Radar | Jun 11,2022

As of next month, interested individuals and financial institutions can buy treasury bills from the National Bank of Ethiopia (NBE) through an auction.

The central bank has also decided the market will determine the yield rate of the bill to attract banks and insurance companies. Individuals with cash can also participate in a primary market through auctions.

The latest move of the central bank is introduced as part of the recently launched Homegrown Economic Reform Agenda, which was crafted with the main aim of rebalancing macroeconomic fundamentals and sustaining economic growth. The government has been using T-bills to cover short-term budget deficits, which are also financed through borrowing money from the central bank.

Ahead of launching the market, the Governor of the NBE, Yinager Dessie (PhD), called heads of the financial institutions to a meeting yesterday, November 30, 2019, to brief them on the changes in the T-bill market. In the same week, the central bank gave technical training to two staff members from the treasury department of each bank.

Yinager Dessie (PhD), governor of the NBE.

On behalf of the Ministry of Finance, the central bank issues four types of T-bills with maturities of 28, 91, 182 and 364 days based on the borrowing demand of the Ministry and the liquidity situation as forecasted by the NBE.

Since T-bills were introduced in 1993, the market was entirely dominated by private and public services social security agencies, the Development Bank of Ethiopia (DBE) and other public non-bank institutions.

The average weighted yield of the T-bills stood at 1.42pc, which is far lower than the minimum deposit interest rate in the market, which currently stands at seven percent. This made financial institutions lose their appetite in participating in T-bill auctions. After the introduction of the NBE bill, a mandatory bond that private banks were obliged to purchase, financial institutions entirely withdrew from buying treasury bills.

"Before the introduction of the NBE bill," said Abe Sano, president of Oromia International Bank and president of the Ethiopian Bankers Association, "liquid banks were buying T-bills."

Eight years ago, the central bank issued a directive compelling private banks to purchase the NBE bill using 27pc of their total loans and advances. The resources mobilised from the private banks, with a five percent interest rate, was redirected to the Development Bank of Ethiopia to finance priority areas. However, two weeks ago, the central bank fully lifted this mandatory requirement.

The new approach will help the government to monitor the monetary base, the total amount of notes circulating in the economy, according to Eyob Tesfaye (PhD), a prominent macroeconomist.

"The central bank should be applauded for this decision," said Eyob. "It is a remarkable departure."

Eyob adds that the latest move of the central bank shows the government's commitment to correcting economic mismanagement, implementing prudent monetary and fiscal policy, as well as following fiscal discipline.

To make the market vibrant, Eyob recommends the government control inflation, modernise the payment system, restructure the Commercial Bank of Ethiopia and enhance the technical knowledge at the central bank.

A large amount of money is involved in the T-bill market. In the 2017/18 fiscal year, the government sold 324 billion Br worth of treasury bills out of the offered 286.5 billion Br, and the market was oversubscribed by 6.1pc. By the end of June 30, 2018, the total outstanding T-bills stood at 111.2 billion Br, a 51.8pc increase from the preceding year. Non-bank institutions constitute all of the outstanding treasury bills.

Since it was launched a quarter of a century ago, the treasury bill market was revised three times. Initially, the maturity period was only three months, and the auction was held monthly. Three years later the government added 28-day bills and 182-days bills (six months) and the auction periods were changed to a biweekly basis. Eight years ago, another new Treasury bill type with a maturity period of 364 days (one year) was introduced. Currently, all four types of bills are sold on a weekly basis.

Abe also sees the change as a new business opportunity.

"Now, banks could potentially join the market, since their financial status, which was drained by the NBE-Bill, will recover," said Abe.

PUBLISHED ON

Nov 30,2019 [ VOL

20 , NO

1022]

Radar | Jun 11,2022

Radar | Nov 21,2020

Fortune News | Mar 26,2022

Fortune News | Sep 04,2021

Fortune News | Jan 07,2023

Radar | Oct 30,2021

Radar | May 14,2022

Fortune News | Jan 19,2019

Radar | May 09,2020

Radar | Mar 23,2024

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

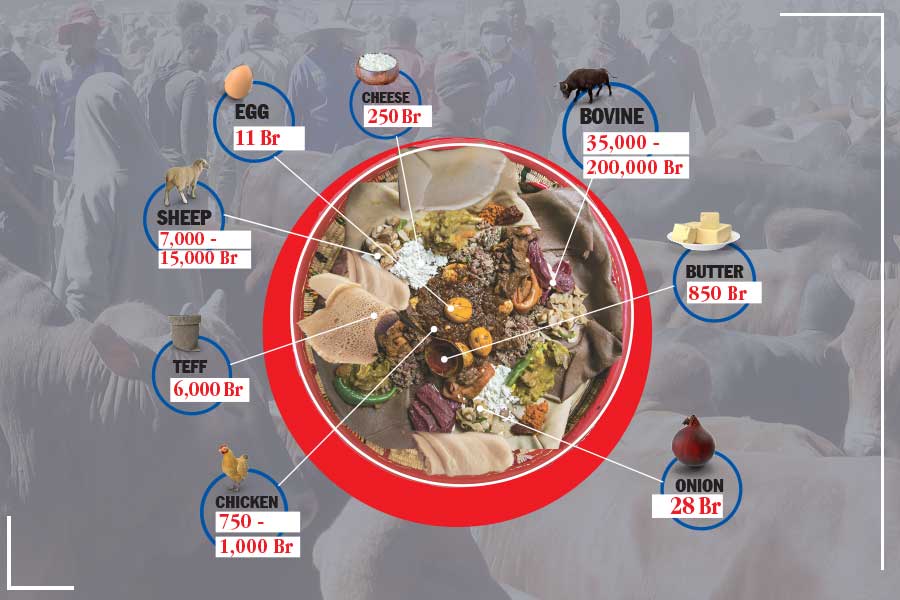

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Mar 23 , 2024

Addis Abeba has been experiencing rapid expansion over the past two decades. While se...