Fortune News | Nov 02,2019

Jan 22 , 2022

By Christian Tesfaye

Against all the odds, there is little indication that the high-end real estate market is struggling. Recently, I visited the headquarters of a reputable real estate firm. Its projects extend all over the city and with plans to expand even further.

In its plush Bole office, sales reps smile and flatter potential buyers. They show them apartments priced in the hundreds of thousands of dollars (prices are seldom quoted in Birr). But, in several cases, they are not ingratiating themselves in the hopes that the visitor at their office will buy. No, there is no problem selling a house; at least not at the real estate firm I visited. They have bigger ambitions. They want a buyer willing to pay in full, not in instalments. This way, they get their commissions early instead of spread out over several months.

This is probably not surprising for anyone to hear. Turn on a TV, and there are several commercials for real estate companies. Africa Avenue is full of billboards for luxury homes to be built in posh areas of Bole, CMC and Ayat. It seems to be a healthy and thriving market.

But should it be?

The past two years have not been great for Ethiopia’s economy. From the COVID-19 pandemic to political uncertainty, the period has seen investments and economic activity cool down. One would think that the real estate business would follow suit. The construction industry as a whole is in decline; it does not make sense that luxury houses are flying off the shelves.

It is likely that real estate is being buoyed above Ethiopia’s challenging situation with another economic force at work – inflation. The cost of goods and services has witnessed a rise not seen in about a decade. For almost everyone in Ethiopia, this is bad news. Everything is all the more harder to afford.

Neither are households with sizeable savings immune to the developments, though they have enough liquid capital to deal with the problem of a currency losing its value. A household with 10,000 Br in savings has few options but to witness the real value of their net worth decline. A household with 10 million Br in savings can cope better; they can go out and get themselves a brand new house. They do not even have to trouble themselves with renting it out. They can flip the house for a much higher price in two years.

Up-to-date market analysis of the real estate market, like in other sectors, is virtually non-existent. But the real estate market is historically susceptible to a bubble. Are we in one?

We probably are in a speculation-fueled bubble of some sort. The only good news is that, ironically, Ethiopia is not nearly financialised enough for the economy to suffer a hit that cannot be plugged up. At worst, it would be some rich folks on their third property, adventurous financial institutions and a few others at the wrong time in the wrong place licking their wounds.

It is not economically irrational for highly liquid individuals to try and take this route. If nothing else, what we are witnessing is a good example of an economy with high inflationary pressure but minimal investment options. A similar situation can be observed with car importers, whose lots have been consistently full over the past year of mayhem and uncertainty, in an economy starved for foreign currency no less. A large pool of money diverted into barely unproductive and unsustainable parts of the economy while small and medium businesses are starved for funding is telling of how far out of whack the health of the economy is in its current state.

PUBLISHED ON

Jan 22,2022 [ VOL

22 , NO

1134]

Fortune News | Nov 02,2019

Advertorials | Aug 10,2023

Featured | Sep 08,2019

Fortune News | Dec 05,2018

Commentaries | Aug 12,2023

Fortune News | Feb 09,2019

Sunday with Eden | Aug 07,2021

Fortune News | May 13,2023

Fortune News | Aug 28,2021

Viewpoints | May 11,2019

Photo Gallery | 96112 Views | May 06,2019

Photo Gallery | 88381 Views | Apr 26,2019

My Opinion | 66988 Views | Aug 14,2021

Commentaries | 65714 Views | Oct 02,2021

My Opinion | Apr 13,2024

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

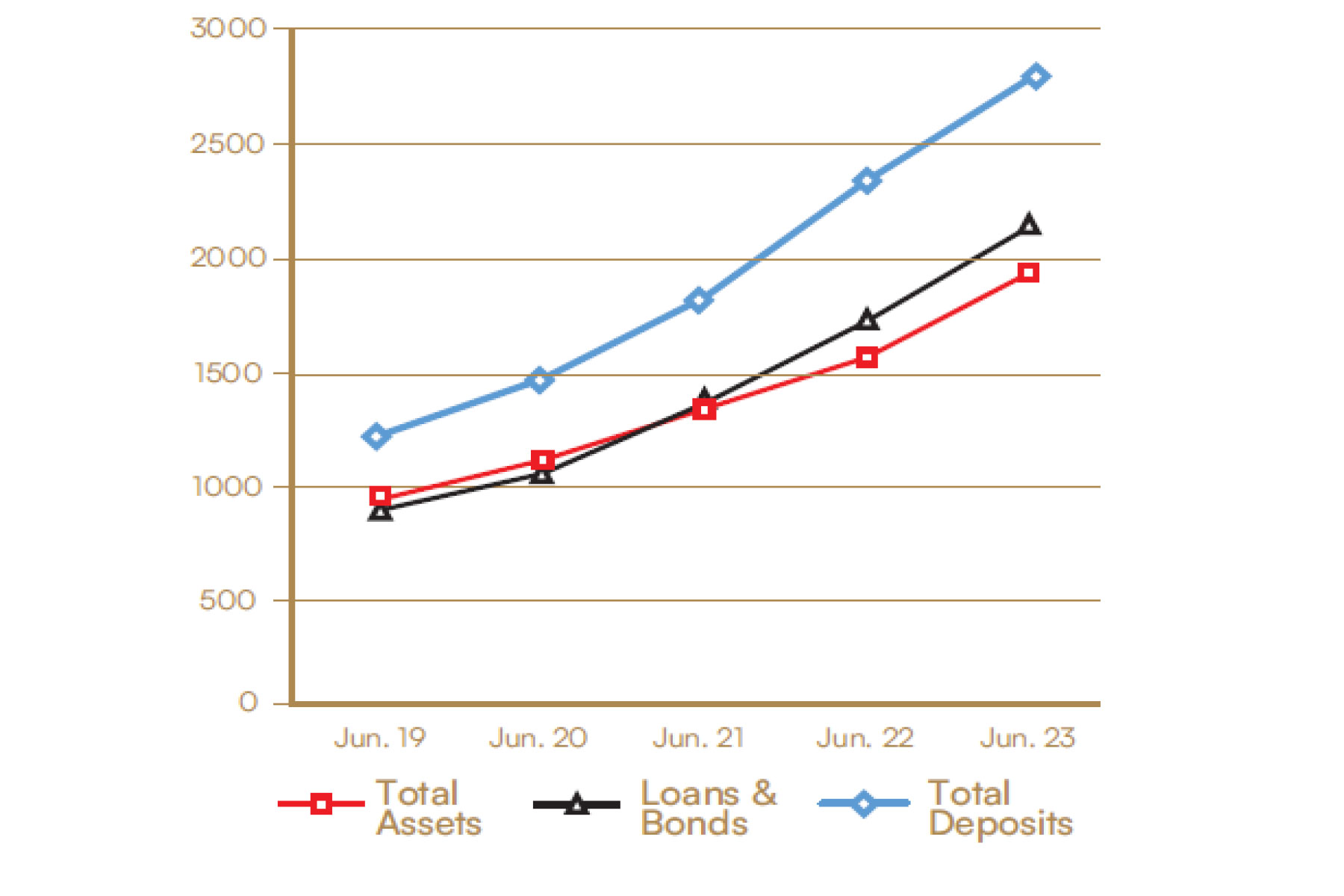

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Mar 23 , 2024

Addis Abeba has been experiencing rapid expansion over the past two decades. While se...

Apr 13 , 2024

A severe financial stranglehold has been imposed on the banking industry, underminin...

Apr 13 , 2024 . By MUNIR SHEMSU

In an unprecedented move, the central bank has published its inaugural stress test report, uncovering potential fault lines within the finan...

Apr 13 , 2024 . By MUNIR SHEMSU

In a bold departure from its historical position on foreign investment, the federal government has opened...

Apr 13 , 2024 . By AKSAH ITALO

A proposed excise tax stamp system draws controversy amongst industry leaders in the alcohol, tobacco, be...