amicable settlement and legal action,” he adds.

The Bank's total assets increased massively last year. Its total assets increased by 40pc to 41.8 billion Br. Loans and advances similarly went up by 56pc to 23.6 billion Br.

The growth in loans and advances was the major contributor to the significant increase in the total assets of the Bank over the last fiscal year. Additionally, deposit mobilisation contributed to the growth in loans and advances.

Coop Bank mobilised deposits of 36.2 billion Br, an increase of 40pc. The loan-to-deposit ratio increased by six percentage points to 65pc. The improvement in the loan-to-deposit ratio must have been supported by considerable liquid resources brought from the preceding year.

"Further increases in the loan-to-deposit ratio may undermine its liquidity," remarked Abdulmenan.

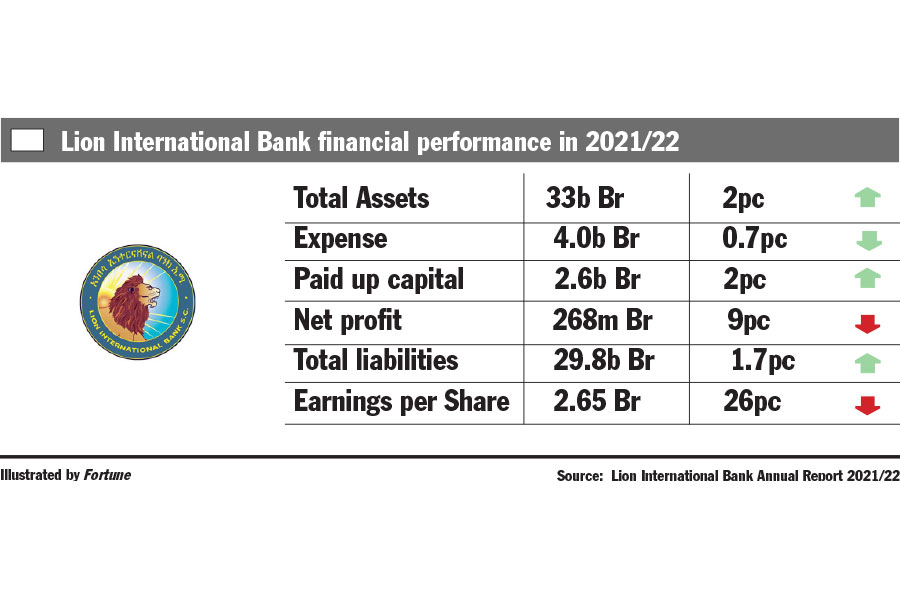

The Bank's investment in NBE bonds increased by 53pc to 8.3 billion Br. This investment represents 20pc of its total assets and 23pc of total deposits of the Bank. Its peer Lion Bank invested 4.2 billion Br in NBE five-year bonds, representing 21pc of the Bank's total assets and 26pc of its total deposits last year.

Liquidity analysis indicates that the liquidity level of Coop-Bank declined in value and relative terms. Cash and bank balances decreased by seven percent to 7.2 billion Br. The ratio of cash and bank balances to total assets went down to 17pc from 25pc and cash and bank balances to total liabilities also decreased to 18.5pc from 27.7pc.

"Even though the liquidity level of the bank declined," said the expert, "it was still at a good level."

The capital adequacy ratio (CAR) of the Bank dropped to 12.5pc from 14.3pc. Even though its CAR is higher than the regulatory requirement, which is eight percent, it is far lower than the industry average of more than 18.5pc.

Oumer Wabe, the general manager of Oromia Coffee Farmers’ Cooperative Union, one of the primary clients and shareholders of the Bank, appreciated the Bank’s performance.

The Bank gives loans to more than 30 farmer unions without collateral via the Oromia Coffee Farmers' Cooperative Union, and these unions generate foreign currency from exports through the Bank, according to Oumer.

Oumer recommends the Bank explore more services to farmers and unions for more significant mutual benefit.

PUBLISHED ON

Mar 21,2020 [ VOL

20 , NO

1038]

Fortune News | Jul 13,2019

Radar | Dec 29,2018

Fortune News | Mar 25,2023

Fortune News | Sep 11,2020

Covid-19 | Mar 31,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...