Radar | Jan 31,2021

Jul 13 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

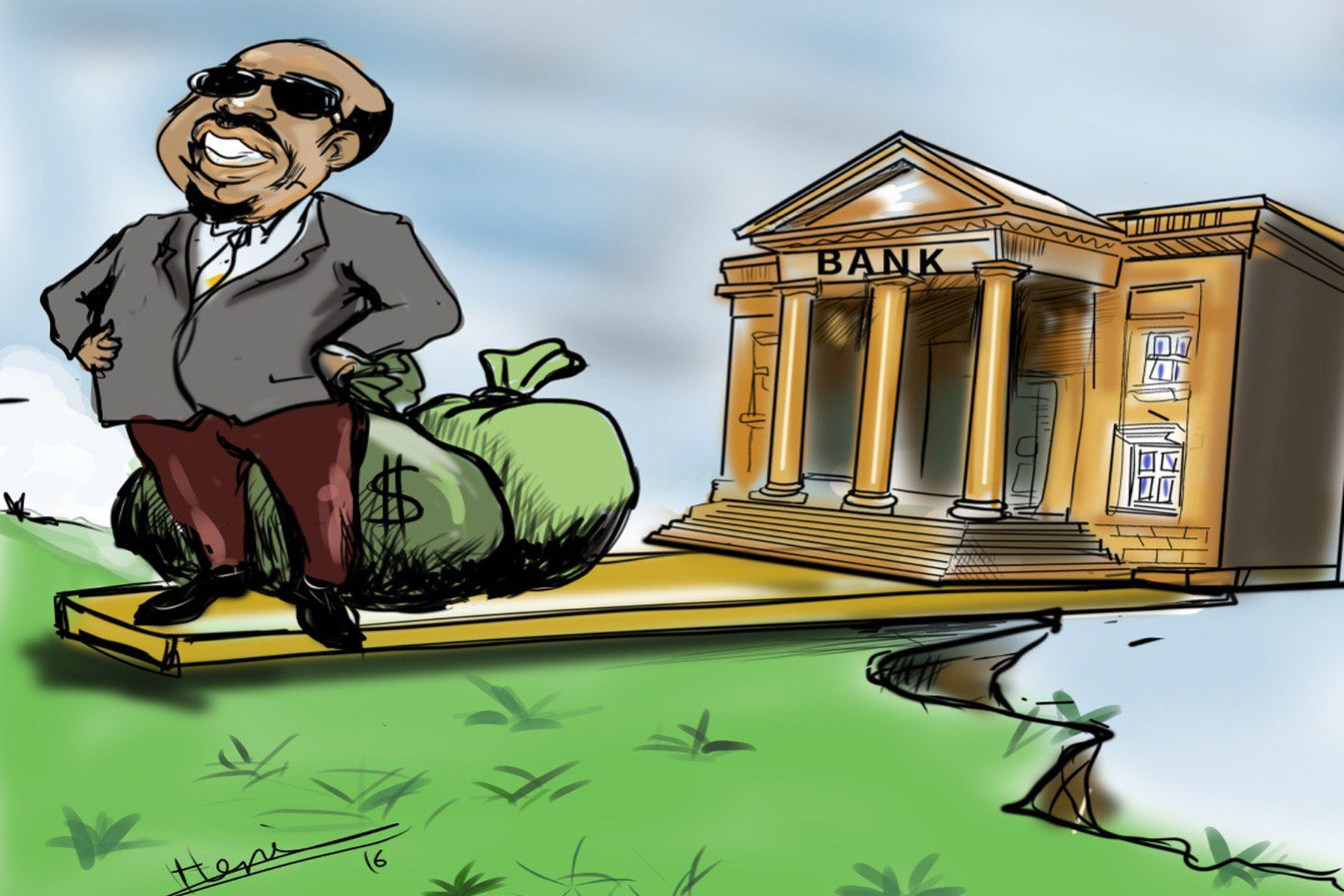

The National Bank of Ethiopia (NBE) has issued the long-awaited directive on the formation of full-fledged interest-free banking (IFB).

The National Bank of Ethiopia (NBE) has issued the long-awaited directive on the formation of full-fledged interest-free banking (IFB). The National Bank of Ethiopia (NBE) has issued the long-awaited directive on the formation of full-fledged interest-free banking (IFB).

Issued on June 18, 2019, the directive was signed by Yinager Dessie (PhD), governor of the central bank, resurrecting a proclamation legislated 11 years ago allowing interest-free banking.

Even though the Banking Business Proclamation was initially enacted in 2008 authorising the establishment of interest-free banking, the directive had restricted operations to a window service alongside other conventional banking.

After the legislation of the proclamation, promoters of ZemZem Bank filed a request with the central bank to form a bank dedicated to Islamic banking. Previously, the issuance of a directive for IFB that restricted it to window service had aborted their initial attempt to establish the bank.

A speech delivered by Prime Minister Abiy Ahmed (PhD) at the end of May this year during an Iftar programme his office hosted at Millennium Hall, showed a ray of hope for those who aspire to form IFBs. In his speech, the Prime Minister expressed his administration’s commitment to allow the formation of Islamic banking.

Within a month after the Prime Minister's promise, the central bank issued the directive that now enables banks to offer exclusive interest-free banking services.

"Interest-free banking has to be promoted for greater financial inclusion," reads the directive.

So far, four share companies have passed the pre-application stage and received permissions from the central bank to open bank accounts and start selling shares. While Zad, Zemzem, Hijira and Nejashi are in the process of formation, two others, Kush and Huda, have initiated a process to organise an interest-free bank.

The opening of financial institutions fully dedicated to Islamic banking in the country will have a significant impact in reaching a segment of the population that remains outside the banking system, according to Munir Hussien, project manager of the under formation Zad Bank S.C, the latest company to receive the under formation status. Started about two and a half months ago with seven promoters, Zad secured a pre-registration license from the central bank last week.

Zad Bank has already identified seven banks to sell shares for public subscription, according to Munir.

"We'll start selling shares beginning this week," he told Fortune.

Zemzem Bank, a pioneer in interest-free banking in the country, has also begun selling shares.

Even though no banks offer full-fledged Islamic banking currently, over half of the commercial banks have been providing it as a side business alongside their conventional banking services. Among the 17 privately and state-owned banks, 11 have secured a license to operate IFBs, and 10 of them have already commenced the service.

Two banks started IFB services as window services in 2013, and most of the banks offer it in three deposit categories: Wadi'a, Qard and Mudarabah.

Bunna International Bank, the latest to secure a license, is in the preparatory stage to kick off the service.

Total deposits collected at the IFB windows of commercial banks stood at over 40 billion Br by the end of May 2019. The resource was mobilised from over three million account holders. These banks have also disbursed close two six billion Birr in loans.

The Commercial Bank of Ethiopia, which is one of the pioneer banks to launch the service, claimed two-thirds of the total deposits, followed by Cooperative Bank of Oromia, Oromia International Bank and Awash Bank.

Acknowledging the bold move of the government in fully opening the service, an expert with knowledge in IFB says that the directive favours new banks that form exclusively to offer IFB service.

"It doesn't have much benefit for the commercial banks, who are already providing IFB window service," said the expert, who requested to remain anonymous.

It could have been good if the directive considered Subsidiary Operating Model [IFB products and services offered by subsidiaries of conventional banks] as an option for banks in the conventional banking business, according to the expert.

The other weakness of the service, the expert cites, is a shortage of skilled professionals in the industry, both at the regulatory level and at operational banks.

Munir shares the expert's opinion of a shortage of human resource of high calibre in banks.

There is a shortage of qualified banking officials in the industry, since the service has a very short existence in the country, according to Munir.

"We're planning to train fresh university graduates to assemble qualified professionals for the IFB industry," said Munir.

The expert also suggests the government relax trade and tax laws to enable the country to utilise the system efficiently.

He argues that IFB has the potential to reduce the debt burden of the country, since there are options that would allow Ethiopia to take an international IFB loan and sell Islamic bonds.

He, additionally, advises the banks that are on the way to organise interest-free banks to join forces and form one robust and efficient bank.

PUBLISHED ON

Jul 13,2019 [ VOL

20 , NO

1002]

Radar | Dec 02,2023

Radar | Aug 05,2023

Fortune News | Jun 04,2022

News Analysis | Nov 25,2023

Fortune News | Feb 09,2019

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...