Jan 18 , 2020

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

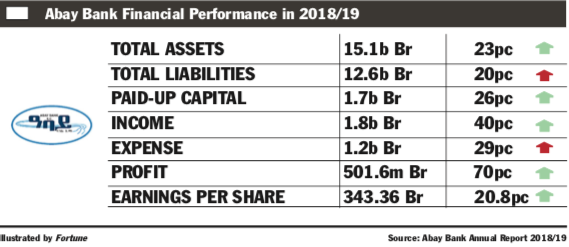

Abay Bank Financial Performance in 2018/19.

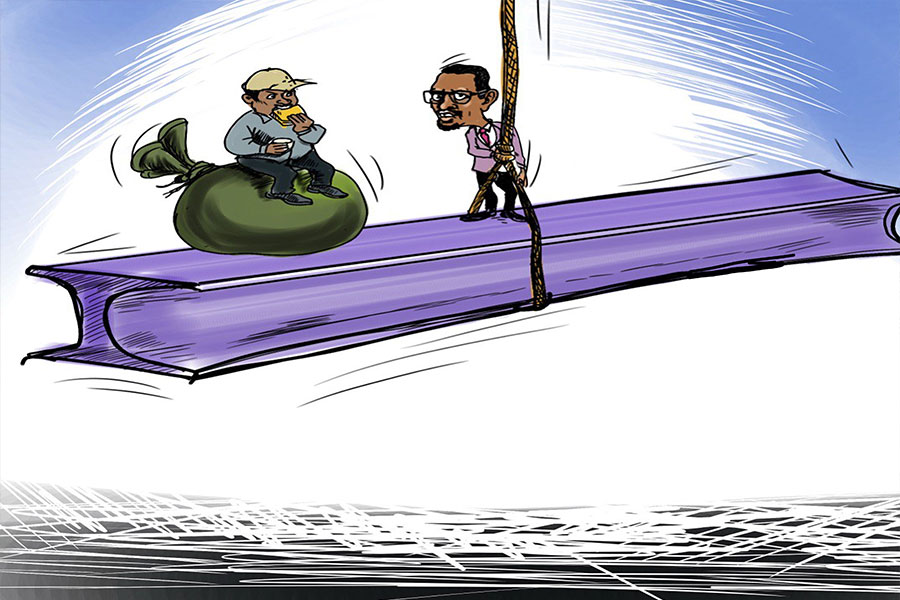

Abay Bank Financial Performance in 2018/19. For the eighth consecutive year, Abay Bank, one of the youngest banks, maintained a positive growth trend, registering a profit three-fold higher than the industry average.

Abay’s profit after taxes shot up by 70pc to 501.6 million Br, while earnings per share (EPS) increased to 343.4 Br from 284.3 Br in the last fiscal year.

Ethiopia Tadesse, the board chairperson of the Bank, noted that the Bank had performed well in both financial and non-financial activities despite the challenging circumstances.

"To enhance its sustained growth," wrote Ethiopia, "the Bank has been involved in various groundbreaking activities."

Identifying top talent, as well as developing and retaining a competent and satisfied staff and management team, were the essential assignments undertaken by the Bank, according to her.

A huge increase in interest, gains on foreign exchange, and service charges and commissions were the contributing factors for the robust performance of the Bank.

Expanding the customer base to 625,000, a 31pc increase from the previous fiscal year, was the primary factor for profitability, according to Belete Dagnew, vice president for Corporate Services at Abay Bank, which opened 30 additional branches, raising the total number to 192.

Interest on loans, advances and NBE bonds reached 1.1 billion Br, a 26pc increase. It also achieved a 41pc rise in service charges and commissions that reached 517.5 million Br.

Abay, who has 4,168 shareholders, was also able to reverse the earlier reduction in foreign exchange earnings. During the period forex earnings soared by 205pc to 181.7 million Br in the last fiscal year.

“Such a level of earnings in a time of severe competition is very commendable,” noted Abdulmenan Mohammed, a financial analyst based in London with close to two decades of experience.

Dedicated customer service and unique treatments designed to attract and retain high-value clients were the major strategies Abay used to increase foreign exchange gains, according to Belete.

Belete also pointed to the speedy loan approval process and approval of letters of credit for its customers engaged in the export business, saying that it helped the Bank improve its forex performance.

All expense items, however, expanded enormously. Deposit interest expenses of the Bank expanded by 31pc to reach 468.7 million Br. Salaries and benefits also went up by 34pc to 349 million Br, with a further increase of 23pc in other operating expenses that reached 268.5 million Br.

Abay's provisions for impairment of loans and other assets showed a 17pc decline to 52.1 million Br.

Even though the provision for loans and other asset impairments declined, Abay still needs to keep its attention on that sector, according to the expert.

Negotiations with borrowers for loan rescheduling helped the Bank to drag down the provisions for impairment of loans and other assets, according to the Vice President.

Abay's total assets have also considerably expanded to 15 billion Br, registering a 23pc increase.

The loans and advances increased by 29pc to reach 7.6 billion Br. Deposit mobilisation has also shown a 21pc rise and reached 11.6 billion Br. The Bank’s loan-to-deposit ratio stood at 65.5pc, rising by four percentage points.

However, this ratio was still far below the average rate of 71pc of most of the banks, according to the expert.

“The management should attempt to increase Abay’s loan-to-deposit ratio, as there is room for improvement,” the expert highlighted.

However, Belete argues that the ratio is an optimal level for the Bank, which is still healthy and balanced with the level of liquidity appropriately maintained.

"The ratio didn't affect other operations, as the Bank didn't overstretch to level with other banks," he said.

The 3.4 billion Br investment Abay made in NBE bonds accounted for 22pc of its total assets and 29pc of its total deposits.

The liquidity level of Abay improved in absolute terms though it slightly declined in relative terms. The cash and bank balances of the Bank went up by 12pc to reach 3.3 billion Br. The ratio of liquid assets to total assets declined by 1.7 percentage points to 22pc. The ratio of liquid assets to total deposits also declined to 29pc from 35pc.

“Despite the reductions, the liquidity level of Abay is reasonable,” Abdulmenan observed.

Abay’s paid-up capital increased by 26pc to nearly reach 1.7 billion Br, achieving a capital adequacy (CAR) ratio of two percent in the last fiscal year.

Since Abay has strong capital and huge liquid resources, the expert suggested that the Bank use these resources to earn more income.

PUBLISHED ON

Jan 18,2020 [ VOL

20 , NO

1029]

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...