Radar | Oct 24,2020

The Development Bank of Ethiopia (DBE) is amending its lease-financing policy in the areas of the time of commencement of interest, time of relief, and working capital.

Under revision for two months, a committee led by the Bank's President has been tinkering with rules and procedures governing the provision of capital goods such as machinery and equipment to small and medium enterprises (SMEs). A part of the five-year strategic reform plan that aims to amend the DBE's overall business model, the amendment is awaiting a final nod from its Board of Directors, chaired by Tegegnework Gettu (PhD).

The Bank provides lease-financing services to qualified enterprises in the agriculture, agro-processing, manufacturing, tour, construction and mining sectors. An enterprise has to employ at least six people to be eligible for financing, amounting to anywhere between half a million Birr and 7.5 million Br.

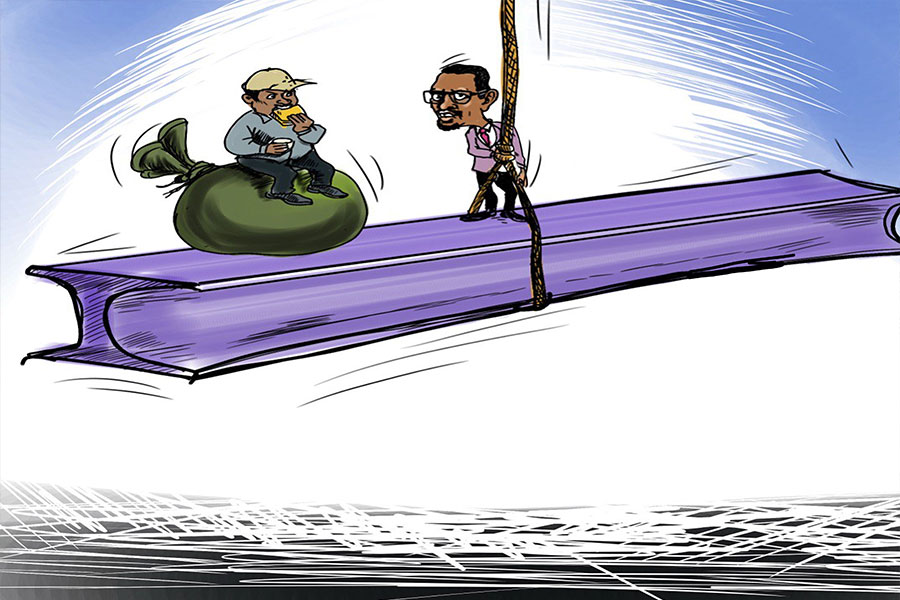

The Bank began providing project-based short, medium and long-term development credit to SMEs in 2016. These were companies in the market identified by DBE's policymakers as the "missing middle." They do not have the capital to provide collateral for loans from commercial banks while at the same time being too large to qualify for access to finance from micro-finance institutions.

Of the 51.1 billion Br in outstanding loans last year, the Bank has mainly provided credit to the manufacturing portfolio (65pc), followed by agriculture (16pc). Over nine billion was earmarked for small and medium enterprises.

However, DBE is known to carry in its book alarmingly high non-performing loans.

The revision was carried out because the formulation of the existing policy and the amendments made to it from time to time did not fulfill the intention of lease financing, Yohannes Ayalew (PhD), president of the DBE, toldFortune.

The previous policy did little except to provide the enterprises with working capital and any necessary machinery and equipment through a hire-purchase modality. The revised policy includes training, mentorship and follow-through.

Under the original policy, the enterprises begin racking up interest upon approval of the lease financing, but the Bank has now revised this so that interest is only factored in once projects have been commenced. Borrowers were previously required to put 20pc of the financing down before receiving the equipment, which often took a very long time, sometimes even years. The revised policy has reversed that and now requires the 20pc to be deposited only after the delivery.

The revision also includes allowing the enterprises to get additional working capital from micro-finance institutions and other banks with lower interest rates once projects have been kicked off.

The issue was not only about the policy but also execution, the President conceded.

The reform was late by a year and a half due to reluctance from management, but Yohannes says the work was completed in the last seven months.

"The policy facilitates the execution, which has to be innovative and modern," he told Fortune.

The Bank has organised training programmes at eight centres across the country, where 2,500 trainees have already taken part and presented plans for financing from the DBE. Attending the training is a prerequisite to receiving the financing and the Bank plans to organise nationwide sessions four times a year, the President disclosed.

"We won’t abandon them after training," Yohannes told Fortune.

Revisiting the policy may be the right move to take, but the main problems exist in the implementation, observes Nurhussein Mohamedali, an official at the Job Creation & Enterprise Development Bureau who works on supporting and monitoring urban agriculture. He sees that the machines and equipment provided do not meet the demand from the enterprises. Although the financing is made available to various sectors, there were practical issues, specifically with the distribution, according to Nurhussien.

"The machines are mostly provided to the manufacturing sector, which pulls other sectors back," said Nurhusein.

He hopes to see the revised policy include a platform for fair distribution.

Nurhusein expressed his misgivings about the amount of capital being availed to the small and medium enterprises.

"The ceiling doesn't consider the economic reality," he told Fortune. "The requirements should be made more flexible."

PUBLISHED ON

[ VOL

, NO

]

Radar | Oct 24,2020

Radar | Feb 02,2019

Fortune News | Nov 29,2020

Radar | Mar 04,2023

Fortune News | May 20,2020

Radar | Oct 24,2020

My Opinion | Jul 30,2022

Fortune News | May 14,2022

Fortune News | Nov 21,2018

Radar | May 14,2022

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...